- United States

- /

- Communications

- /

- NasdaqGS:ADTN

A Piece Of The Puzzle Missing From ADTRAN Holdings, Inc.'s (NASDAQ:ADTN) Share Price

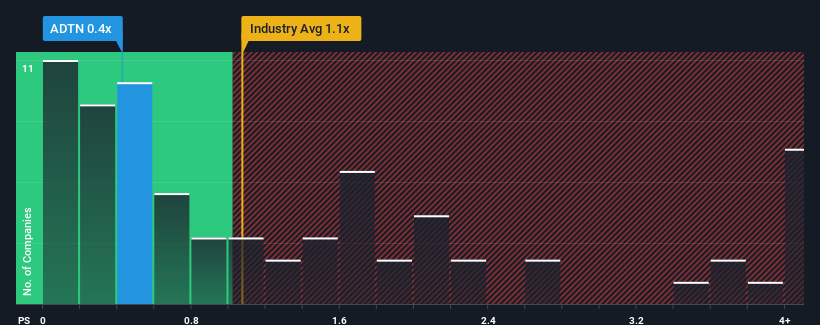

ADTRAN Holdings, Inc.'s (NASDAQ:ADTN) price-to-sales (or "P/S") ratio of 0.4x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Communications industry in the United States have P/S ratios greater than 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for ADTRAN Holdings

What Does ADTRAN Holdings' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, ADTRAN Holdings has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think ADTRAN Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as ADTRAN Holdings' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 56% last year. The latest three year period has also seen an excellent 160% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 4.4% per annum over the next three years. That's shaping up to be similar to the 3.6% per annum growth forecast for the broader industry.

In light of this, it's peculiar that ADTRAN Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On ADTRAN Holdings' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for ADTRAN Holdings remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware ADTRAN Holdings is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on ADTRAN Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ADTN

ADTRAN Holdings

Provides networking and communications platforms, software, systems, and services in the United States, Germany, the United Kingdom, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success