- United States

- /

- Software

- /

- NYSEAM:BMNR

Bitmine Immersion Technologies (BMNR) Is Down 17.0% After Short Report Challenges Ethereum Share Issuance Strategy – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Shares of BitMine Immersion Technologies recently faced pressure after Kerrisdale Capital released a short report questioning the company's Ethereum accumulation strategy and the sustainability of issuing new shares to purchase digital assets.

- This debate has drawn increased attention to BitMine's unique position as the world's largest corporate holder of Ethereum, with ambitions to control 5% of the cryptocurrency's total supply.

- Against a backdrop of a 17% weekly share price decline, we'll examine how growing scrutiny of BitMine's equity-for-Ethereum approach shapes its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Bitmine Immersion Technologies' Investment Narrative?

To be a BitMine Immersion Technologies shareholder, the big-picture pitch comes down to believing in the lasting importance of Ethereum as an institutional-grade asset and in BitMine’s aggressive accumulation model. With this approach, BitMine is essentially offering investors a public equity vehicle linked directly to the value of Ethereum. Until now, the most important catalysts have centered on Ethereum’s price moves, institutional crypto adoption, and BitMine’s expanding ETH treasury. However, the recent high-profile short report and criticism of BitMine’s equity-for-Ethereum model, paired with a sharp 17% selloff, bring new, more immediate risks into focus. Dilution risk, questions over premium valuations, and concerns about funding future ETH purchases could now overshadow previously expected drivers. While index inclusion and board additions support the story, this level of public scrutiny has the potential to materially shape near-term sentiment and alter which risks matter most.

Yet, many investors may be unaware just how quickly business model risks can overshadow crypto moves.

Exploring Other Perspectives

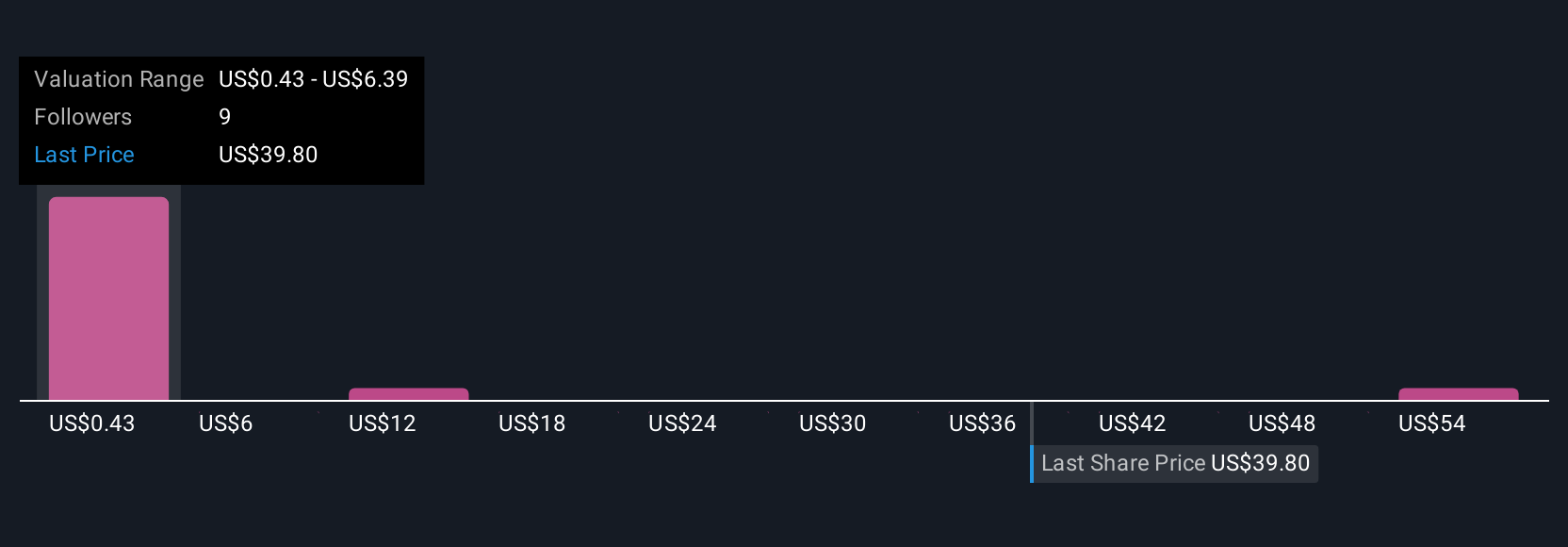

Explore 27 other fair value estimates on Bitmine Immersion Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own Bitmine Immersion Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Bitmine Immersion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitmine Immersion Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success