- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:AEY

Shareholders Will Most Likely Find ADDvantage Technologies Group, Inc.'s (NASDAQ:AEY) CEO Compensation Acceptable

ADDvantage Technologies Group, Inc. (NASDAQ:AEY) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 15 September 2021. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for ADDvantage Technologies Group

How Does Total Compensation For Joe Hart Compare With Other Companies In The Industry?

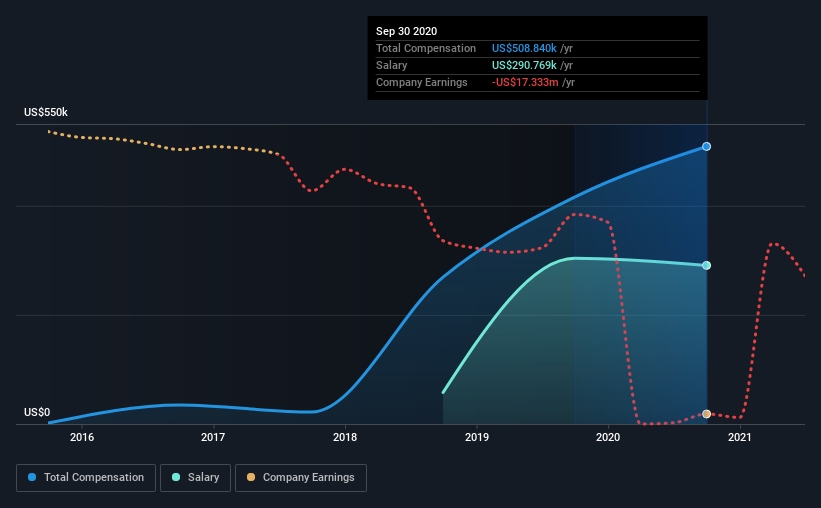

According to our data, ADDvantage Technologies Group, Inc. has a market capitalization of US$32m, and paid its CEO total annual compensation worth US$509k over the year to September 2020. We note that's an increase of 22% above last year. In particular, the salary of US$290.8k, makes up a fairly large portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under US$200m, the reported median total CEO compensation was US$444k. So it looks like ADDvantage Technologies Group compensates Joe Hart in line with the median for the industry. What's more, Joe Hart holds US$492k worth of shares in the company in their own name.

On an industry level, around 29% of total compensation represents salary and 71% is other remuneration. According to our research, ADDvantage Technologies Group has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

ADDvantage Technologies Group, Inc.'s Growth

ADDvantage Technologies Group, Inc. has reduced its earnings per share by 31% a year over the last three years. Its revenue is down 2.0% over the previous year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has ADDvantage Technologies Group, Inc. Been A Good Investment?

Most shareholders would probably be pleased with ADDvantage Technologies Group, Inc. for providing a total return of 76% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for ADDvantage Technologies Group (2 are concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading ADDvantage Technologies Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:AEY

ADDvantage Technologies Group

ADDvantage Technologies Group, Inc., through its subsidiaries, operates as a communications infrastructure services and equipment provider in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Salesforce (CRM) The Agentic Pivot: Salesforce Redefines the SaaS Era

Nvidia (NVDA) The Sovereign of Silicon: Accelerating Beyond the $5 Trillion Horizon

IA Analysis

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks