- United States

- /

- Software

- /

- NYSE:WEAV

Weave Communications (WEAV): Revenue Growth Forecast Outpaces Sector but Unprofitability Challenges Bullish Narratives

Reviewed by Simply Wall St

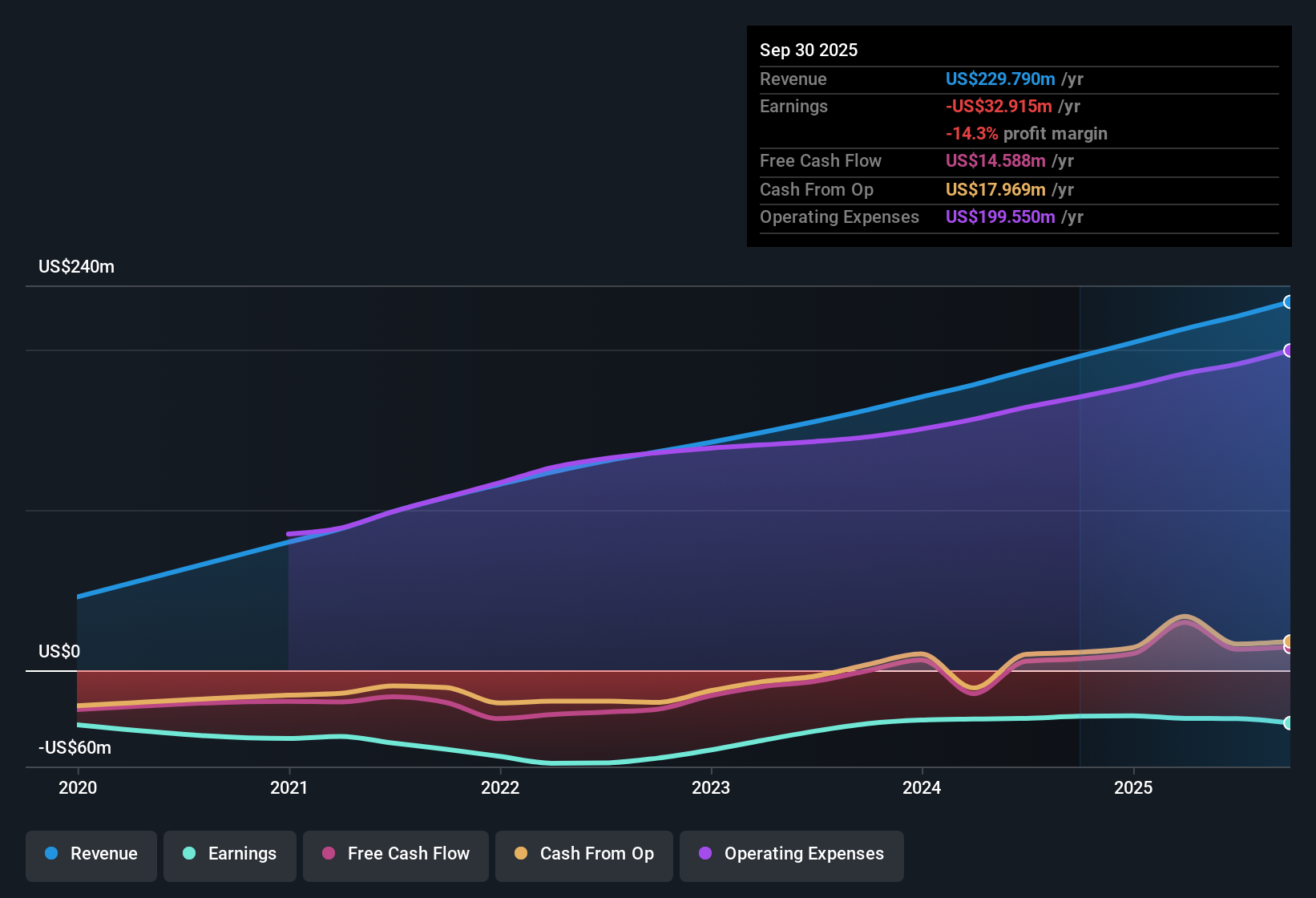

Weave Communications (WEAV) is expected to grow revenue at a 14% annual clip, notably ahead of the broader US market's projected 10.3% rate. Despite steady progress in reducing losses by 13.2% per year over the past five years, the company remains unprofitable and is not forecast to break even within the next three years. With a Price-to-Sales ratio sitting at 2.5x, well below both industry and peer averages, and shares trading at $7.41, which is less than the $11.35 estimated fair value, investors are watching how this strong growth outlook balances against ongoing losses and recent insider selling.

See our full analysis for Weave Communications.Next up, we will see how these key figures hold up when weighed against the popular market narratives shaping sentiment around Weave Communications.

See what the community is saying about Weave Communications

Operating Margins Show Early Leverage

- Losses have been reduced by 13.2% per year over the past five years, highlighting steady efficiency gains even as the company continues to invest in growth.

- Analysts' consensus view sees ongoing investment in AI-powered automation and operating efficiencies translating to expanding margins over time.

- Consensus narrative notes that continued improvement in operating metrics is key for Weave to shift from losses to positive operating income and free cash flow.

- Despite progress, consensus remains cautious given the company is not forecast to reach profitability within the next three years, underscoring the challenge of scaling up margin improvements fast enough to offset ongoing costs.

Customer Concentration as a Vertical Risk

- Weave’s revenue base remains heavily concentrated within dental, optometry, and newly-entered specialty medical practices, leaving growth vulnerable to healthcare sector shifts or regulatory changes that could accelerate churn or disrupt recurring transaction flows.

- Analysts' consensus view highlights the risk that vertical concentration and limited adoption beyond current healthcare niches could restrict both revenue stability and expansion.

- What’s surprising is that despite under 1% current market share in adjacent healthcare markets, integration and cross-selling of new product bundles are already progressing, giving some upside optionality if retention and ARPU can build sustainably beyond core segments.

- Critics highlight that slow take-up among less tech-forward practices and rising R&D spend may offset these early wins, keeping the vertical risk firmly on investors’ radar.

DCF Valuation and Analyst Target Gap

- With shares trading at $7.41, there is a significant discount to the DCF fair value of $11.35 and the analyst price target of $11.42, placing Weave among the cheaper stocks in the US Software industry relative to its peers and expected growth rate.

- Analysts' consensus view frames this valuation gap as both a risk and an opportunity.

- Consensus highlights that, for the price targets to materialize, Weave would need to grow revenue to $337.6 million, shift profit margins from -13.6% to the US Software average of 13.1%, and trade at a forward PE of 32.3x by September 2028.

- What stands out is the disconnect between ongoing unprofitability and discounted valuation, as bulls point to future upside if execution and market expansion continue, while bears remain skeptical due to the company’s path to profitability remaining unproven.

Consensus expectations point to long-term upside if Weave can deliver on market share gains and margin improvement, but near-term risks remain for those seeking a faster turnaround. See all key controversies and analyst takes in the full consensus narrative: 📊 Read the full Weave Communications Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Weave Communications on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh take on these trends? It only takes a few minutes to turn your insights into a unique narrative of your own. Do it your way

A great starting point for your Weave Communications research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Weave Communications struggles with continued unprofitability and margin pressures, which casts doubt on its ability to deliver stable, consistent earnings in the near term.

If you want to focus on companies with reliable growth and predictable performance, check out stable growth stocks screener (2103 results) for steady results even when others falter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weave Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEAV

Weave Communications

Provides a customer experience and payments software platform for small and medium-sized healthcare businesses.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives