- United States

- /

- Electronic Equipment and Components

- /

- OTCPK:AKTS.Q

Not Many Are Piling Into Akoustis Technologies, Inc. (NASDAQ:AKTS) Stock Yet As It Plummets 29%

Unfortunately for some shareholders, the Akoustis Technologies, Inc. (NASDAQ:AKTS) share price has dived 29% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 95% loss during that time.

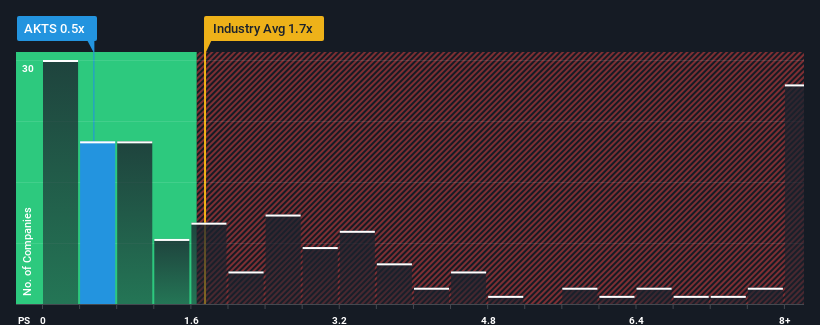

After such a large drop in price, Akoustis Technologies' price-to-sales (or "P/S") ratio of 0.5x might make it look like a buy right now compared to the Electronic industry in the United States, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Akoustis Technologies

What Does Akoustis Technologies' P/S Mean For Shareholders?

Akoustis Technologies certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Akoustis Technologies will help you uncover what's on the horizon.How Is Akoustis Technologies' Revenue Growth Trending?

Akoustis Technologies' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 20% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 6.7%, which is noticeably less attractive.

With this information, we find it odd that Akoustis Technologies is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Akoustis Technologies' P/S

The southerly movements of Akoustis Technologies' shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Akoustis Technologies' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It is also worth noting that we have found 4 warning signs for Akoustis Technologies (2 are potentially serious!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:AKTS.Q

Akoustis Technologies

Through its subsidiary, Akoustis, Inc., designs, develops, manufactures, and sells radio frequency (RF) filter products for the wireless industry in the Americas, Asia, Europe, and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives