- United States

- /

- Software

- /

- NYSE:ZETA

Zeta Global Holdings (NYSE:ZETA) Raises 2024 Earnings Guidance, Highlights Yahoo Partnership Benefits

Reviewed by Simply Wall St

Zeta Global Holdings (NYSE:ZETA) has recently raised its earnings guidance for the fourth quarter and full year 2024, reflecting a strong revenue outlook of $293M to $297M for the quarter, driven by an expanding customer base and innovative product offerings. Despite these positive developments, the company faces challenges such as unprofitability and a high Price-To-Sales Ratio, which may affect investor sentiment. In the following discussion, we will explore Zeta's competitive advantages, strategic gaps, growth opportunities, and the key risks impacting its success.

See the full analysis report here for a deeper understanding of Zeta Global Holdings.

Competitive Advantages That Elevate Zeta Global Holdings

David A. Steinberg, CEO, highlighted a revenue increase of 25% year-over-year, driven by an expanding customer base and heightened demand for services. This growth trajectory is supported by a forecasted annual revenue growth of 17.1%, outpacing the US market average. The company's innovative product launches, such as the recent offerings with a 40% increase in early adoption rates, underscore its commitment to market responsiveness and customer satisfaction. This focus on innovation and customer experience positions Zeta favorably in the competitive environment. Additionally, the company has raised its earnings guidance for the fourth quarter and full year 2024, projecting a revenue range of $293M to $297M for the quarter, a notable increase from previous estimates.

Strategic Gaps That Could Affect Zeta Global Holdings

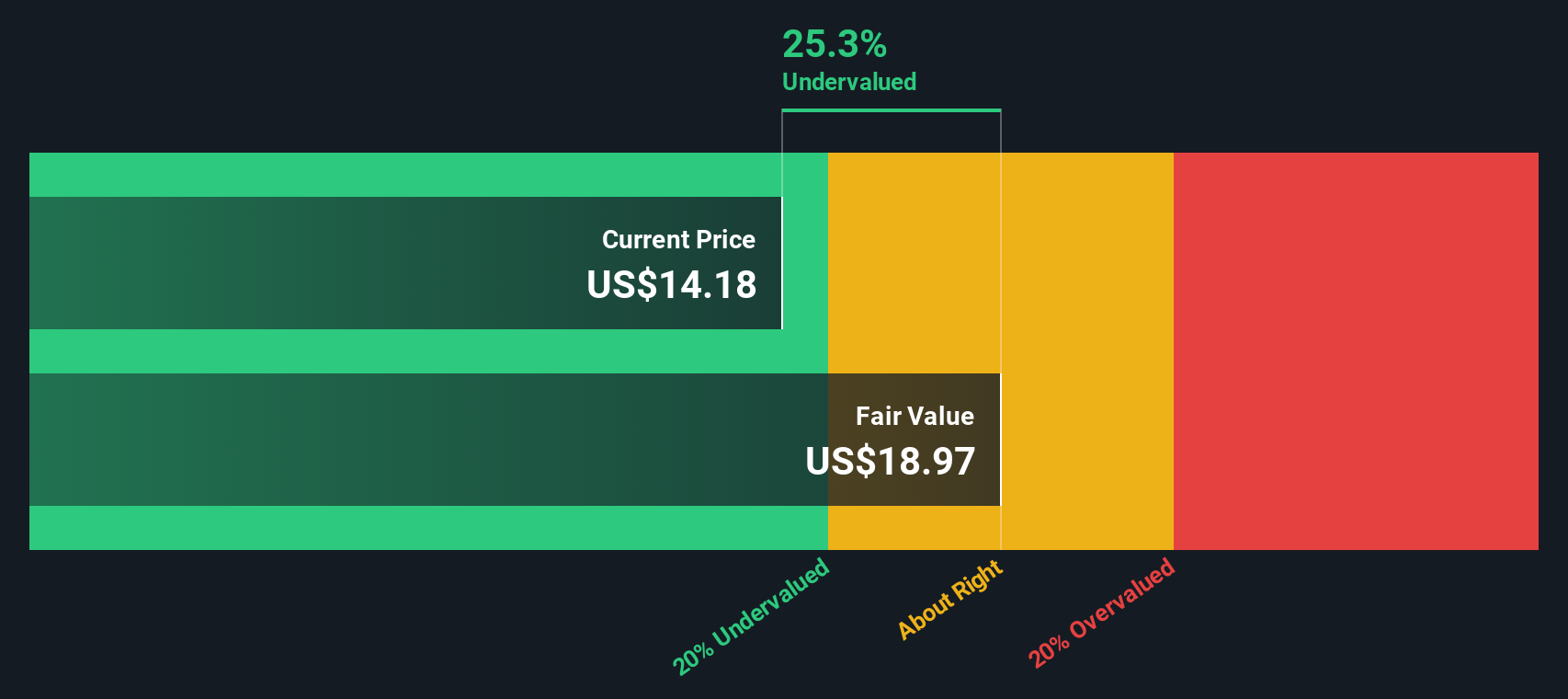

Despite these strengths, Zeta faces challenges such as being currently unprofitable with a return on equity of -25.33%. The company has also experienced a 7.3% decline in certain market segments, indicating potential vulnerabilities. Furthermore, Zeta's high Price-To-Sales Ratio of 7.4x suggests it may be overvalued compared to industry peers, potentially impacting investor sentiment. Managing rising operational costs due to increased technology investments remains a critical area for improvement.

Growth Avenues Awaiting Zeta Global Holdings

Opportunities for Zeta include international expansion and technological investments in AI and machine learning, expected to enhance product offerings and operational efficiencies. The strategic partnership with Yahoo to integrate marketing platforms exemplifies Zeta's focus on leveraging alliances to broaden service capabilities and market reach. This collaboration aims to deliver high-value audiences and maximize engagement through advanced customer intelligence and personalized marketing strategies.

Key Risks and Challenges That Could Impact Zeta Global Holdings's Success

Economic headwinds and regulatory challenges pose significant risks. The company is closely monitoring economic indicators to mitigate potential downturn impacts. Additionally, supply chain disruptions have been noted, emphasizing the need for robust management strategies. The volatility in share price further highlights the importance of maintaining investor confidence amidst these external pressures.

Explore the current health of Zeta Global Holdings and how it reflects on its financial stability and growth potential.

Conclusion

Zeta Global Holdings demonstrates strong growth potential with a 25% year-over-year revenue increase and a forecasted annual growth rate of 17.1%, driven by an expanding customer base and innovative product offerings. However, the company's current unprofitability, with a return on equity of -25.33%, and a high Price-To-Sales Ratio of 7.4x suggest it may be perceived as expensive compared to industry peers, potentially affecting investor sentiment. Opportunities for international expansion and strategic technological investments, such as the partnership with Yahoo, could enhance Zeta's market reach and operational efficiencies. The company must navigate economic headwinds and manage operational costs effectively to maintain investor confidence and capitalize on its growth avenues.

Taking Advantage

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives