- United States

- /

- IT

- /

- NYSE:SNOW

Does Snowflake’s Healthcare AI Data Cloud Push and Q3 Results Change The Bull Case For SNOW?

Reviewed by Sasha Jovanovic

- Earlier this month, TileDB announced TileDB Carrara as a Snowflake Connected App for Healthcare & Life Sciences, while Snowflake reported fiscal Q3 2026 results featuring 29% year-over-year revenue and product revenue growth alongside increased AI-related investment and more measured forward guidance.

- Together with new initiatives like the Open Semantic Interchange project and ExecAtlas integration, these developments highlight Snowflake’s push to embed its AI Data Cloud more deeply into complex, highly regulated enterprise workflows such as healthcare analytics and executive intelligence.

- We’ll now examine how Snowflake’s heavier AI investment and expanding healthcare-focused integrations might influence its long-term investment narrative and risk profile.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Snowflake Investment Narrative Recap

To own Snowflake, you have to believe its AI Data Cloud can stay central as enterprises modernize data and analytics, even as competition and AI itself threaten its core model. The latest results and guidance reset keep the key near term catalyst focused on broader AI and analytics adoption, while also reinforcing the main risk that higher AI spend and slower product growth could weigh on margins and sentiment; the recent news does not materially change that equation.

Among the recent updates, the TileDB Carrara Connected App for Healthcare & Life Sciences looks especially important, because it shows Snowflake’s AI platform being pulled into complex, multimodal healthcare data workflows where compliance, security and performance really matter. If Snowflake can turn these kinds of deep, regulated use cases into durable AI workloads rather than one off migration spikes, it would directly support the long term AI driven usage growth that many shareholders are counting on.

But even as AI centric deals grow, investors should be aware that...

Read the full narrative on Snowflake (it's free!)

Snowflake's narrative projects $7.8 billion revenue and $497.5 million earnings by 2028. This requires 23.8% yearly revenue growth and an earnings increase of about $1.9 billion from -$1.4 billion today.

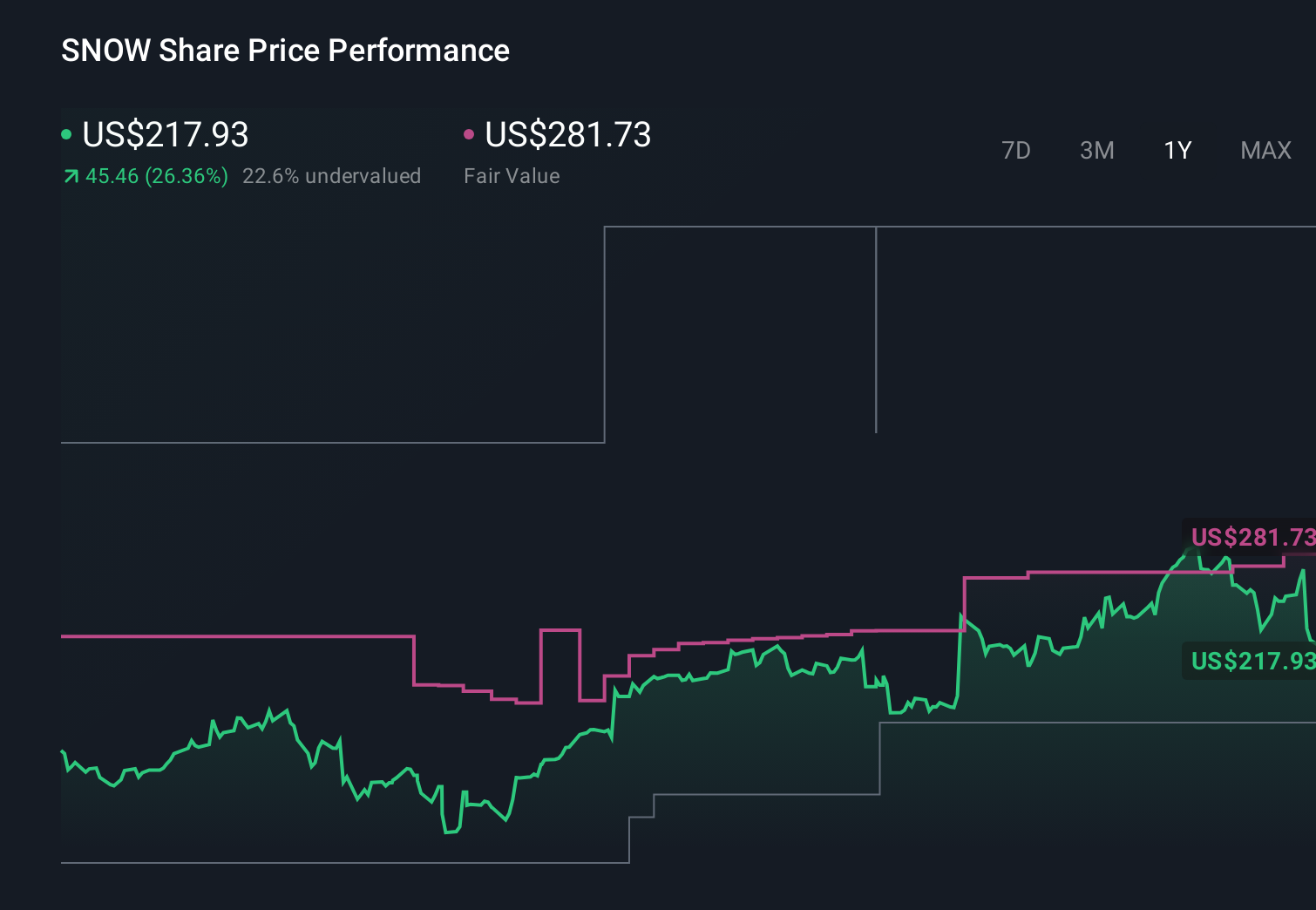

Uncover how Snowflake's forecasts yield a $281.73 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Twelve fair value estimates from the Simply Wall St Community span roughly US$152 to US$282 per share, underlining how far apart views on Snowflake’s worth can be. When you weigh that diversity against Snowflake’s heavy AI investment and the risk that new AI products may take time to monetize at scale, it becomes even more important to compare several independent views before forming your own stance.

Explore 12 other fair value estimates on Snowflake - why the stock might be worth 32% less than the current price!

Build Your Own Snowflake Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Snowflake research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Snowflake's overall financial health at a glance.

No Opportunity In Snowflake?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion