- United States

- /

- Communications

- /

- NasdaqGM:AAOI

Does AAOI’s New Stock Offering Reveal Underlying Tensions in Its Profitability and Growth Narrative?

Reviewed by Sasha Jovanovic

- In early November 2025, Applied Optoelectronics reported record third-quarter revenue of US$118.63 million and issued fourth-quarter guidance, while also launching a US$180 million at-the-market follow-on offering of common stock.

- Despite revenue growth, analyst concerns regarding continued losses and reliance on the cyclical CATV segment led to heightened scrutiny of the company's profitability and outlook.

- We'll assess how the recent analyst downgrade and profitability concerns influence Applied Optoelectronics' updated investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Applied Optoelectronics Investment Narrative Recap

To own shares of Applied Optoelectronics, you have to believe the company can transition from customer concentration and unprofitability toward sustainable growth through high-speed optical transceivers, while managing reliance on the volatile CATV segment. The recent follow-on equity offering of US$180 million, alongside cautious analyst guidance and a downgrade, has put profitability and customer risk front and center. These developments elevate existing risks rather than shifting the short-term catalysts, and the central debate remains whether AAOI can deliver sustained growth without margin setbacks.

Among the recent announcements, the Q4 2025 revenue guidance of US$125 million to US$140 million directly informs the near-term outlook. This guidance, which fell short of analyst consensus, highlights questions around AAOI’s ability to accelerate revenue from its ramping 800G products and diversify its customer base, two key points investors are watching as part of the overall growth catalyst.

By contrast, a single change in customer orders could quickly remind shareholders that customer concentration is a risk every investor should be aware of...

Read the full narrative on Applied Optoelectronics (it's free!)

Applied Optoelectronics is projected to reach $1.3 billion in revenue and $111.0 million in earnings by 2028. This outlook assumes annual revenue growth of 51.5% and an earnings increase of $266.7 million from current earnings of -$155.7 million.

Uncover how Applied Optoelectronics' forecasts yield a $28.40 fair value, a 19% upside to its current price.

Exploring Other Perspectives

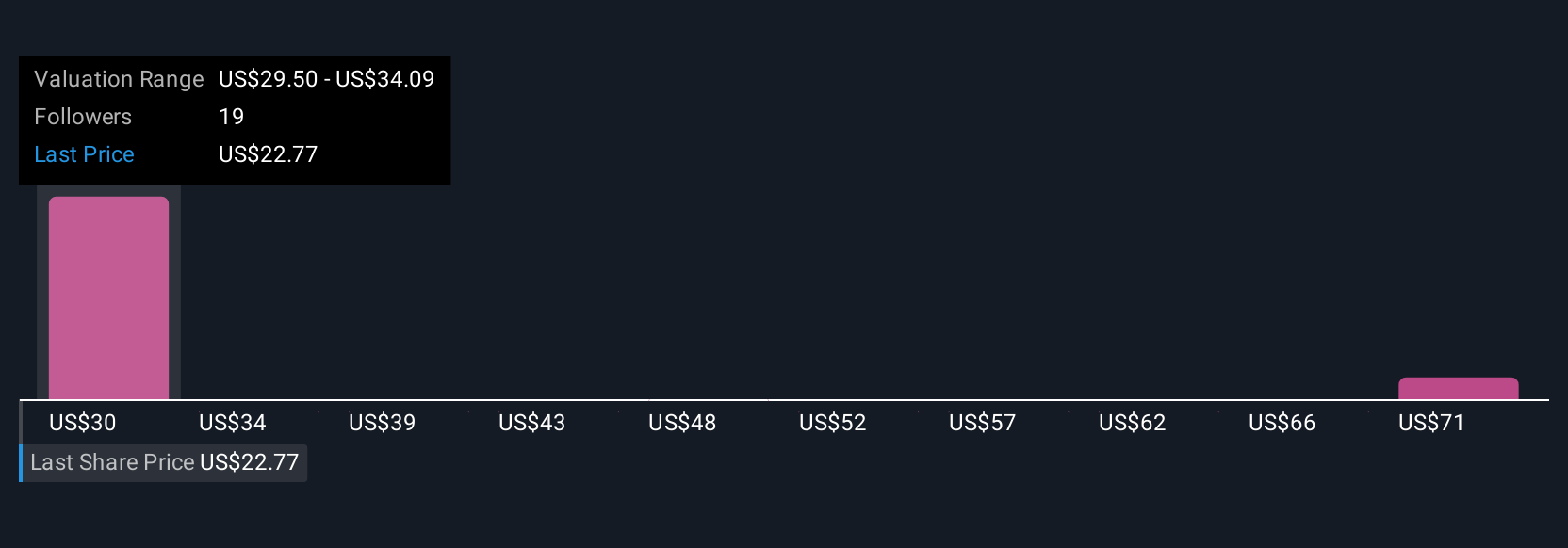

Seven members of the Simply Wall St Community have fair value estimates for AAOI between US$28.40 and US$75.38 per share. While some expect high growth from expanding advanced transceiver capacity, customer concentration remains a pivotal issue for future returns, a topic many participants continue to debate.

Explore 7 other fair value estimates on Applied Optoelectronics - why the stock might be worth just $28.40!

Build Your Own Applied Optoelectronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Optoelectronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Applied Optoelectronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Optoelectronics' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AAOI

Applied Optoelectronics

Designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives