- United States

- /

- Software

- /

- NYSE:YEXT

Does Yext's (YEXT) Modular Platform Shift Signal a New Phase in Competitive Positioning?

- In recent days, Yext officially retired its Knowledge Assistant tool and unveiled new features, including a user-editable schema for technical SEO and customizable modules, to enhance its digital experience platform.

- This move marks Yext's shift toward modular, mobile-optimized architecture to better address the changing needs of brands in a post-AI, mobile-first market.

- We’ll now explore how Yext’s focus on customizable, technically advanced platform updates could influence its overall investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Yext Investment Narrative Recap

To be a Yext shareholder right now, you need to believe that its approach to modular, AI-ready digital experience solutions will keep it relevant with brands as search and presence management keep fragmenting. While the new SEO and customization features reinforce Yext’s tech credentials, the immediate impact on the company’s two main issues, winning meaningful upsell and defending against pricing pressure, appears limited in the near term.

Among Yext’s recent announcements, the rollout of Yext Scout, its AI-powered search and competitive intelligence agent, stands out as directly aligned with the company’s focus on platform flexibility showcased by these new updates. As brands demand better data visibility and control in a post-AI environment, Scout’s early positive reception could become a catalyst for upsell and higher customer retention, though execution risk remains.

However, investors should also be aware that, despite innovation, persistent pricing pressure from low-cost competitors could...

Read the full narrative on Yext (it's free!)

Yext's narrative projects $517.1 million revenue and $62.1 million earnings by 2028. This requires 6.0% yearly revenue growth and a $85.5 million increase in earnings from -$23.4 million currently.

Uncover how Yext's forecasts yield a $9.44 fair value, a 11% upside to its current price.

Exploring Other Perspectives

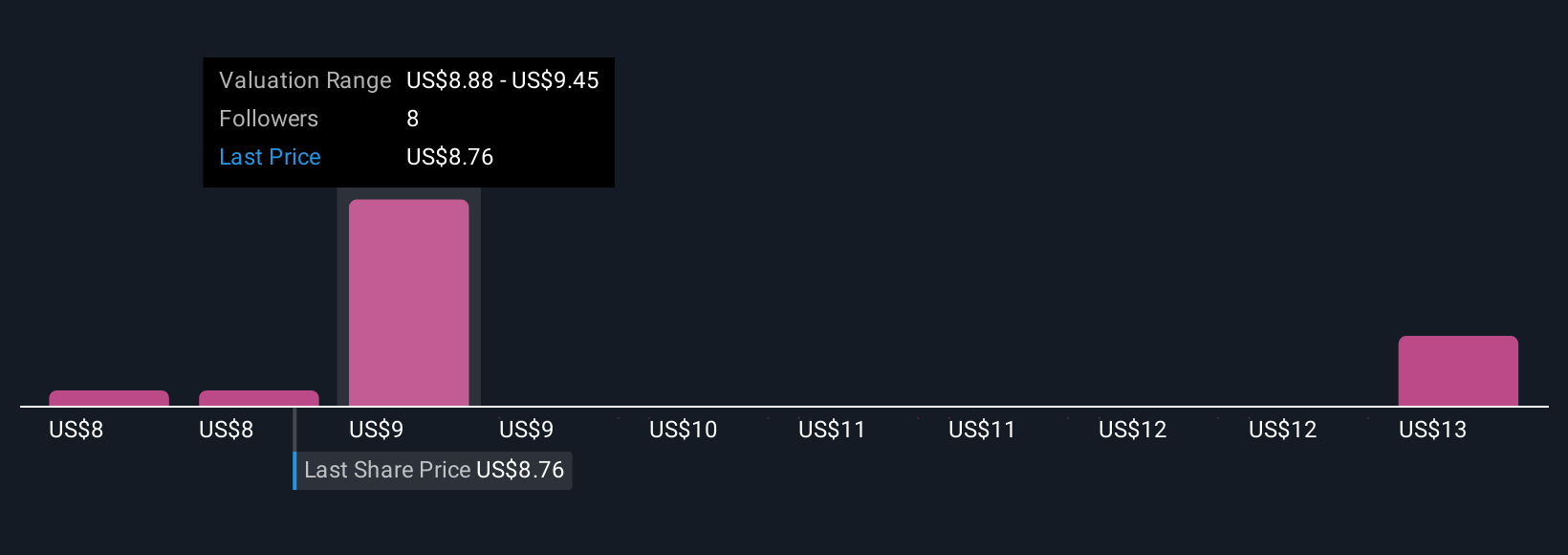

Four members of the Simply Wall St Community placed fair value for Yext stock between US$7.75 and US$13.37, reflecting a broad spread of investor expectations. Against this backdrop, ongoing pricing pressure from competitors has potential to impact revenue and margins, shaping the outlook for Yext’s performance.

Explore 4 other fair value estimates on Yext - why the stock might be worth 9% less than the current price!

Build Your Own Yext Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yext research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Yext research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yext's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YEXT

Yext

Provides a platform that offers answers to consumer questions in North America and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

The Concentration Trap: Why the S&P 500 Is No Longer a 'Safe' Diversifier

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.