- United States

- /

- Software

- /

- NYSEAM:BMNR

Should Investors Rethink Bitmine After Shares Jumped 1,339% Amid Recent Partnerships?

Reviewed by Bailey Pemberton

If you're sitting at your screen puzzling over whether Bitmine Immersion Technologies is a buy, sell, or just a stock to watch, you're definitely not alone. The past year has been a wild ride, with shares up a staggering 1,339.5% over twelve months and a jaw-dropping 650.6% since the start of the year. Even over the past week, Bitmine has eked out another 1.3% gain, while its 30-day return stands at a healthy 4.0%. It's a stock that's caught more than a few eyes. All this buzz raises the key question: what's driving the surge, and is the company really as undervalued as some believe?

Behind the recent momentum, Bitmine Immersion Technologies has stayed in the headlines thanks to a string of business development announcements and partnerships, which have stoked hopes around its long-term growth prospects and changed how some investors perceive its risk profile. However, as much as the story seems to be about explosive potential, the numbers present a different narrative. Bitmine's valuation score comes in at just 0 out of 6, meaning, by standard valuation checks, it's not flagged as undervalued on any front right now.

So what do all these valuation approaches actually tell us, and are they looking at the right factors for a company like this? Next up, I'll break down each method, and stick with me until the end for a discussion of an even more insightful way to judge Bitmine's future worth.

Bitmine Immersion Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bitmine Immersion Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation method that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach offers investors a sense of what a business might truly be worth, regardless of current market sentiment.

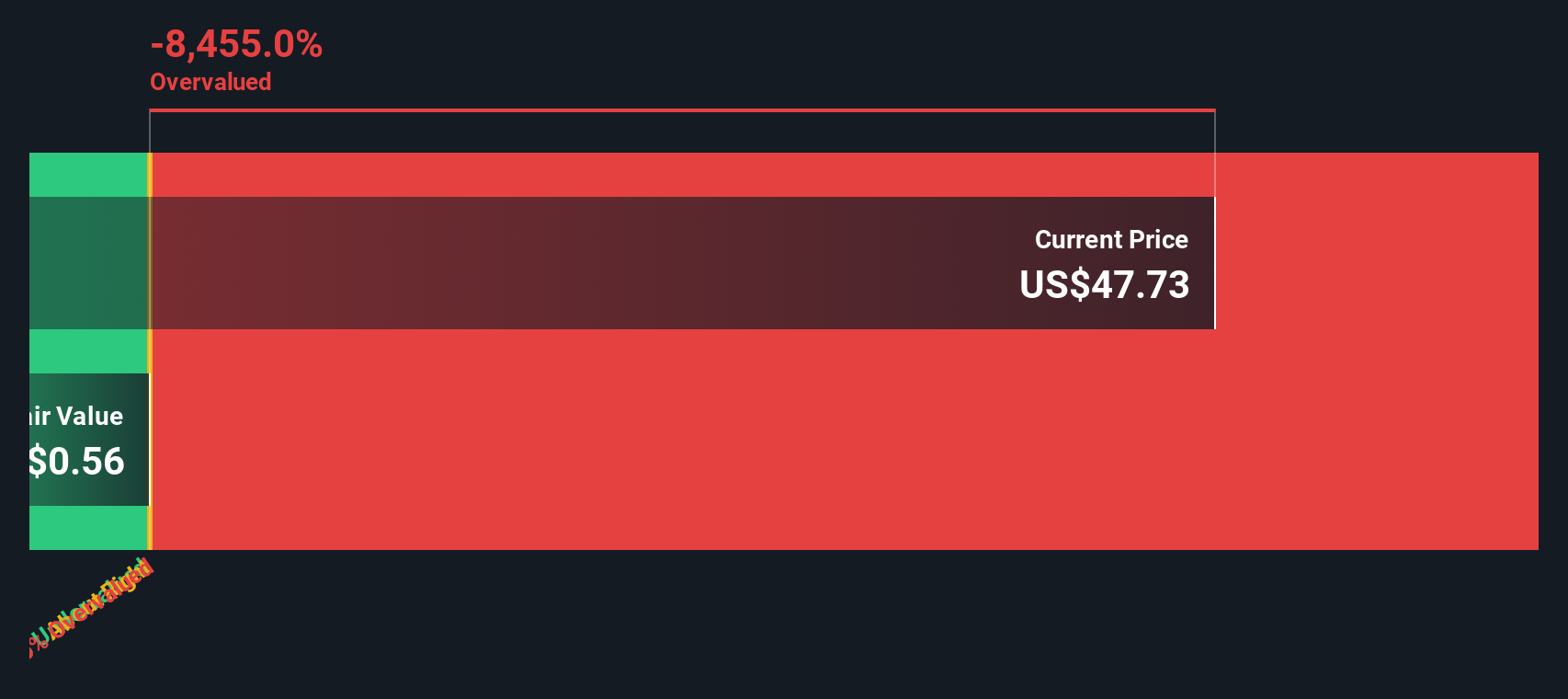

For Bitmine Immersion Technologies, the latest 12-month Free Cash Flow stands at $0.84 million. Looking ahead, the model uses estimates that factor in strong growth expectations, with cash flows projected to increase each year for the next decade. By 2035, the discounted Free Cash Flow is expected to reach about $3.45 million. These projections combine analyst estimates for the first five years with simply calculated extrapolations for the following five years.

