- United States

- /

- Software

- /

- NYSE:TUYA

3 Growth Companies With Insider Ownership Ranging From 13% To 25%

Reviewed by Simply Wall St

In the current U.S. market, major stock indexes like the Dow Jones, S&P 500, and Nasdaq have shown resilience by advancing modestly after Nvidia's impressive results boosted tech stocks and Walmart's strong performance lifted its outlook. Amid these movements, investors are increasingly interested in growth companies with significant insider ownership as this can indicate confidence from those who understand the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 21.9% | 73.4% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 23% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.2% |

| Astera Labs (ALAB) | 12.5% | 27.1% |

| AppLovin (APP) | 27.5% | 26.6% |

Here we highlight a subset of our preferred stocks from the screener.

PDF Solutions (PDFS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PDF Solutions, Inc. offers proprietary software, intellectual property for integrated circuit designs, hardware tools, methodologies, and services globally with a market cap of approximately $947.13 million.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $206.71 million.

Insider Ownership: 17.1%

PDF Solutions is experiencing significant growth, with recent earnings showing a revenue increase to US$57.12 million in Q3 2025 from US$46.41 million the previous year. Despite a net income decline, the company reaffirmed its 2025 revenue growth guidance of 21-23%. Collaborations like that with Lavorro Inc. and the release of Exensio Studio AI highlight its strategic focus on enhancing semiconductor manufacturing efficiency through AI-driven solutions, positioning it well for future profitability and market expansion.

- Navigate through the intricacies of PDF Solutions with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that PDF Solutions' current price could be inflated.

MNTN (MNTN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MNTN, Inc. operates a technology platform focused on performance marketing for Connected TV and has a market cap of approximately $1.03 billion.

Operations: The company generates revenue from its Internet Software & Services segment, amounting to $272.81 million.

Insider Ownership: 13.2%

MNTN is experiencing robust growth, with Q3 2025 sales rising to US$70.02 million from US$57.13 million a year prior, and net income reaching US$6.44 million compared to a loss previously. The company forecasts strong revenue growth for Q4 2025 and has launched QuickFrame AI, enhancing its video ad production capabilities significantly. With strategic partnerships like those with Haus and PubMatic, MNTN is well-positioned in the expanding Connected TV market despite facing legal challenges over patent infringement claims.

- Click here and access our complete growth analysis report to understand the dynamics of MNTN.

- In light of our recent valuation report, it seems possible that MNTN is trading beyond its estimated value.

Tuya (TUYA)

