- United States

- /

- Tech Hardware

- /

- NasdaqGS:AAPL

Is Apple Still a Bargain After Bold AI Moves and New iPad Launch in 2025?

Reviewed by Bailey Pemberton

- Curious if Apple is still a bargain after all its gains, or if it is starting to look overvalued? You're definitely not alone in asking that, especially with so many headlines swirling around this stock.

- Apple’s share price has seen plenty of ups and downs lately, slipping 2.5% over the past week but still up 17.0% over the last year and an impressive 135.7% across five years. This hints at both growth potential and constantly shifting sentiment.

- Recent news has highlighted Apple's bold moves in AI and hardware innovation, such as the launch of new iPad models and continued investment in developing its own chips. These headlines have kept investors buzzing, but they've also contributed to short-term price swings as the market digests the company's evolving narrative.

- When it comes to traditional valuation checks, though, Apple scores just 1 out of 6 for being undervalued. This means there is a lot more nuance to uncover. Before making any judgment calls, let’s break down the major valuation methods and consider a smarter approach to figuring out whether Apple is actually worth your money.

Apple scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Apple Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model aims to estimate a company’s intrinsic value by projecting its future cash flows and then discounting those figures back to today’s dollars. This approach gives investors a sense of what Apple’s ongoing business could be worth, based on how much cash it is expected to generate over time.

Currently, Apple produces a substantial Free Cash Flow (FCF) of $99.9 billion, reflecting a healthy ability to generate cash from its operations. Analysts estimate Apple’s FCF will continue to grow, reaching as high as $186.8 billion by 2030. Projections for the next several years, which rely on analyst consensus through 2028 and then on Simply Wall St’s extrapolations beyond that, demonstrate Apple’s strong cash-generating potential and sustained growth outlook.

