- United States

- /

- Software

- /

- NYSE:TYL

Tyler Technologies (TYL): Assessing Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for Tyler Technologies.

The recent dip in Tyler Technologies’ share price fits into a larger trend, with the 1-year total shareholder return now at -22.5%. Momentum has clearly faded compared to its strong three-year run. Despite this, the company has a reputation for consistent growth and a resilient business model.

If you want to see which other tech leaders are navigating similar shifts, now’s the perfect moment to discover See the full list for free.

With shares trading well below recent highs and analysts still seeing upside, the question arises: are investors underestimating Tyler’s growth prospects, or is the current valuation already accounting for everything ahead?

Most Popular Narrative: 28% Undervalued

Tyler Technologies closed at $465.77, while the most popular valuation narrative places fair value at $649.83. This considerable gap is fueling debate over how much upside remains. To understand the thinking behind this price, it is important to look at the factors analysts see driving long-term growth and profitability.

Ongoing investment in AI-powered tools and automation, evident in product launches like the AI-driven Resident Assistant and enhanced budgeting solutions, caters to public sector labor challenges and the need for data-driven decision-making. This enables premium pricing, reduces customer churn, and unlocks scalable margin improvements over time.

Curious what bold growth levers justify such a bullish valuation? The full narrative reveals unique earnings assumptions, ambitious revenue targets, and the kind of future profit margins that only market leaders dream of. Want to know which key projections are moving the needle and why they spark so much debate? Dive in for the strategic details driving this fair value.

Result: Fair Value of $649.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Tyler’s growth depends on consistent government spending and the successful integration of acquisitions. Any disruption to these factors could undermine optimistic forecasts.

Find out about the key risks to this Tyler Technologies narrative.

Another View: High Valuation Ratios Signal Caution

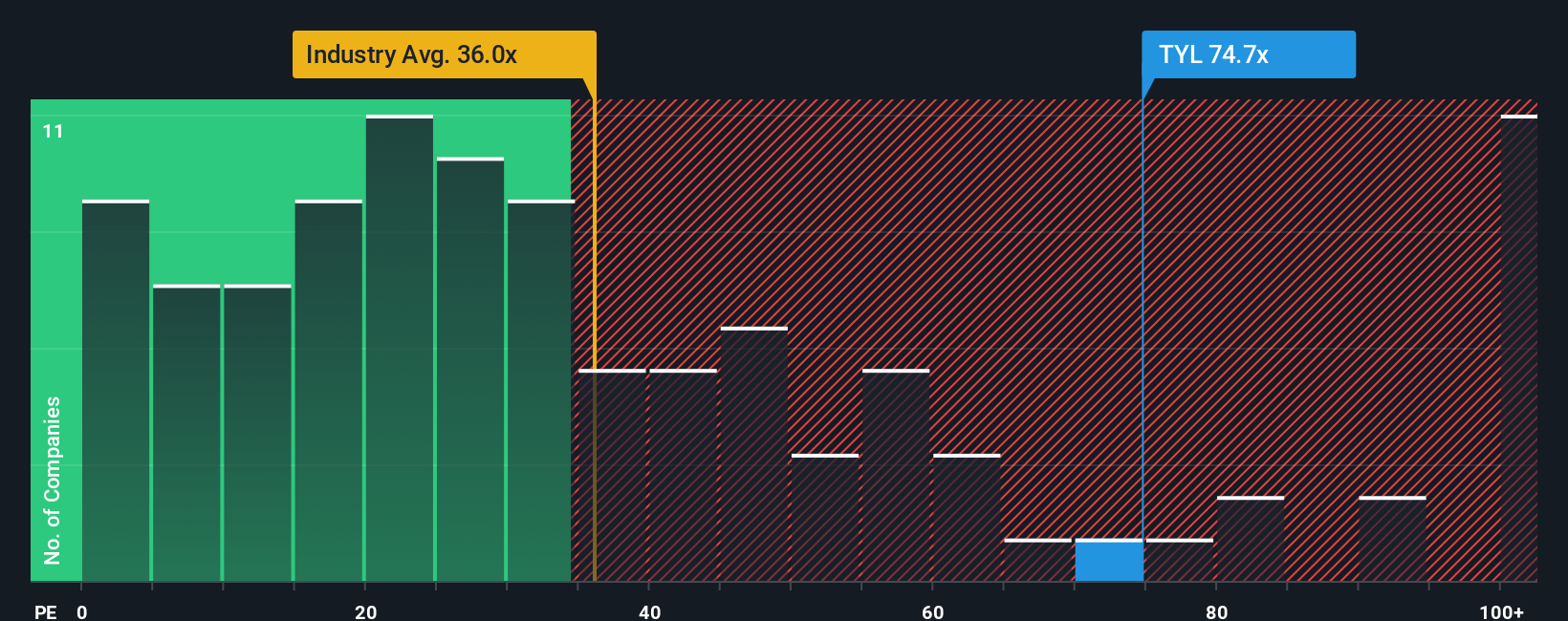

Looking at valuation through the lens of price-to-earnings, Tyler Technologies trades at 63.6x, which is well above both the US Software industry average of 30x and its peer average of 45.4x. The fair ratio for a company like Tyler is 34.3x, so there is a wide gap that can present valuation risk if investor sentiment changes. Could the company’s market leadership and growth justify staying this expensive?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyler Technologies Narrative

If you want to dive deeper or challenge these perspectives, crafting your own Tyler Technologies narrative from the data takes just a few minutes. Why not Do it your way?

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Tyler Technologies.

Looking for More Smart Investment Ideas?

Why wait to upgrade your portfolio? The right research sets you apart from the crowd, and the quickest way to find tomorrow’s winners is to act now.

- Uncover exceptional value with these 898 undervalued stocks based on cash flows that spotlight companies trading below what they're truly worth. Don’t let these overlooked opportunities pass you by.

- Gain an income edge by searching among these 15 dividend stocks with yields > 3% offering reliable yields above 3%, and put your money to work with proven performers.

- Ride the technology wave by targeting these 27 AI penny stocks unlocking real growth through AI innovation. Secure your stake in this unstoppable trend before everyone else catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyler Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TYL

Tyler Technologies

Provides integrated software and technology management solutions for the public sector.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives