- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AVT

Assessing Avnet (AVT) Valuation After Expanded Navitas Deal Targets AI and Clean Energy Growth

Reviewed by Simply Wall St

Avnet (AVT) just landed a meaningful expansion of its distribution deal with Navitas Semiconductor, strengthening their partnership around next generation GaN and SiC power devices for fast growing AI and clean energy markets.

See our latest analysis for Avnet.

The expanded Navitas deal lands at a time when sentiment around Avnet has been a bit mixed, with a roughly 10 percent 1 month share price return but a slightly negative year to date share price performance. At the same time, the 3 year total shareholder return near 29 percent still reflects solid longer term value creation and suggests today’s announcement could help rebuild momentum.

If this AI driven power story has your attention, it might be a good moment to see what else is lining up in tech by exploring high growth tech and AI stocks.

Yet with shares still below analysts’ price targets and longer term returns solid despite a choppy year, is Avnet quietly trading at a discount, or has the market already priced in its next wave of growth?

Most Popular Narrative Narrative: 6.1% Undervalued

With Avnet last closing at $49.76 against a narrative fair value of $53, the current setup assumes meaningful upside if the growth path holds.

With improving book to bill ratios, a stabilizing inventory environment, and a strong commitment to operational efficiency (cost control and optimized capital allocation), Avnet is positioned to translate industry tailwinds into higher earnings and cash flow, which could support shareholder returns through buybacks/dividends and potential multiple expansion.

Curious how steady but modest sales growth can still justify a richer future earnings profile and expanding buybacks. Want to see which assumptions do the heavy lifting in this valuation story.

Result: Fair Value of $53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained margin pressure from weaker EMEA demand and elevated inventories could crimp cash flows and undermine the optimistic earnings and buyback trajectory.

Find out about the key risks to this Avnet narrative.

Another Angle on Value

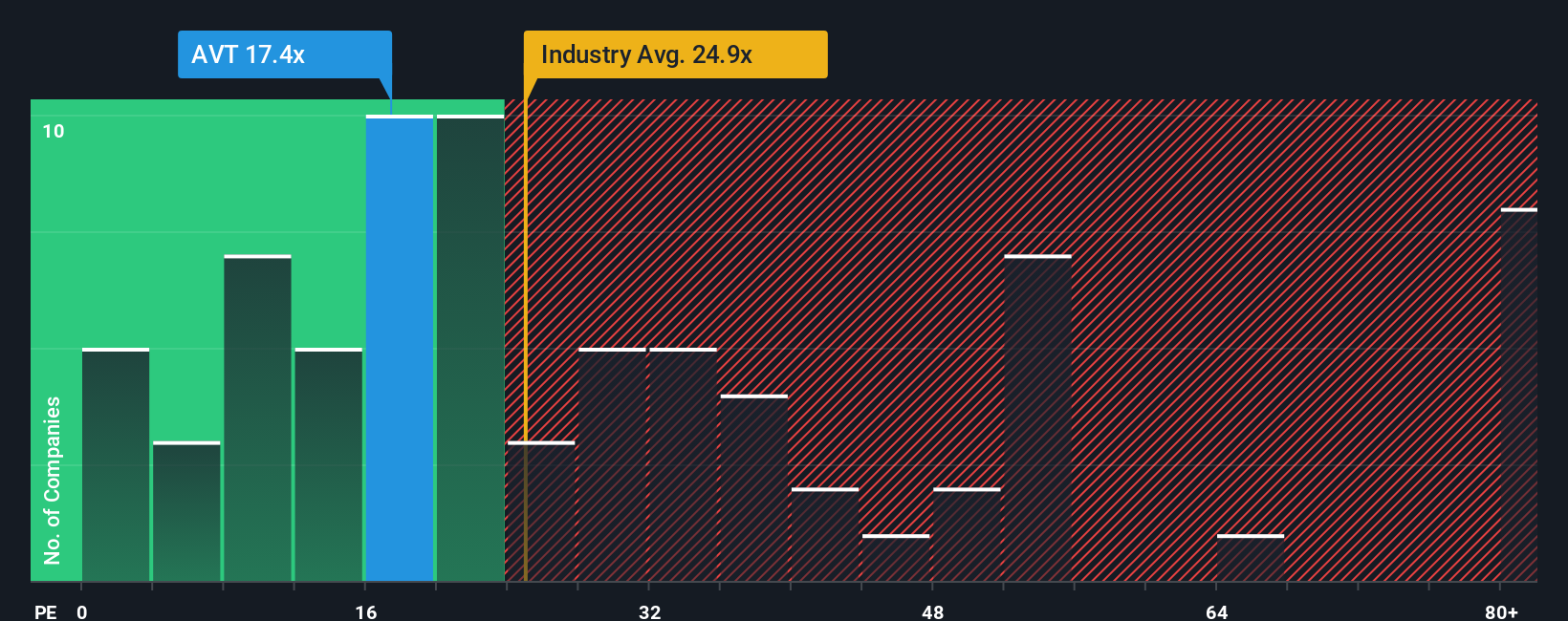

On earnings based metrics, Avnet looks more attractively priced than the US Electronic industry at 17.4 times earnings versus 24.5 times, and even below our estimated fair ratio of 34.6 times. That discount hints at upside, but also begs the question: what is the market still worried about?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avnet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avnet Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Avnet research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity; your next market winner could be waiting in our screeners, built to surface stocks most investors have not seriously considered yet.

- Capture early stage growth potential by reviewing these 3624 penny stocks with strong financials with robust balance sheets and fundamentals that could surprise the market.

- Strengthen your income strategy by assessing these 13 dividend stocks with yields > 3% that offer attractive yields without sacrificing quality.

- Position yourself ahead of the next tech wave by scanning these 25 AI penny stocks that are poised to benefit from accelerating adoption of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVT

Avnet

Distributes electronic component technology in the Americas, Europe, the Middle East, Africa, and Asia/Pacific.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion