- United States

- /

- Software

- /

- NYSE:TUYA

What Tuya (TUYA)'s COP30 Solutions Hub Spotlight Means for Its AI-Driven Sustainability Partnerships

Reviewed by Sasha Jovanovic

- Tuya Smart recently participated in the launch of the United Nations Solutions Hub at COP30, where it showcased its AIoT-powered energy management solutions, including large-scale deployments and international partnerships focused on optimizing energy use in homes, businesses, and cities.

- This high-profile involvement underlines Tuya's expanding influence in global sustainability initiatives, highlighting real-world applications of AI technology in reducing energy consumption and supporting climate action.

- To assess the implications of Tuya's COP30 participation, we'll examine how its AI-driven energy partnerships strengthen the company's investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Tuya Investment Narrative Recap

The core case for owning Tuya shares is the company's ability to scale its AIoT platform globally as smart devices and intelligent energy management become mainstream. While Tuya’s presence at COP30 supports its positioning as a sustainability innovator and may aid its international reputation, the immediate impact on major short-term catalysts, such as rapid SaaS growth and rising developer participation, is likely limited. However, risks tied to international trade tensions and competitive pricing pressures remain front of mind.

Among recent company developments, the announcement of a special cash dividend on November 10, 2025, stands out. This move signals management’s confidence in Tuya’s current earnings profile and cash position, though it may not directly address the need for continued margin improvement and resilience against global supply chain risks in the near term.

In contrast, investors should also be mindful of ongoing global trade policies and tariff uncertainties that could...

Read the full narrative on Tuya (it's free!)

Tuya's outlook anticipates $442.7 million in revenue and $76.0 million in earnings by 2028. This scenario assumes 11.6% annual revenue growth and a $47.0 million increase in earnings from the current $29.0 million.

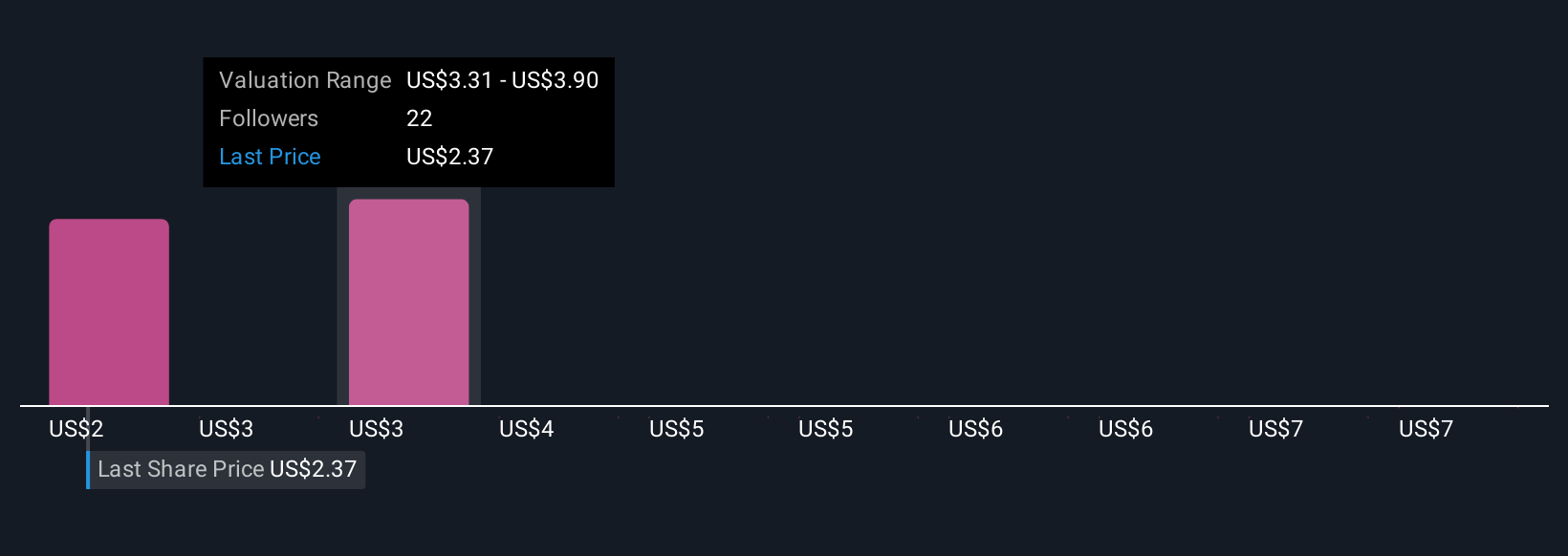

Uncover how Tuya's forecasts yield a $3.32 fair value, a 56% upside to its current price.

Exploring Other Perspectives

Twelve private investors in the Simply Wall St Community estimate Tuya’s fair value between US$2.11 and US$8.09 per share. With international trade uncertainty influencing near-term margins and revenue, it is clear that the market holds a wide range of alternate viewpoints on Tuya’s outlook.

Explore 12 other fair value estimates on Tuya - why the stock might be worth just $2.11!

Build Your Own Tuya Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tuya research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tuya research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tuya's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tuya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TUYA

Tuya

Provides AI cloud platform services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives