- United States

- /

- Software

- /

- NYSE:TUYA

Tuya (NYSE:TUYA): Evaluating Valuation as COP30 Spotlight Highlights Smart Energy and Sustainability Innovations

Reviewed by Simply Wall St

Tuya (NYSE:TUYA) drew attention this week by participating in the United Nations Solutions Hub launch at COP30. The company demonstrated how its AIoT platforms deliver measurable energy savings for partners focused on smart and sustainable solutions.

See our latest analysis for Tuya.

Momentum around Tuya has shifted recently. While the company’s newsworthy smart energy initiatives have sharpened its sustainability profile, the share price has faced a 15% pullback in the past month after notable year-to-date gains. Still, its one-year total shareholder return is up an impressive 34.8%, and investors who bought in three years ago have seen their total returns more than double, signaling resilient long-term growth despite short-term fluctuations.

If sustainability breakthroughs are on your radar, it could be the right moment to discover the latest smart tech innovators. See the full list for free: See the full list for free.

With Tuya trading at a notable discount to analyst price targets, yet following a sharp share pullback, the key question is whether this offers an appealing entry for investors or if future growth is already reflected in the stock.

Most Popular Narrative: 38.5% Undervalued

With Tuya’s widely followed narrative assigning a fair value notably above its last close, there is a broad gap between market price and future growth expectations. This sets the stage for a deeper look at what is fueling this confidence.

The continued global proliferation of IoT devices, evidenced by strong growth in developer numbers, cross-category AI adoption, and expansion into new product verticals (such as AI energy solutions, toys, and pet care), positions Tuya to benefit from expanding end markets, which should drive sustained top-line growth and increased diversification of revenue streams.

What is the engine behind these ambitious projections? There is a distinctive mix of sector trends, rapid segment expansion, and some surprising financial targets propelling this valuation narrative. The real intrigue lies in a bold set of assumptions, including industry-shaping revenue growth rates and margin leaps. Ready for a breakdown that rewrites the rulebook?

Result: Fair Value of $3.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global trade uncertainties and intense competition could easily upend these growth projections, which makes Tuya’s future far less certain.

Find out about the key risks to this Tuya narrative.

Another View: Is Tuya Actually Expensive?

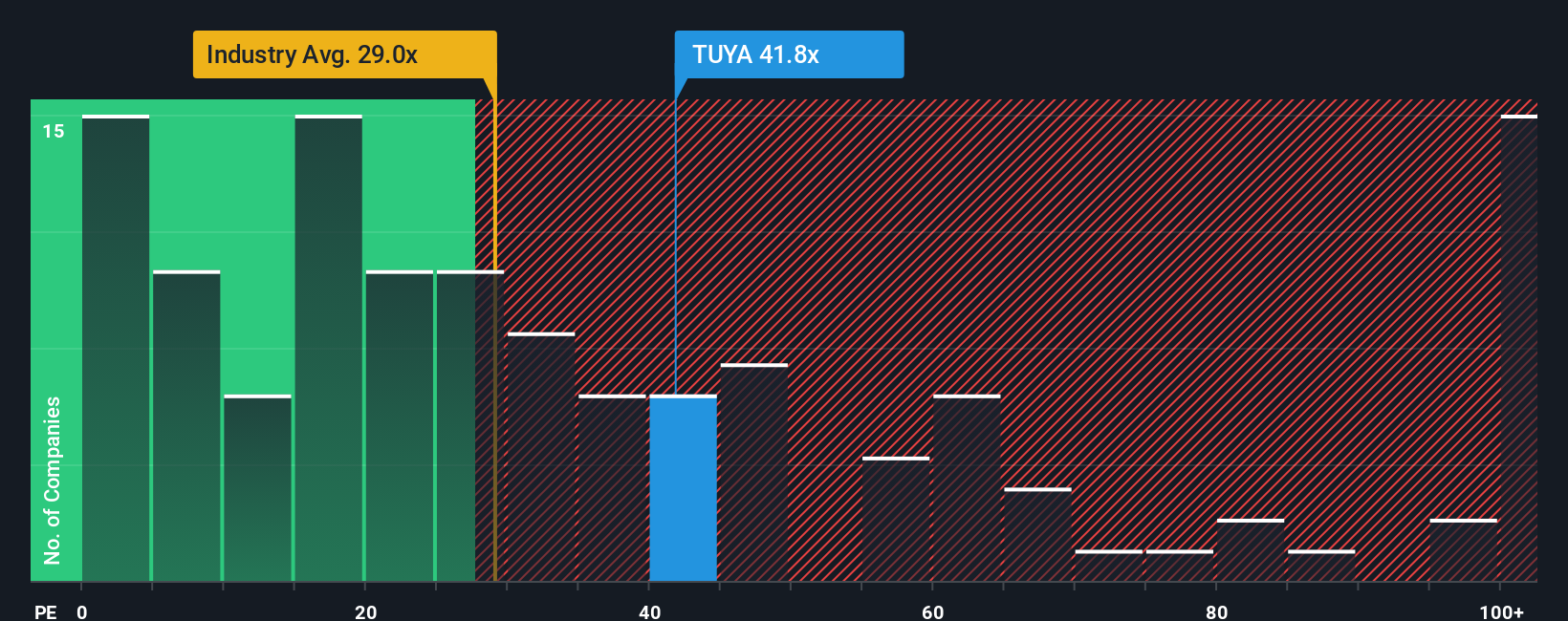

Looking at valuation through earnings, Tuya trades at 42.4 times earnings, which is significantly higher than both the US Software industry average of 29.2 times and its peer average of 23.8 times. The share price also sits above the fair ratio of 33.1 times. These gaps signal a notable valuation risk if growth slows or investor enthusiasm wanes. Could the multiple compress and bring the share back to earth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tuya Narrative

If you want to dig into the numbers yourself and shape your own viewpoint, building a personalized narrative only takes a few minutes. Do it your way

A great starting point for your Tuya research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Investment Opportunities?

The best investors stay ahead by acting on new trends before the crowd. If you want to spot tomorrow’s winners today, now is your chance to get an edge.

- Uncover overlooked gems with solid growth potential by starting your research at these 3579 penny stocks with strong financials.

- Capitalize on future healthcare revolutions by tapping into these 30 healthcare AI stocks that are using AI to transform patient outcomes and medical technology.

- Lock in steady streams of income with these 15 dividend stocks with yields > 3% offering yields above 3 percent without sacrificing quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tuya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TUYA

Tuya

Provides AI cloud platform services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives