- United States

- /

- Software

- /

- NYSE:VIA

Assessing Via Transportation (VIA) Valuation: Does the Current Premium Reflect Its Real Growth Potential?

Reviewed by Simply Wall St

See our latest analysis for Via Transportation.

Via Transportation’s recent share price return paints a challenging picture, with a 1-month share price return of -26.85% capping off months of pressure on the stock. While the company has posted impressive revenue and net income growth figures, momentum is clearly fading for now as investors appear to be reassessing the risk-reward profile in today’s market environment.

If you’re exploring what else could complement your watchlist, now is an ideal time to discover fast growing stocks with high insider ownership.

The real question now is whether the recent selloff leaves Via Transportation undervalued compared to its fundamentals, or if the market has already priced in its future growth prospects, leaving little room for upside.

Price-to-Sales Ratio of 7.1x: Is it justified?

Via Transportation is currently trading at a price-to-sales (P/S) ratio of 7.1x, which signals a premium relative to both its immediate peers and the industry average.

The price-to-sales ratio measures how much investors are willing to pay for each dollar of revenue. It is a meaningful gauge for high-growth software companies that may not yet turn a profit. For Via Transportation, this metric is especially relevant because the company is still unprofitable but posting strong top-line expansion.

Despite impressive revenue growth rates, Via Transportation's P/S ratio is significantly higher than the US Software industry average of 4.4x and even the peer average of 6.6x. This indicates that the market is pricing in substantial future growth or profitability, but at a notable premium over similar companies. Without profitability on the horizon, such a steep multiple can be difficult to justify if growth slows or competitive pressures emerge.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales Ratio of 7.1x (OVERVALUED)

However, slower revenue growth or ongoing net losses could quickly challenge perceptions of Via Transportation’s future potential, as well as investor confidence in the current valuation.

Find out about the key risks to this Via Transportation narrative.

Another View: Discounted Cash Flow Model

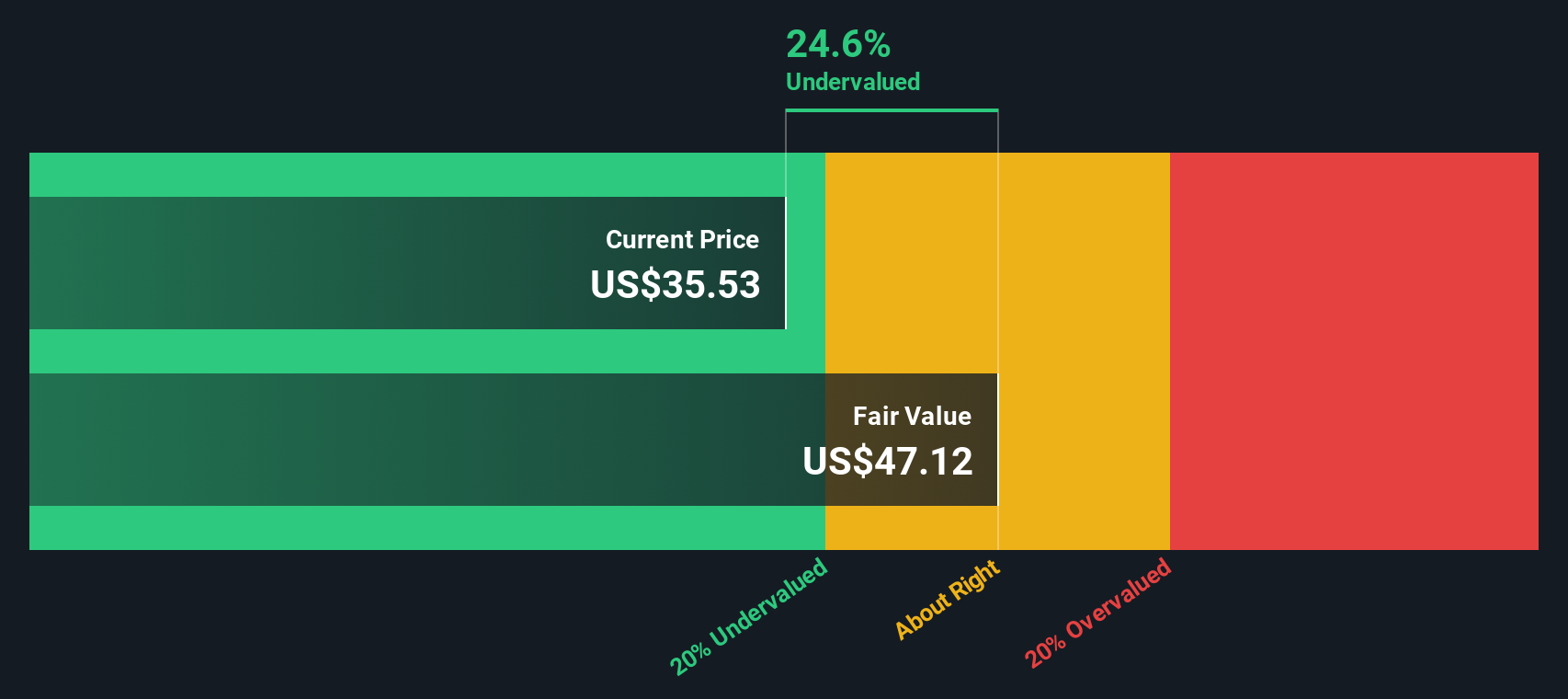

Looking beyond market multiples, our SWS DCF model offers a different perspective on Via Transportation’s valuation. According to this approach, shares are trading roughly 24.6% below intrinsic fair value, suggesting the stock could be undervalued. Does this present a real bargain or simply reflect optimism built into the model?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Via Transportation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Via Transportation Narrative

If you want to dig deeper and draw your own conclusions based on the data, you can easily create your own take in just minutes with Do it your way.

A great starting point for your Via Transportation research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why settle for the usual when you can unlock your next great idea? Join savvy investors using the Simply Wall Street Screener to spot winning stocks, before the crowd catches on.

- Target consistent income streams, and check out these 17 dividend stocks with yields > 3% for companies with attractive yields and solid payout histories.

- Seize tomorrow’s tech trends by exploring these 25 AI penny stocks to spot firms harnessing the power of artificial intelligence and automation.

- Capitalize on market mispricing by reviewing these 917 undervalued stocks based on cash flows that offer strong fundamentals at appealing valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIA

Via Transportation

Provides a digital public transportation system platform in the United States, Germany, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives