- United States

- /

- Software

- /

- OTCPK:ABXX.F

Why Abaxx Technologies (ABXX.F) Is Up 6.0% After ARTEX Partnership and Wind Futures Launch

Reviewed by Sasha Jovanovic

- ARTEX AG recently announced a strategic partnership with Abaxx Technologies to modernise trading, financing, and management of alternative and real-world assets across global regulated markets.

- This collaboration, along with the debut of Abaxx's German Wind Futures contract, highlights the company's push to innovate in digital asset infrastructure and renewable energy risk management.

- We'll look at how the ARTEX AG partnership and environmental product launch could influence Abaxx Technologies' investment narrative and global reach.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Abaxx Technologies' Investment Narrative?

For those considering Abaxx Technologies as an investment, the big picture centers on its ambitious efforts to reshape digital asset infrastructure and risk management, particularly in the energy and alternative assets space. The recent ARTEX AG partnership and the launch of German Wind Futures are current milestones, bringing Abaxx closer to cross-market integration and a wider product reach. These moves could act as fresh short-term catalysts, potentially elevating market visibility and expanding client interest. Still, with sales just over CA$309,000 for the third quarter and mounting net losses, the company remains in early-stage, high-growth territory where execution risk looms large. The newly secured partnerships may help address questions around commercial scale and client adoption, but until meaningful revenue improvement follows, the key risk is whether product launches and collaborations will translate into financial traction fast enough to support its premium valuation.

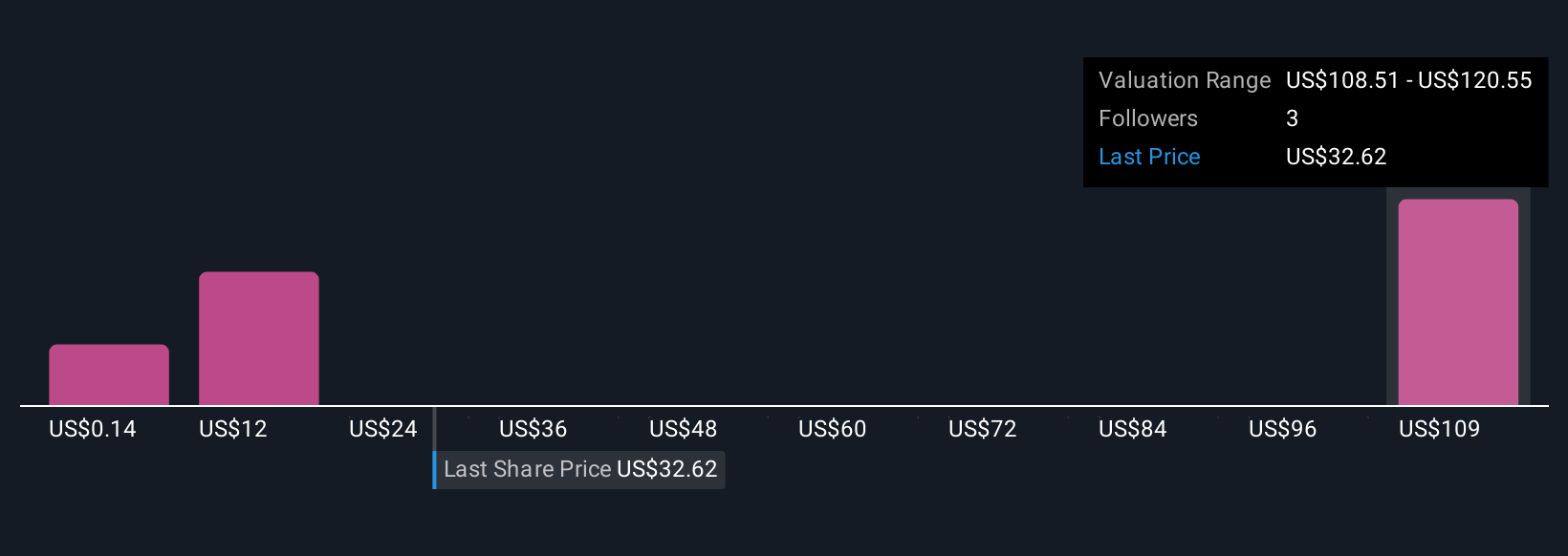

But counter to the optimistic headlines, losses are still rising and scale remains an open question for investors. Abaxx Technologies' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Abaxx Technologies - why the stock might be worth less than half the current price!

Build Your Own Abaxx Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abaxx Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Abaxx Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abaxx Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:ABXX.F

Abaxx Technologies

Engages in developing software tools which enable commodity traders and finance professionals to communicate, trade, and transact in Canada.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives