- United States

- /

- Software

- /

- NYSE:YEXT

Yext (YEXT): Evaluating Valuation Following Shift to Modular, Mobile-Optimized Platform and Customizable SEO Tools

Yext (YEXT) is turning the page on its old Knowledge Assistant feature and is moving toward a modular, mobile-optimized platform with new tools that let users tailor technical SEO and site modules themselves.

See our latest analysis for Yext.

Yext’s recent shift to a modular, mobile-first platform comes as the stock demonstrates clear momentum, with a 29.51% year-to-date share price return and a robust 17.80% total shareholder return over the past year. While some volatility still lingers from its tough long-term track record, recent moves to streamline its offerings could mark the start of a sustained turnaround for investors seeking growth potential.

If you’re curious about what other tech and AI-driven innovators are capturing investor attention right now, check out the opportunities on our carefully curated See the full list for free..

But with robust growth metrics and a recent turnaround, does Yext's current valuation still leave room for upside, or have markets already accounted for the company’s next chapter in digital innovation?

Most Popular Narrative: 10.3% Undervalued

At $8.47, Yext’s share price lags behind the narrative’s fair value estimate of $9.44, hinting at untapped upside if consensus assumptions play out. The valuation reflects expectations for a business on the cusp of material margin and profit expansion driven by next-generation product uptake.

Improved customer retention (gross and net) and rising value perception indicate that Yext's platform differentiation is reducing churn risk and positioning its core products as mission-critical in an increasingly complex digital environment. This supports sustained top-line and earnings growth.

Tech insiders are betting on explosive growth behind this valuation, with profitability and expansion built into every forecast. Want to see which numbers drive the bullish story and what must go right for this premium to stick? You’ll want to read the full breakdown to catch the scenes behind the headline.

Result: Fair Value of $9.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure from market competitors and ongoing economic uncertainty could undermine Yext’s growth trajectory if retention or renewal rates decline.

Find out about the key risks to this Yext narrative.

Another View: Multiples Tell a Different Story

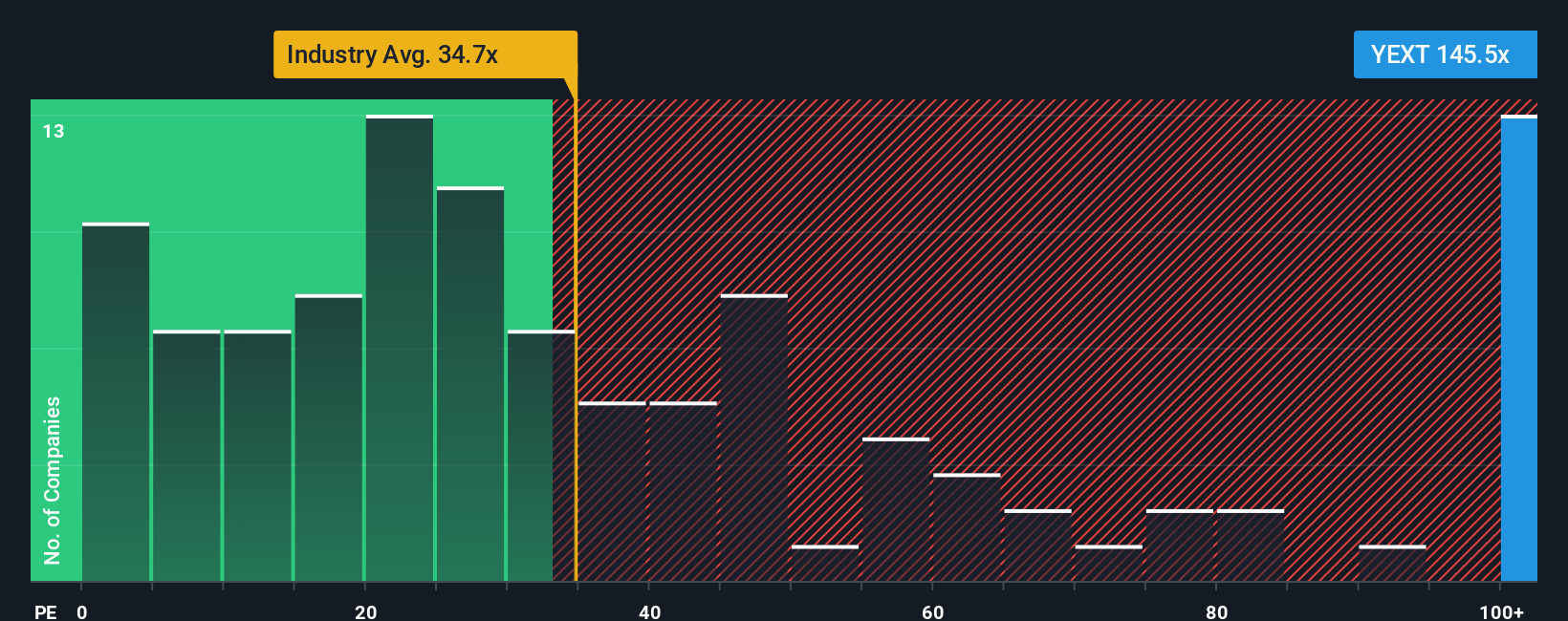

Looking at valuation through the lens of earnings multiples, Yext trades at 140.2 times earnings, significantly higher than both the US Software industry average of 34.9x and the peer average of 31.5x. The market’s fair ratio for Yext is estimated at just 39.3x. This wide gap flags considerable valuation risk, especially if profit growth slows. Could this premium be justified, or is the stock priced for perfection?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yext Narrative

If you see things differently or prefer your own hands-on approach, dive into the figures to build a Yext narrative in just a few minutes. Do it your way.

A great starting point for your Yext research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

There are many dynamic opportunities available beyond a single stock. Make your next smart investment move by exploring pre-screened lists designed for real growth potential.

- Explore the momentum of emerging markets by checking out these 3587 penny stocks with strong financials with strong financials and real upside.

- Take advantage of the surge in artificial intelligence by uncovering these 27 AI penny stocks at the forefront of this trend.

- Focus on these 20 dividend stocks with yields > 3% that regularly deliver yields above 3% to pursue steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YEXT

Yext

Provides a platform that offers answers to consumer questions in North America and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

EU#1 - From German Startup to EU’s Biggest Company

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion