- United States

- /

- Software

- /

- NYSEAM:BMNR

Can BitMine Immersion Technologies' (BMNR) ETH Staking Ambitions Redefine Its Competitive Position?

- BitMine Immersion Technologies recently announced it holds 3.63 million ETH tokens, about 3% of Ethereum's total supply, and unveiled plans to launch its Made in America Validator Network (MAVAN) for ETH staking in early 2026.

- The company’s ambitious goal to acquire 5% of the Ethereum network highlights its focus on expanding its position as the largest corporate Ethereum holder globally.

- We’ll explore how BitMine’s increased Ethereum accumulation and staking infrastructure plan inform the company’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Bitmine Immersion Technologies' Investment Narrative?

To see Bitmine Immersion Technologies as a compelling story, you need to believe in corporate-scale ownership of digital assets as a treasury strategy, specifically, deep exposure to Ethereum. The company's recent update, revealing its 3.63 million ETH position and the upcoming MAVAN staking network, reinforces Bitmine’s continued drive to cement its dominance in Ethereum holdings. While the company posted a sharp jump in profitability for the most recent year, the short-term catalysts remain tied to crypto market momentum, upcoming regulatory clarity, and early progress on staking infrastructure ambitions. However, the combination of recent stock price swings and high unrealized non-cash earnings creates new uncertainties. Executive changes, a small annual dividend, and a rising profile among institutional holders are encouraging, but the core risks, such as crypto price volatility and concentration in a single asset, may become even more central moving forward. The recent news fits into this by increasing exposure to both these upside and downside possibilities, rather than shifting the balance one way or the other in the immediate term.

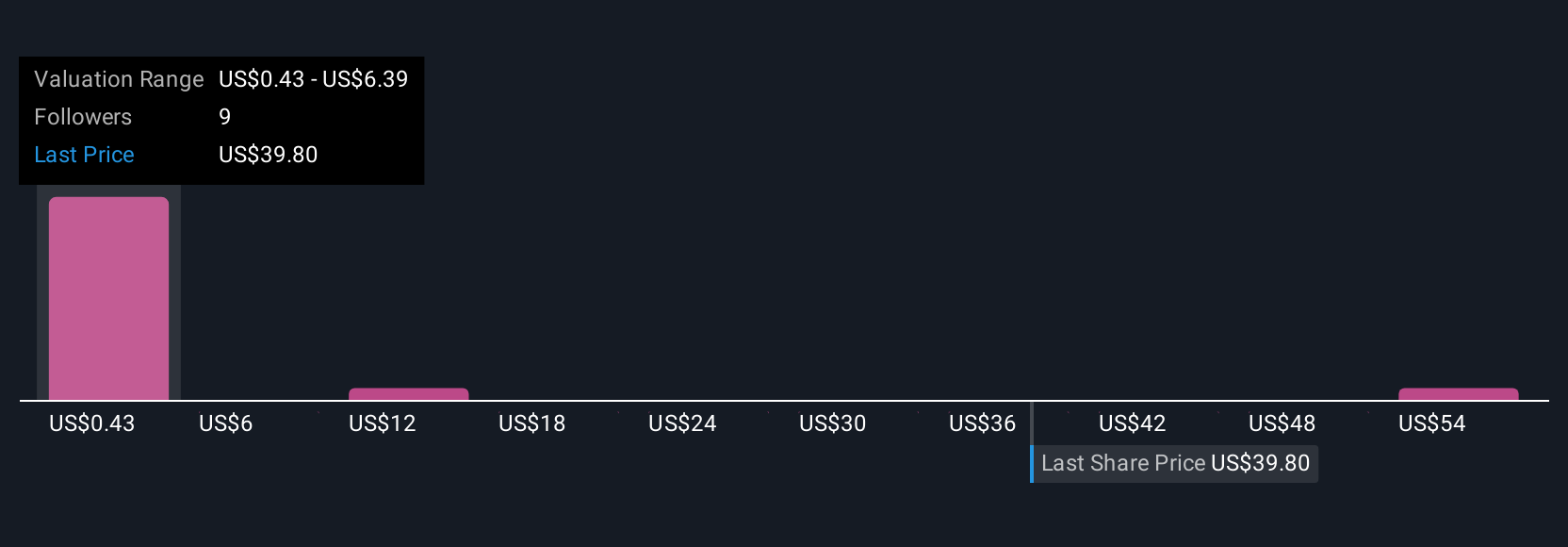

But at the same time, changing market conditions or regulatory shifts could sharply affect Ethereum holdings. In light of our recent valuation report, it seems possible that Bitmine Immersion Technologies is trading beyond its estimated value.Exploring Other Perspectives

Explore 25 other fair value estimates on Bitmine Immersion Technologies - why the stock might be worth over 4x more than the current price!

Build Your Own Bitmine Immersion Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bitmine Immersion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitmine Immersion Technologies' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion