Stock Analysis

- United States

- /

- Software

- /

- NYSE:TUYA

High Growth Tech Stocks in the United States to Watch

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.1% drop, yet it has shown resilience with a 30% rise over the past year and anticipated earnings growth of 15% per annum in the coming years. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that demonstrate robust innovation and adaptability to capitalize on long-term market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Invivyd | 50.60% | 71.37% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Clene | 78.50% | 60.70% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Travere Therapeutics | 31.75% | 72.43% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 251 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Verra Mobility (NasdaqCM:VRRM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verra Mobility Corporation offers smart mobility technology solutions and services across the United States, Australia, Canada, and Europe with a market cap of approximately $3.86 billion.

Operations: The company generates revenue primarily through its Commercial Services, Government Solutions, and Parking Solutions segments, with Commercial Services contributing $403.56 million and Government Solutions $381.71 million.

Verra Mobility, with a projected annual revenue growth of 6.5%, trails the U.S. market average but outpaces it in earnings growth at 23.5% per year, suggesting a robust operational focus despite broader market challenges. The company's recent expansion into Italy's electronic tolling for rental cars underscores its strategic push into high-traffic European markets, leveraging partnerships like Telepass to enhance service accessibility and efficiency. This move not only diversifies its revenue streams but also aligns with global trends towards automated and integrated mobility solutions, positioning Verra well within the evolving transportation tech landscape.

- Get an in-depth perspective on Verra Mobility's performance by reading our health report here.

Gain insights into Verra Mobility's past trends and performance with our Past report.

Viant Technology (NasdaqGS:DSP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Viant Technology Inc. is an advertising technology company with a market capitalization of approximately $1.02 billion.

Operations: Viant Technology generates revenue primarily from its Internet Information Providers segment, which accounts for $263.59 million. The company focuses on leveraging technology to enhance digital advertising solutions.

Viant Technology's recent pivot towards AI-driven solutions, particularly with the launch of ViantAI, underscores its strategic alignment with industry shifts towards automation in programmatic advertising. This innovation is poised to enhance campaign efficiency and accuracy, marking a significant step in Viant's operational evolution. Financially, the company has shown resilience and growth; third-quarter sales surged to $79.92 million from $59.59 million year-over-year, coupled with a swing to net income of $1.51 million from a net loss previously. These figures align with their forward-looking revenue guidance for Q4 2024, projected between $82 million and $85 million, reflecting an optimistic trajectory amidst competitive market dynamics.

Tuya (NYSE:TUYA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tuya Inc. provides a specialized Internet of Things (IoT) cloud development platform both in China and globally, with a market capitalization of $901.37 million.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $260.44 million. The focus is on providing a cloud development platform for IoT applications across various regions.

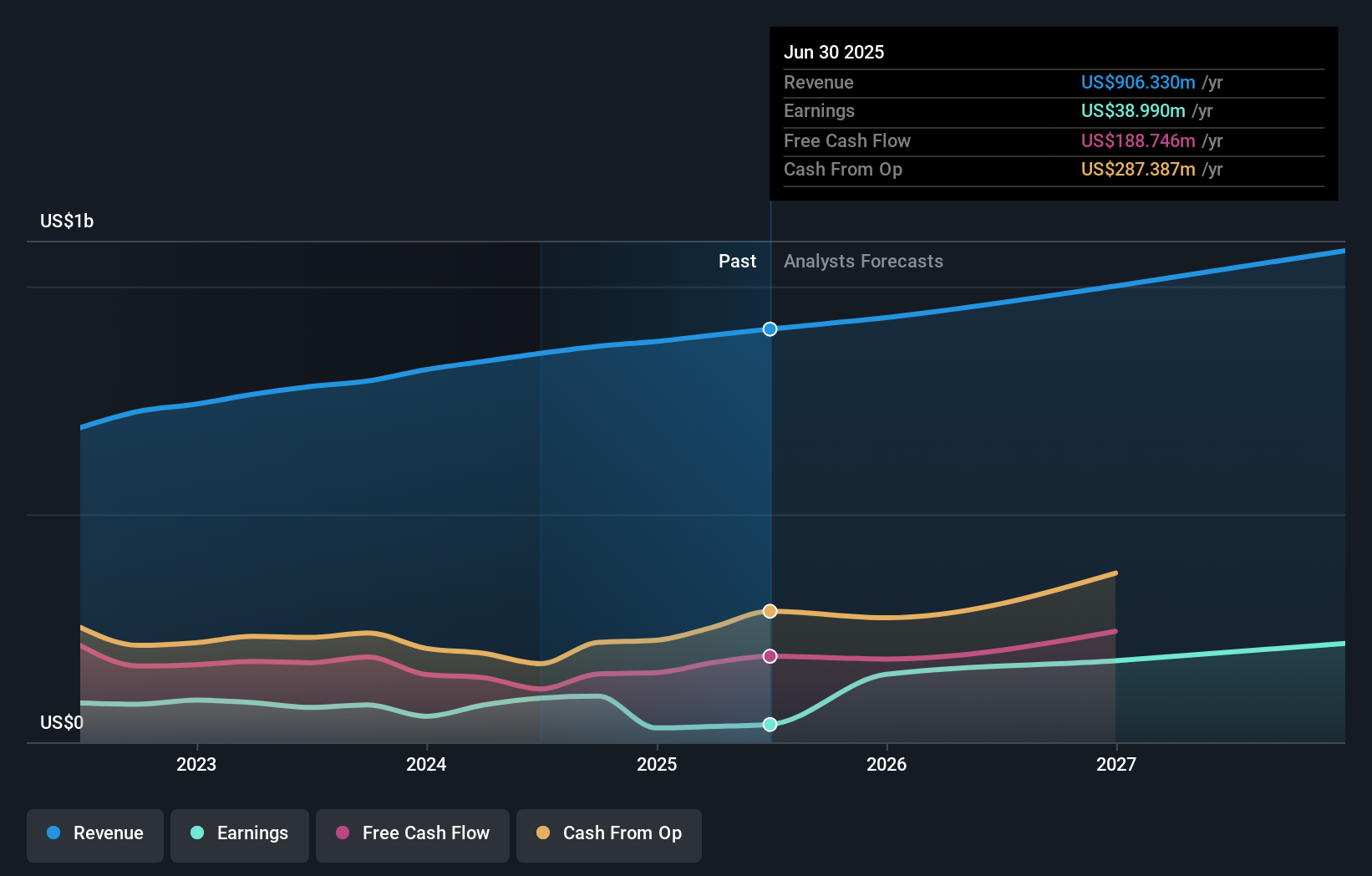

Tuya's strategic partnerships, notably with InfraX and MLG during GITEX 2024, underscore its commitment to expanding its smart city capabilities. These alliances not only enhance Tuya's product offerings but also position it as a pivotal player in the evolving smart home industry in the Middle East. Financially, Tuya is navigating a turnaround with Q3 sales rising to $73.28 million from $57 million year-over-year and net income reaching $3.13 million from a previous loss of $23.55 million, reflecting robust operational improvements and market adaptation. These developments are crucial as Tuya aims for profitability with expected earnings growth of 103.2% annually, despite currently growing slower than some industry benchmarks at 15.5% per year in revenue.

- Dive into the specifics of Tuya here with our thorough health report.

Understand Tuya's track record by examining our Past report.

Where To Now?

- Dive into all 251 of the US High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tuya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TUYA

Tuya

Offers purpose-built Internet of Things (IoT) cloud development platform in the People’s Republic of China and internationally.