Despite these growth assumptions, the DCF model lands on a fair value per share of just $0.34. With the stock currently trading well above this level, the implied discount suggests Bitmine Immersion Technologies is 15,476% above its calculated intrinsic value.

The bottom line is that according to the DCF, Bitmine Immersion Technologies looks massively overvalued based on projected cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bitmine Immersion Technologies may be overvalued by 15475.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Bitmine Immersion Technologies Price vs Book

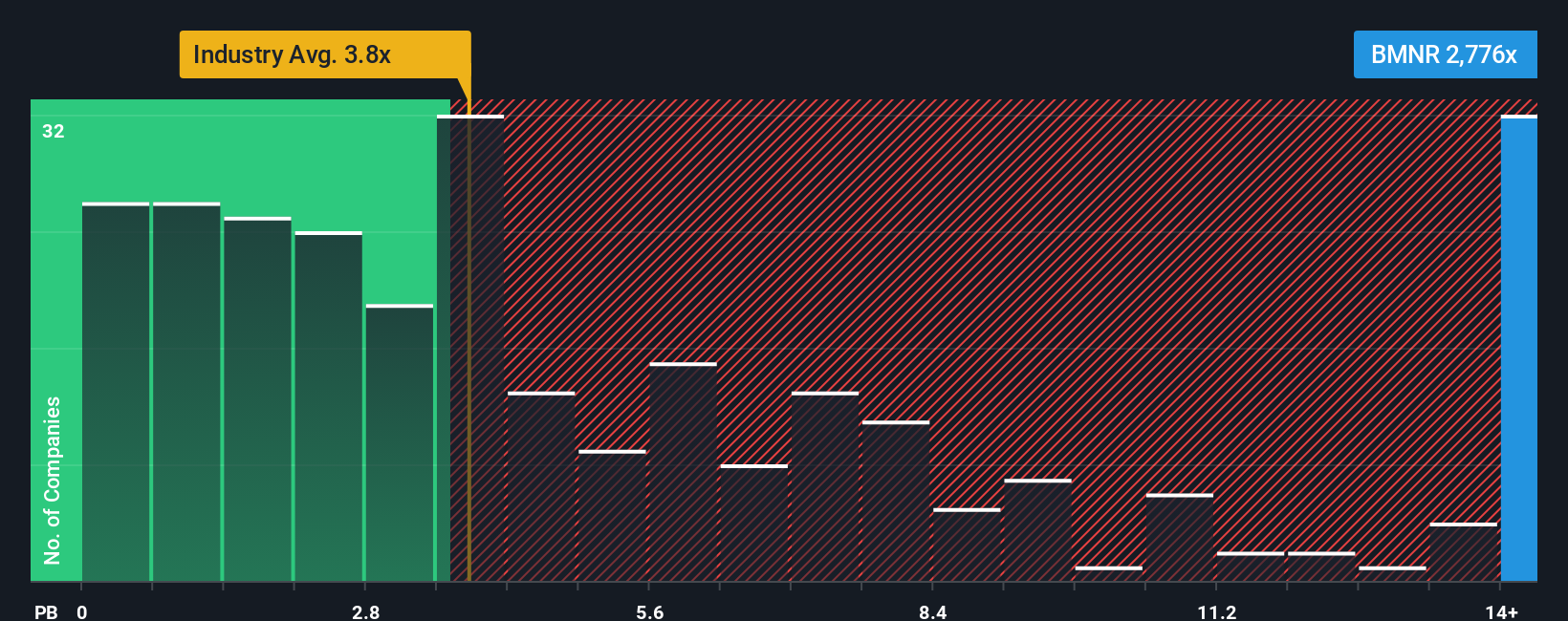

The Price-to-Book (P/B) ratio is a widely used valuation metric, especially for companies whose earnings may fluctuate or are not yet consistently profitable. By comparing a company’s market value to its net assets, the P/B ratio can provide a clearer picture of how the market values the underlying business, regardless of near-term profit swings. This makes it a practical metric for evaluating companies in rapidly evolving sectors or those experiencing significant growth investments.

A "normal" or "fair" P/B ratio is influenced by expectations for future growth as well as perceptions of risk. Companies expected to grow faster or with safer business models often deserve a higher ratio, while those carrying more uncertainty or limited expansion potential might see a lower norm.