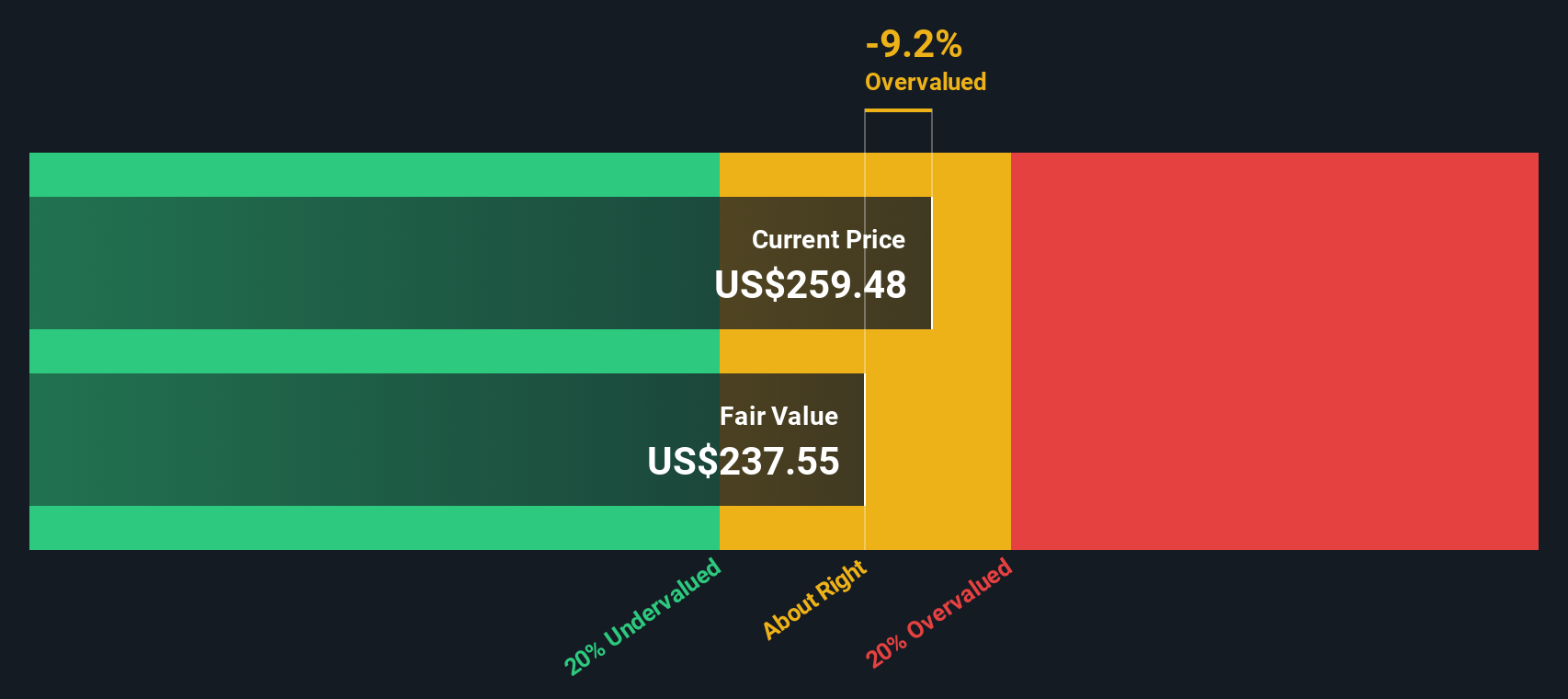

Essentially, the DCF model calculates the fair value of Apple’s shares at $223.92. When compared to the current share price, this suggests that Apple is trading at an 18.9% premium to its intrinsic value. In other words, based on DCF, Apple appears overvalued at current levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Apple may be overvalued by 18.9%. Discover 919 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Apple Price vs Earnings (PE Ratio)

For established, profitable companies like Apple, the Price-to-Earnings (PE) ratio is a widely-recognized valuation metric. It helps investors understand what price the market is currently willing to pay for each dollar of earnings Apple generates. The PE ratio is particularly informative when a company is steadily profitable, as it relates the share price directly to bottom-line performance.

Interpreting a PE ratio requires context, since growth expectations and business risks influence what counts as "normal." A higher PE can reflect confidence in a company's continuing earnings growth, robust profit margins, or lower perceived risk. Conversely, a low PE may signal the opposite.

Apple currently trades at a PE ratio of 35.1x. This is noticeably higher than the tech industry average of 22.2x and also above the peer average of 32.6x. On the surface, this could look expensive. However, simply comparing to peers and industry averages does not tell the whole story, especially for a market leader like Apple.

This is where Simply Wall St's proprietary “Fair Ratio” provides a more nuanced gauge. Unlike basic benchmarks, the Fair Ratio reflects Apple's unique earnings growth outlook, risk profile, industry position, profit margins, and market cap. For Apple, the Fair Ratio is 43.9x, which is significantly higher than both the current market PE and the comparisons above. This suggests that even accounting for its higher headline PE, Apple is actually trading below what would be expected for its performance and prospects.

Because the difference between Apple's PE (35.1x) and its Fair Ratio (43.9x) is more than 0.10, the stock screens as undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1422 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Apple Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple story behind the numbers: it’s your perspective on a company’s future, how quickly you think it will grow, what margins you expect, and your own estimate of fair value, all grounded in real business events and forecasts, rather than just ratios or historical trends.

Narratives connect the company's story to a financial forecast and, ultimately, a fair value. This makes them a powerful tool for investors who want more than just a snapshot. On Simply Wall St’s platform, millions of users post and update Narratives on the Community page, making it easy for you to test or adjust your view alongside others.

By comparing a Narrative’s fair value to today’s market price, investors can quickly decide whether a stock looks attractive, fairly priced, or expensive. Because Narratives are dynamically updated when news or earnings emerge, they always reflect the latest outlook.

For example, Narratives for Apple range from bullish, with one assigning a fair value of $281 and betting on sustained services growth and AI innovation, to bearish, with a $177 fair value for those concerned about margin pressure, China exposure, and slower hardware growth.

For Apple, however, we'll make it really easy for you with previews of two leading Apple Narratives:

- 🐂 Apple Bull Case

Fair Value: $275.00

Undervalued by: 3.2%

Revenue Growth Rate: 12.78%

- Highlights Apple’s resilience despite a 35% drop from its peak, mainly due to steep US tariffs on Chinese imports that threaten margins.

- Notes continued financial strength, with Q1 2025 profits topping $36.33 billion and a record services revenue as production shifts to India and Vietnam.

- Sees long-term upside thanks to investments in AI and strong brand loyalty. Top analysts project potential recovery and benefit from AI-driven growth.

- 🐻 Apple Bear Case

Fair Value: $177.34

Overvalued by: 50.2%

Revenue Growth Rate: 14.68%

- Warns that Apple’s high P/E ratio is unsustainable as revenue growth slows and core hardware markets mature, raising concerns over a stretched valuation.

- Points to pressures on margins from rising production costs, market saturation, dependence on China, and intensifying competition from local players.

- Questions management’s use of vast cash reserves and flags overly optimistic market expectations as reasons the stock may be at risk of a correction.

Do you think there's more to the story for Apple? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAPL

Apple

Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives