- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AEIS

Will Advanced Energy Industries’ (AEIS) Dividend Policy Reveal Its True Capital Allocation Intentions?

Reviewed by Simply Wall St

- Advanced Energy Industries recently declared that its board authorized a quarterly cash dividend of US$0.10 per share, payable on September 5, 2025 to shareholders of record as of August 25, 2025.

- This dividend announcement reflects the company’s approach to shareholder returns and offers insights into its current capital allocation priorities.

- We'll explore how the recent dividend decision supports Advanced Energy Industries' narrative of financial discipline and investor confidence.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Advanced Energy Industries Investment Narrative Recap

To be a shareholder in Advanced Energy Industries, you need confidence in its ability to translate design wins in data center and semiconductor markets into sustainable revenue, while managing ongoing macroeconomic and supply chain headwinds. The most recent dividend affirmation underscores a commitment to shareholder returns and financial discipline, but it does not materially alter the short-term outlook for the company’s key catalysts or largest risks, especially ongoing tariff and manufacturing cost pressures.

Of the recent announcements, the launch of the Thyro-XD™ power controller for semiconductor manufacturing stands out as particularly relevant. This product release aligns with Advanced Energy’s growth drivers in semiconductor markets, supporting the narrative that innovation and new product introductions may help balance or offset broader risks, including those related to tariffs or manufacturing efficiency.

By contrast, investors should pay particular attention to potential disruptions stemming from manufacturing footprint adjustments, as...

Read the full narrative on Advanced Energy Industries (it's free!)

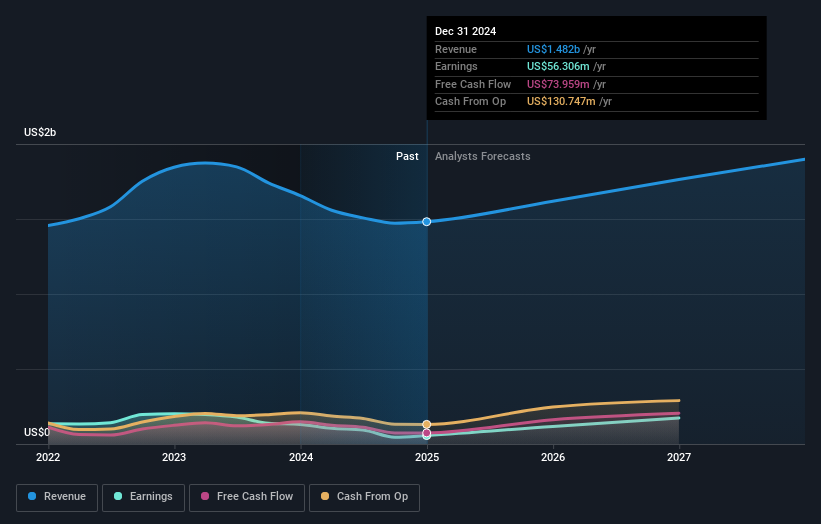

Advanced Energy Industries' outlook anticipates $2.0 billion in revenue and $292.4 million in earnings by 2028. This scenario assumes an 8.6% annual revenue growth rate and a $217.2 million increase in earnings from the current $75.2 million.

Uncover how Advanced Energy Industries' forecasts yield a $130.80 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Two private investors in the Simply Wall St Community estimate the company’s fair value between US$104.46 and US$130.80 per share. With the company facing cost and margin risks tied to tariffs and production changes, your view may differ, see how other Community valuations stack up before making your own call.

Explore 2 other fair value estimates on Advanced Energy Industries - why the stock might be worth 26% less than the current price!

Build Your Own Advanced Energy Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Advanced Energy Industries research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Advanced Energy Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Advanced Energy Industries' overall financial health at a glance.

No Opportunity In Advanced Energy Industries?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEIS

Advanced Energy Industries

Provides precision power conversion, measurement, and control solutions in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives