- United States

- /

- IT

- /

- NYSE:SNOW

Snowflake (NYSE:SNOW) Collaborates With Tredence To Revolutionize Automotive AI Data Cloud

Reviewed by Simply Wall St

Snowflake (NYSE:SNOW) announced a collaboration with Tredence to enhance its AI Data Cloud, particularly in the automotive sector, which may have contributed to its 29% rise over the past month. This partnership aims to modernize systems for OEMs and improve supply chain agility, aligning with current market demand for AI-driven solutions. While broader markets experienced a decline due to anticipation over federal decisions and tariff concerns, Snowflake's focus on integrating AI capabilities and expanding data applications in manufacturing stood in contrast, likely supporting its positive price movement amidst these broader economic uncertainties.

We've discovered 1 warning sign for Snowflake that you should be aware of before investing here.

The recent collaboration between Snowflake and Tredence focusing on AI enhancements in the automotive sector builds on Snowflake's efforts to improve its AI-driven product capabilities. This partnership, likely contributing to Snowflake's share price rise of 29% last month, could strengthen its market position and drive future revenue growth, essential given its current unprofitability. Over the past three years, Snowflake's total shareholder return was 17.15%, offering a broader context to its shorter-term price movements.

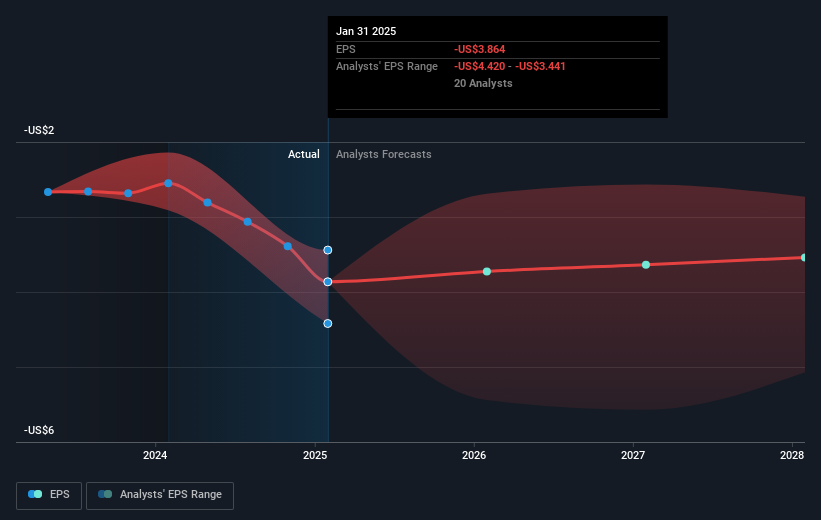

Compared to the broader market, Snowflake's one-year performance still trails behind, as it underperformed both the US market, which saw an 8.2% rise, and the US IT industry, which returned 15.9%. The integration of AI capabilities is expected to support revenue increases, potentially aligning with analysts' forecasts of a 23.2% annual revenue growth over the next three years. Yet, earnings forecasts remain critical, as Snowflake is anticipated to remain unprofitable during this period.

Given the current share price of US$160.35, it remains below the consensus analyst price target of US$195.17, suggesting potential upside should Snowflake meet growth expectations. Analysts estimate this would require substantial improvements in profit margins and a PE ratio significantly above the industry average by 2028. As investors consider these forecasts, Snowflake’s ability to execute its AI strategy effectively will be crucial in achieving the valued targets.

Understand Snowflake's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion