- United States

- /

- Software

- /

- NYSE:ZETA

Zeta Global (ZETA) Is Down 8.0% After Raising Revenue Guidance and Reporting Smaller Net Loss—Has the Growth Story Shifted?

Reviewed by Sasha Jovanovic

- Zeta Global Holdings Corp. recently raised its revenue guidance for both the fourth quarter and full year 2025, and provided 2026 guidance projecting US$1.54 billion in annual revenue, with these updates assuming US$15 million in political candidate revenue.

- The company also announced strong third quarter results, highlighting substantial year-over-year revenue growth and a significant reduction in net loss, indicating continued operational momentum.

- We'll examine how Zeta Global's increased full-year revenue outlook and improved profitability impact the company's long-term investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Zeta Global Holdings Investment Narrative Recap

To own Zeta Global Holdings, investors must believe that the company can continue driving strong revenue growth and narrowing net losses, primarily by expanding adoption of its AI-powered marketing platform and increasing client retention. The recent upward revision in full-year and 2026 revenue guidance supports the near-term growth catalyst but does not materially reduce the biggest risk: intensifying market competition from larger, established software giants leveraging their own AI solutions, which could pressure pricing and customer loyalty.

The most relevant announcement is Zeta's updated Q4 and 2025 full-year revenue guidance, which was raised on the back of sustained double-digit top-line growth. This move reinforces the company’s positioning as a high-growth player amid broader sector headwinds, and highlights management’s confidence in enterprise demand for its AI-driven offerings, putting added attention on the sustainability of its sales execution and ability to differentiate in a crowded market.

However, against these high expectations, investors should also be aware that Zeta remains exposed to...

Read the full narrative on Zeta Global Holdings (it's free!)

Zeta Global Holdings' narrative projects $1.9 billion revenue and $106.5 million earnings by 2028. This requires 18.3% yearly revenue growth and a $143.1 million increase in earnings from -$36.6 million.

Uncover how Zeta Global Holdings' forecasts yield a $28.27 fair value, a 69% upside to its current price.

Exploring Other Perspectives

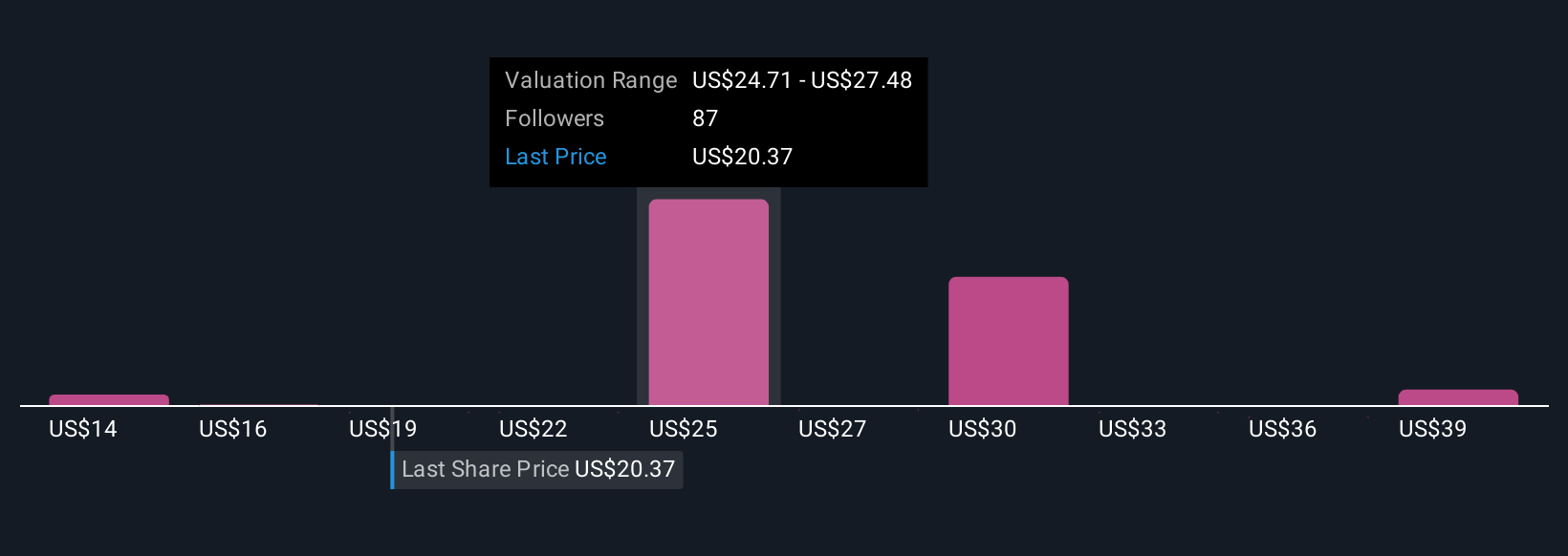

Thirty individual fair value estimates from the Simply Wall St Community for Zeta Global span a wide range from US$13.63 to US$41.34 per share. As you weigh these opinions, consider how large-scale AI integration across the software industry could affect Zeta’s client retention and pricing power over time.

Explore 30 other fair value estimates on Zeta Global Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Zeta Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zeta Global Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zeta Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zeta Global Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives