- United States

- /

- Communications

- /

- NasdaqGS:AUDC

AudioCodes' (NASDAQ:AUDC) Dividend Will Be $0.18

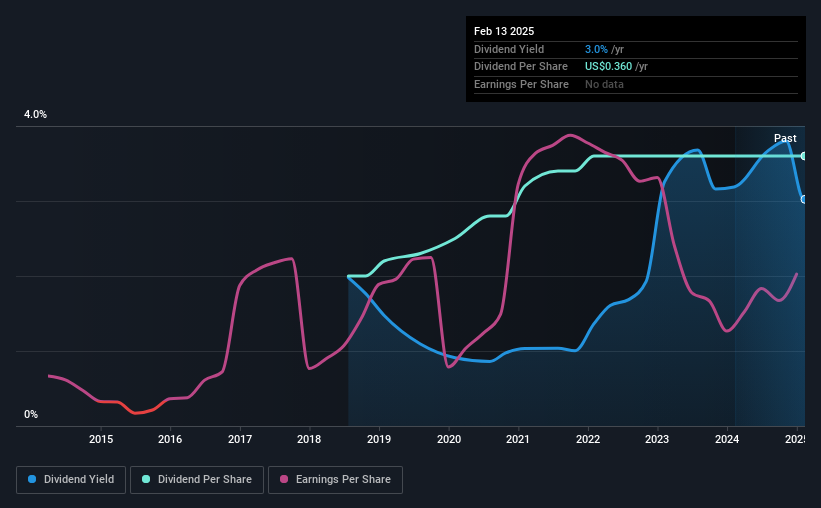

The board of AudioCodes Ltd. (NASDAQ:AUDC) has announced that it will pay a dividend on the 6th of March, with investors receiving $0.18 per share. This means that the annual payment will be 3.0% of the current stock price, which is in line with the average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that AudioCodes' stock price has increased by 45% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for AudioCodes

AudioCodes' Future Dividend Projections Appear Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. Before making this announcement, AudioCodes was paying out quite a large proportion of both earnings and cash flow, with the dividend being 99% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

Over the next year, EPS could expand by 30.0% if recent trends continue. If the dividend continues on this path, the payout ratio could be 59% by next year, which we think can be pretty sustainable going forward.

AudioCodes Doesn't Have A Long Payment History

It is great to see that AudioCodes has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. The dividend has gone from an annual total of $0.20 in 2018 to the most recent total annual payment of $0.36. This means that it has been growing its distributions at 8.8% per annum over that time. The dividend has been growing as a reasonable rate, which we like. However, investors will probably want to see a longer track record before they consider AudioCodes to be a consistent dividend paying stock.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. AudioCodes has impressed us by growing EPS at 30% per year over the past five years. Fast growing earnings are great, but this can rarely be sustained without some reinvestment into the business, which AudioCodes hasn't been doing.

Our Thoughts On AudioCodes' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While AudioCodes is earning enough to cover the payments, the cash flows are lacking. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for AudioCodes that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AUDC

AudioCodes

Provides advanced communications software, products, and productivity solutions for the digital workplace worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

MPAA often has inventory and core-related timing issues. While this quarter’s problems may ease, similar issues have recurred historically and can persist for several quarters. It's not a one-off, it's a structural part of their business. Core returns are simply estimates: How many customers will actually return the original part; how quickly they'll do so; how many are useable; what they're worth, etc. MPAA predicts X sales in a quarter and Y core returns and its reserves, inventory values, etc. are based on that. If they expect a 90% core return rate and only 80% come back it doesn't change cash but they have to write down inventory and increase cost of goods sold which impacts EPS. They've also cited inventory buildup at key customers multiple times in the past. The assumption the latest backlog will all shift into future quarters this year with no impact on pricing, etc. seems more like wishful thinking. Retailer X was slated to buy $10m in parts this quarter but finds they have a lot more inventory on hand than they anticipated so they pushed the order. Realistically there are likely to be SKU cuts, reduction in safety stock on others, etc. Assuming that all $10m will come in this year plus the regular replenishment seems pretty unrealistic. MPAA also has a shaky track record when it comes to new lines and the supposed impact on business. If you look at the EV testing solutions hype back around 2020 that was supposed to diversify them beyond traditional reman and be a higher margin business that would grow with EV adoption. But it has never turned into a material contributor. The debt reduction and stock buy backs are meaningful but IMHO this narrative takes a very optimistic view of things.