Bitmine Immersion Technologies currently trades at a P/B ratio of 5,198.3x. In comparison, the software industry average stands at just 3.95x, and the average for close peers comes in at 15.19x. This suggests the market places a premium price on Bitmine relative to its book value, many times over what is typical for peers or the industry as a whole.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. Instead of a straightforward comparison to industry averages or competitors, the Fair Ratio establishes what would be a justifiable multiple for Bitmine Immersion Technologies specifically, based on its expected growth, risks, profit margins, industry, and market cap. This means it offers a more tailored and meaningful benchmark for valuation, helping investors avoid misleading comparisons and get a clearer view of whether the stock’s price is justified.

Since the Fair Ratio data is not available for Bitmine Immersion Technologies, but its current P/B ratio sits thousands of multiples higher than both its industry and peers, the evidence strongly suggests the shares are significantly overvalued by this metric.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bitmine Immersion Technologies Narrative

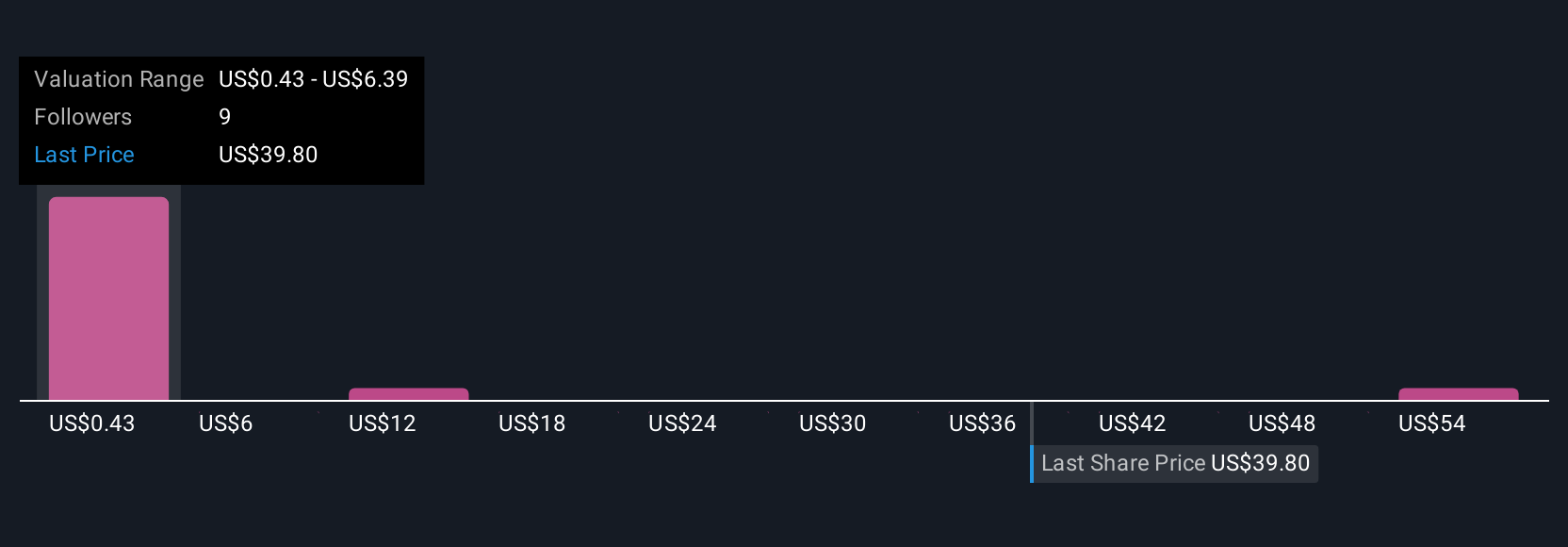

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own perspective on Bitmine Immersion Technologies, where you craft a story about the company’s future using your assumptions for fair value, revenue growth, earnings, and profit margins. Narratives link what you believe about a company, including its growth potential, risks, and competitive advantages, to a financial forecast and an estimated fair value. This approach can help make your investment decisions smarter and more personal.

Narratives are easy to use and available right on the Simply Wall St Community page, trusted by millions of investors worldwide. This tool shows you at a glance whether Bitmine’s fair value based on your Narrative is above or below the current share price, helping you decide if it’s time to buy, hold, or sell. Every Narrative updates automatically when big news or earnings results arrive, so your view stays fresh. For example, you might see Bitmine’s Community Narratives range from forecasts calling for massive upside to others expecting a major correction. With Narratives, your view sits alongside the crowd, and the numbers always tell the story.

Do you think there's more to the story for Bitmine Immersion Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Adequate balance sheet with low risk.

Market Insights

Community Narratives