Simply Wall St Growth Rating: ★★★★☆☆

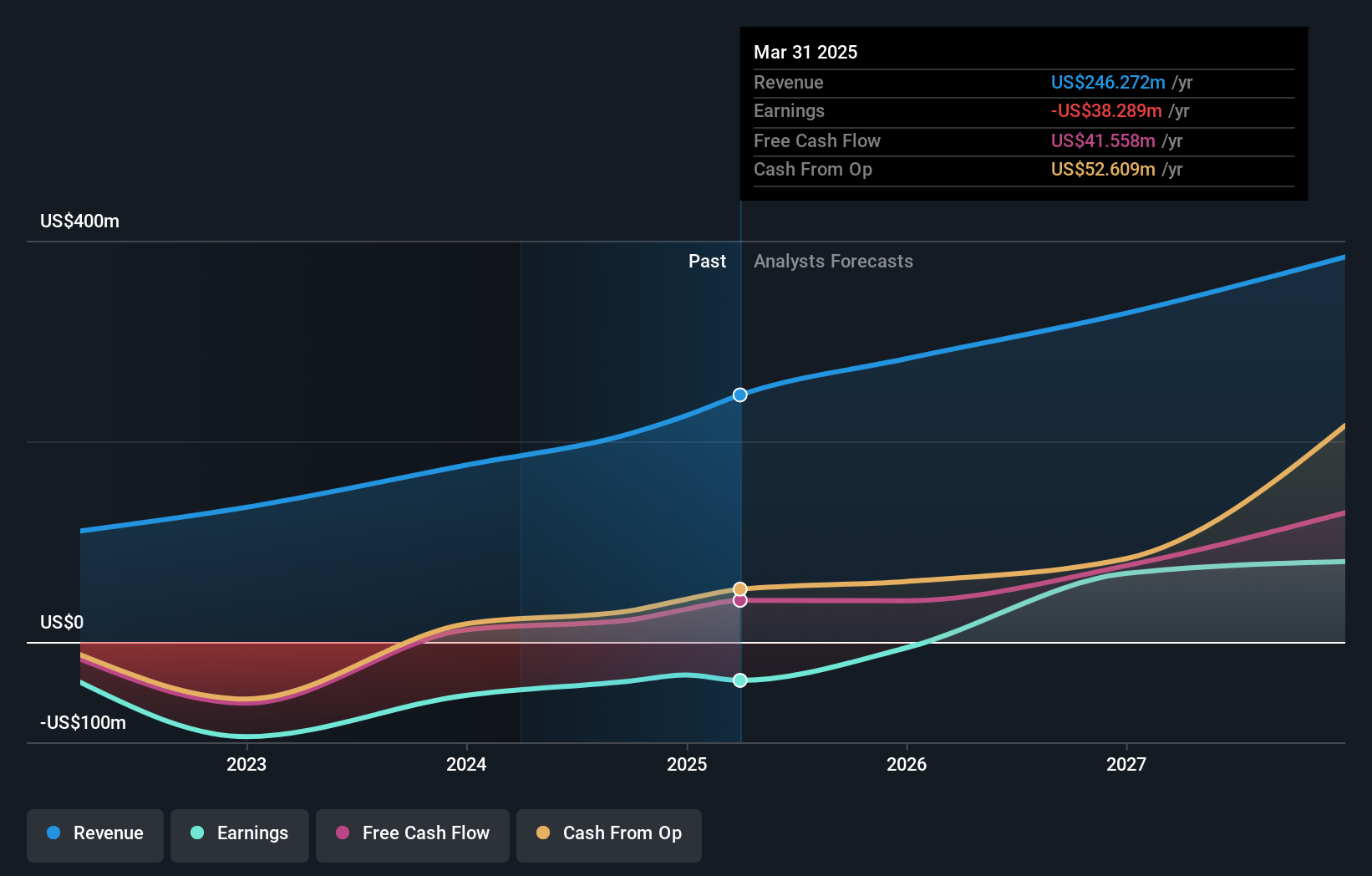

Overview: Tuya Inc. operates as an AI cloud platform service provider in the People’s Republic of China, with a market cap of approximately $1.21 billion.

Operations: The company generates revenue of $318.49 million from its Internet Software & Services segment.

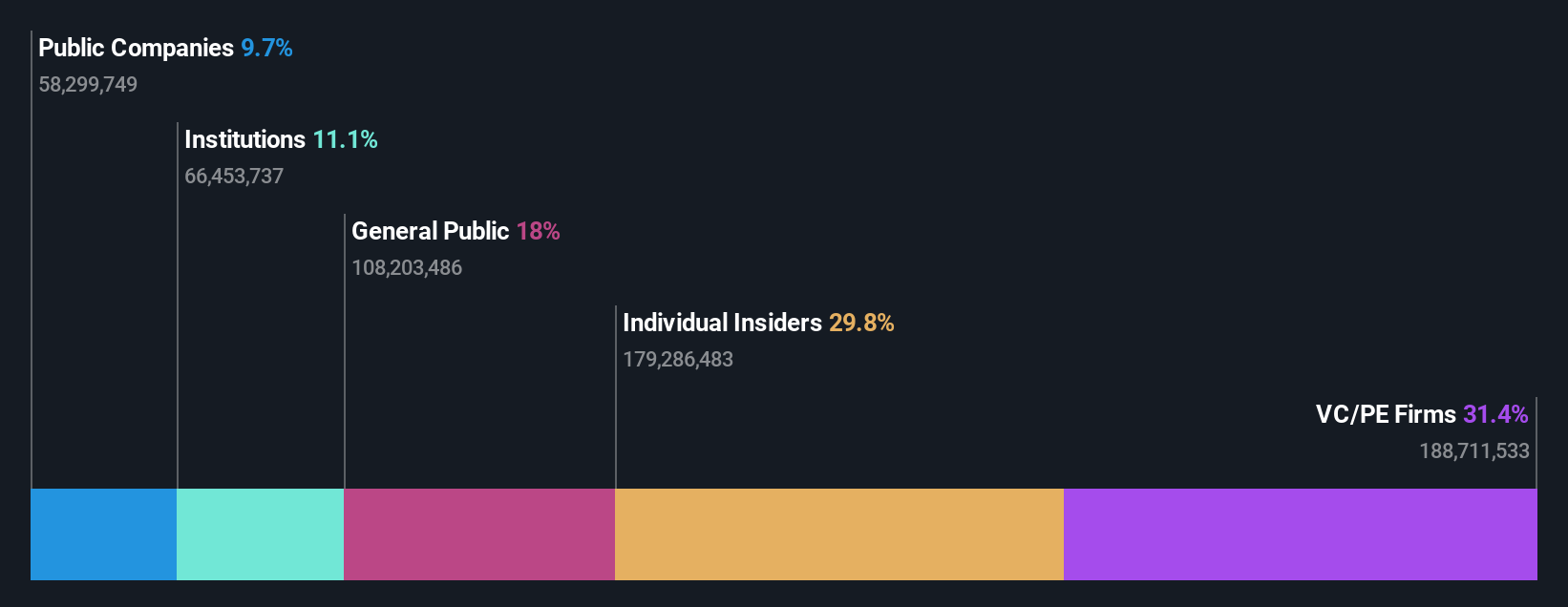

Insider Ownership: 25.6%

Tuya has demonstrated strong growth, becoming profitable this year with significant earnings expansion expected at 22.4% annually, outpacing the US market. Recent participation in global sustainability initiatives highlights its strategic focus on AIoT solutions for energy efficiency and smart urban planning. Despite a dividend yield of 5.29% not being well-covered by earnings, Tuya's stock is trading below fair value estimates and analysts anticipate a substantial price increase of 62.2%.

- Delve into the full analysis future growth report here for a deeper understanding of Tuya.

- Our valuation report here indicates Tuya may be overvalued.

Key Takeaways

- Delve into our full catalog of 194 Fast Growing US Companies With High Insider Ownership here.

- Contemplating Other Strategies? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Tuya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TUYA

Tuya

Provides AI cloud platform services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives