- United States

- /

- Biotech

- /

- NasdaqGS:HALO

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The market has been flat over the last week but is up 32% over the past year, with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and scalability potential in line with these optimistic earnings projections.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.24% | 69.64% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.51% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Clene | 78.50% | 60.16% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 246 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Halozyme Therapeutics (NasdaqGS:HALO)

Simply Wall St Growth Rating: ★★★★★☆

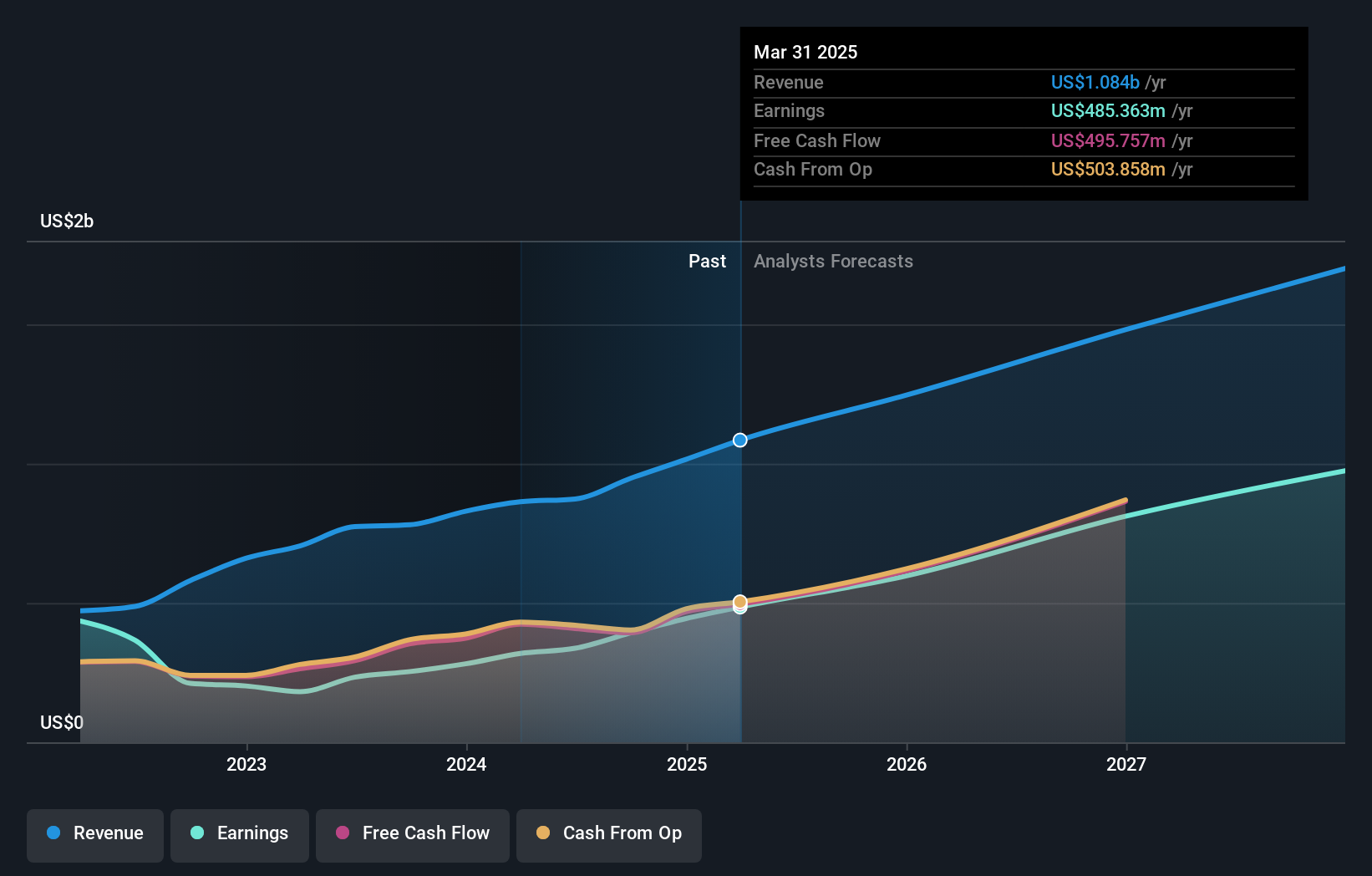

Overview: Halozyme Therapeutics, Inc. is a biopharma technology platform company that focuses on researching, developing, and commercializing proprietary enzymes and devices across the United States, Switzerland, Belgium, Japan, and internationally with a market cap of $6.13 billion.

Operations: Halozyme Therapeutics generates revenue primarily from the research, development, and commercialization of its proprietary enzymes, amounting to $947.36 million. The company operates in multiple international markets including the United States, Switzerland, Belgium, and Japan.

Halozyme Therapeutics, demonstrating a robust financial performance, reported a significant increase in Q3 2024 revenues to $290.08 million from $216.03 million the previous year, with net income surging to $137.01 million from $81.84 million. This growth trajectory is underscored by an ambitious expansion strategy, evidenced by its potential acquisition of Evotec SE for approximately $2.1 billion, signaling strategic moves to broaden its technological and market footprint significantly. Further illustrating its commitment to innovation and market leadership, Halozyme's R&D expenses have strategically aligned with its revenue growth trends, ensuring sustained development in high-stakes biotech sectors.

- Click to explore a detailed breakdown of our findings in Halozyme Therapeutics' health report.

Assess Halozyme Therapeutics' past performance with our detailed historical performance reports.

Endeavor Group Holdings (NYSE:EDR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Endeavor Group Holdings, Inc. is a sports and entertainment company with operations in the United States, the United Kingdom, and internationally, and has a market capitalization of approximately $14.22 billion.

Operations: Endeavor generates revenue primarily through its Owned Sports Properties, which brought in $2.96 billion, and Events, Experiences & Rights segment with $2.53 billion. Representation services also contribute significantly to its income at $1.61 billion.

Endeavor Group Holdings, despite a challenging year with a net loss widening to $616.53 million from a previous profit of $342 million, continues to innovate within its diverse portfolio. The company's strategic review and potential divestiture of high-profile events like the Miami Open signal a reshaping strategy aimed at optimizing its asset base. Notably, R&D expenses have been crucial in supporting this transition, aligning closely with industry demands for continuous innovation and adaptation in the fast-evolving sectors of sports and entertainment. This focus on refining its operations while maintaining investment in growth areas underlines Endeavor’s proactive approach to navigating market dynamics and enhancing shareholder value over time.

Zeta Global Holdings (NYSE:ZETA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises both in the United States and internationally, with a market cap of approximately $5.06 billion.

Operations: Zeta Global Holdings generates revenue primarily through its Internet Software & Services segment, which contributes $901.40 million. The company focuses on providing a cloud platform for consumer intelligence and marketing automation to enterprises globally.

Zeta Global Holdings, navigating through a turbulent period marked by legal challenges and allegations of financial discrepancies, has nonetheless shown resilience with a robust revenue growth forecast at 17.1% annually, outpacing the U.S. market's 8.9%. This growth is underpinned by significant R&D investments which have surged to support innovations despite current profitability challenges; earnings are expected to leap by 123.5% annually over the next few years. Amidst this backdrop, Zeta has committed to a $100 million share repurchase program, reinforcing confidence in its long-term value despite recent stock price volatility triggered by adverse reports and legal proceedings.

Summing It All Up

- Click here to access our complete index of 246 US High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halozyme Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HALO

Halozyme Therapeutics

A biopharmaceutical company, researches, develops, and commercializes of proprietary enzymes and devices in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives