- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:AEY

Would ADDvantage Technologies Group (NASDAQ:AEY) Be Better Off With Less Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies ADDvantage Technologies Group, Inc. (NASDAQ:AEY) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for ADDvantage Technologies Group

What Is ADDvantage Technologies Group's Net Debt?

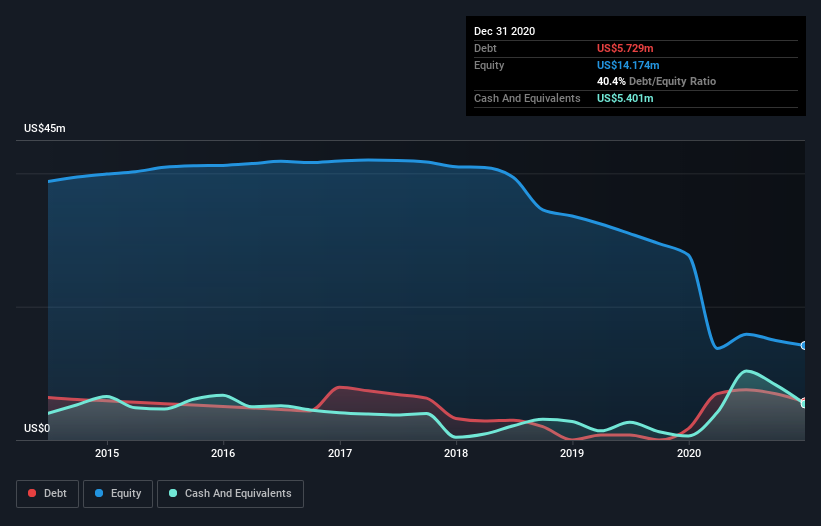

As you can see below, at the end of December 2020, ADDvantage Technologies Group had US$5.73m of debt, up from US$1.70m a year ago. Click the image for more detail. However, because it has a cash reserve of US$5.40m, its net debt is less, at about US$328.0k.

How Healthy Is ADDvantage Technologies Group's Balance Sheet?

We can see from the most recent balance sheet that ADDvantage Technologies Group had liabilities of US$11.3m falling due within a year, and liabilities of US$4.50m due beyond that. Offsetting these obligations, it had cash of US$5.40m as well as receivables valued at US$7.21m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$3.19m.

Given ADDvantage Technologies Group has a market capitalization of US$24.4m, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Carrying virtually no net debt, ADDvantage Technologies Group has a very light debt load indeed. There's no doubt that we learn most about debt from the balance sheet. But it is ADDvantage Technologies Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, ADDvantage Technologies Group made a loss at the EBIT level, and saw its revenue drop to US$49m, which is a fall of 21%. That makes us nervous, to say the least.

Caveat Emptor

Not only did ADDvantage Technologies Group's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping US$9.4m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through US$5.9m of cash over the last year. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example ADDvantage Technologies Group has 5 warning signs (and 2 which don't sit too well with us) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade ADDvantage Technologies Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:AEY

ADDvantage Technologies Group

ADDvantage Technologies Group, Inc., through its subsidiaries, operates as a communications infrastructure services and equipment provider in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Energy One (ASX:EOL): Sticky software with improving margins

Circle Internet Group: From Crypto Proxy to Rate-Sensitive Financial Infrastructure

Salesforce (CRM) The Agentic Pivot: Salesforce Redefines the SaaS Era

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks