- United States

- /

- IT

- /

- NYSE:SNOW

Snowflake (SNOW): Assessing Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Snowflake.

Snowflake’s recent momentum is hard to ignore, with a 1-year total shareholder return of over 100% and the share price up more than 50% year-to-date. This performance highlights renewed optimism around its growth prospects and suggests that investor sentiment is strengthening, especially following this month’s notable double-digit share price jump.

If you’re curious about what other tech leaders are capturing attention right now, check out the full list of movers in our latest roundup: See the full list for free.

With Snowflake posting impressive returns and trading just under analyst price targets, the question for investors is clear: are shares still undervalued, or has the market already factored in all the future growth potential?

Most Popular Narrative: 8.6% Undervalued

Snowflake’s most-followed narrative points to a fair value noticeably above the latest closing price of $240.74. The stage is set by robust recent performance and big expectations riding on platform innovation.

*Rapid product innovation, including the launch of ~250 new features and expanded offerings such as Snowflake Intelligence, Cortex AI SQL, and Postgres support, is increasing average revenue per user and deepening customer stickiness. This is expected to drive recurring revenue and long-term topline growth.*

Want to know exactly which quantitative levers this narrative is betting on? Behind the headline, it’s all about hypergrowth in revenue, margins, and an aggressive future profit multiple. There is also the financial leap needed to justify this price. Unpack which pivotal assumptions turbocharge that fair value and see if your own forecast would match.

Result: Fair Value of $263.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Snowflake’s heavy reliance on migration-driven growth and intensifying competition from major cloud providers could pose challenges to its long-term revenue expansion.

Find out about the key risks to this Snowflake narrative.

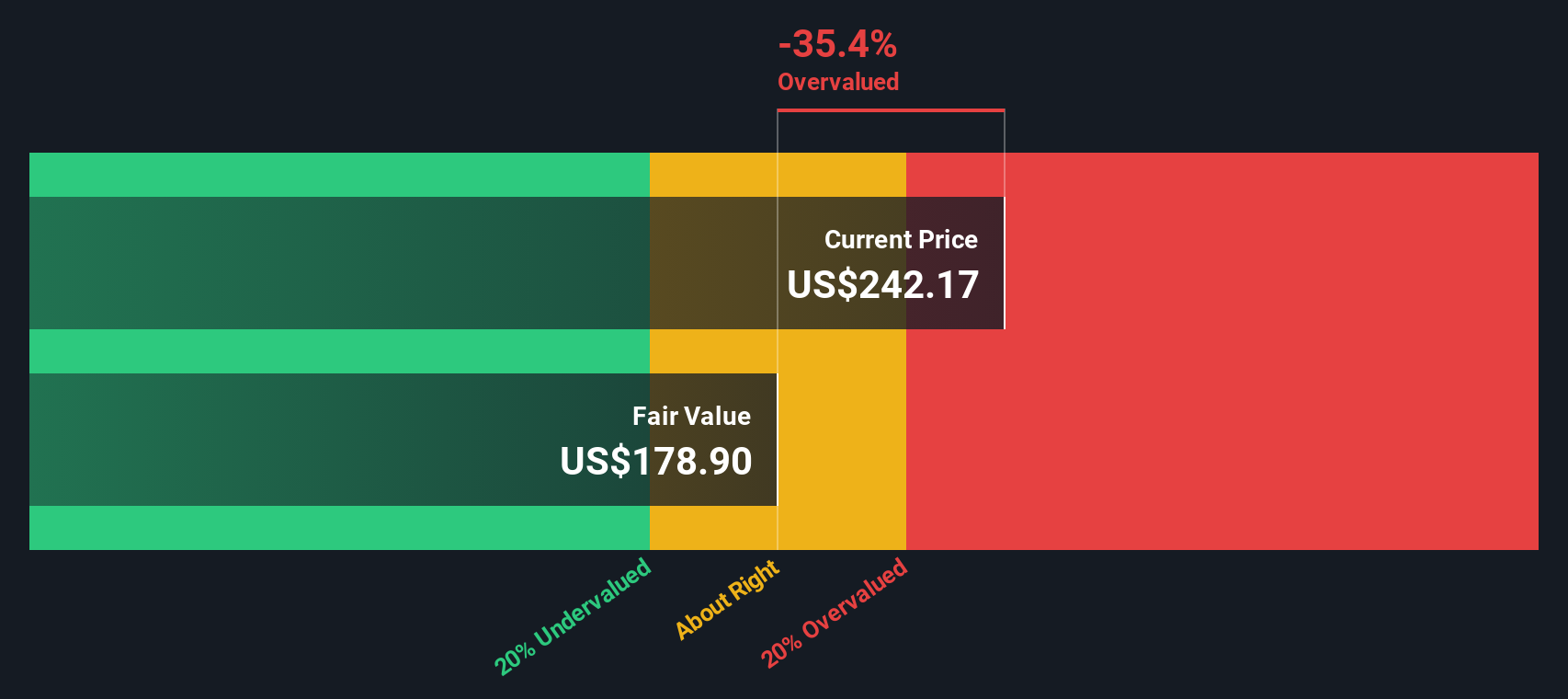

Another View: SWS DCF Model Suggests Overvaluation

While analyst narratives see Snowflake as undervalued, our SWS DCF model presents a different picture. Based on discounted future cash flows, Snowflake's fair value is calculated at $177.58 per share, which is well below current levels and signals potential overvaluation. How much weight should investors place on cash flow forecasts compared to market optimism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Snowflake Narrative

If these conclusions do not match your view, you can dig into the fundamentals yourself and build your own perspective in just a few minutes. Do it your way

A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Winning Stock Ideas?

Sticking with just one company could mean missing tomorrow's breakout opportunities. Don’t let that happen! Expand your investing toolkit with these unbeatable sources of fresh ideas:

- Supercharge your portfolio returns by tapping into these 878 undervalued stocks based on cash flows that the market may have overlooked. This gives you a head start on hidden gems.

- Capture the explosive growth of artificial intelligence by following these 24 AI penny stocks, which are gaining momentum in real-world innovations and reshaping entire industries.

- Boost your income stream by selecting high-yield companies from these 18 dividend stocks with yields > 3% with consistently strong dividends and proven financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion