- United States

- /

- IT

- /

- NYSE:SNOW

Does Snowflake’s 63% Rally in 2025 Reflect Its True Worth After Major Partnerships?

Reviewed by Bailey Pemberton

- Wondering if Snowflake's impressive performance justifies its current price? You're not alone, and digging into its value could reveal some interesting surprises.

- After racing up 104.0% over the past year, and posting a huge 63.2% gain year-to-date, Snowflake stock has shown both momentum and volatility, particularly with a 6.7% climb in the past month despite a small dip last week.

- Behind these moves, the company has been making headlines thanks to major partnerships and product launches that highlight its focus on growing data cloud solutions. These developments have put Snowflake in the spotlight, driving both optimism and skepticism about its future growth and competitive edge.

- But when it comes to valuation, Snowflake currently scores 0 out of 6 on our undervaluation checks, which should have you questioning whether its growth justifies its price tag. Let's dig into the different ways financial analysts assess value, and stick around for an even better perspective on what fair value really means for Snowflake.

Snowflake scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Snowflake Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and then discounting those amounts back to their value today. This method gives investors a way to evaluate whether a stock's current price fairly reflects the business's true earning potential over time.

For Snowflake, the DCF uses a two-stage free cash flow to equity model. The company's latest annual Free Cash Flow is $726.87 Million. Analysts forecast strong growth ahead, with Snowflake's free cash flow expected to reach approximately $3.17 Billion by 2030. Although analyst estimates extend out five years, projections beyond that are extrapolated by Simply Wall St to provide a longer-term view.

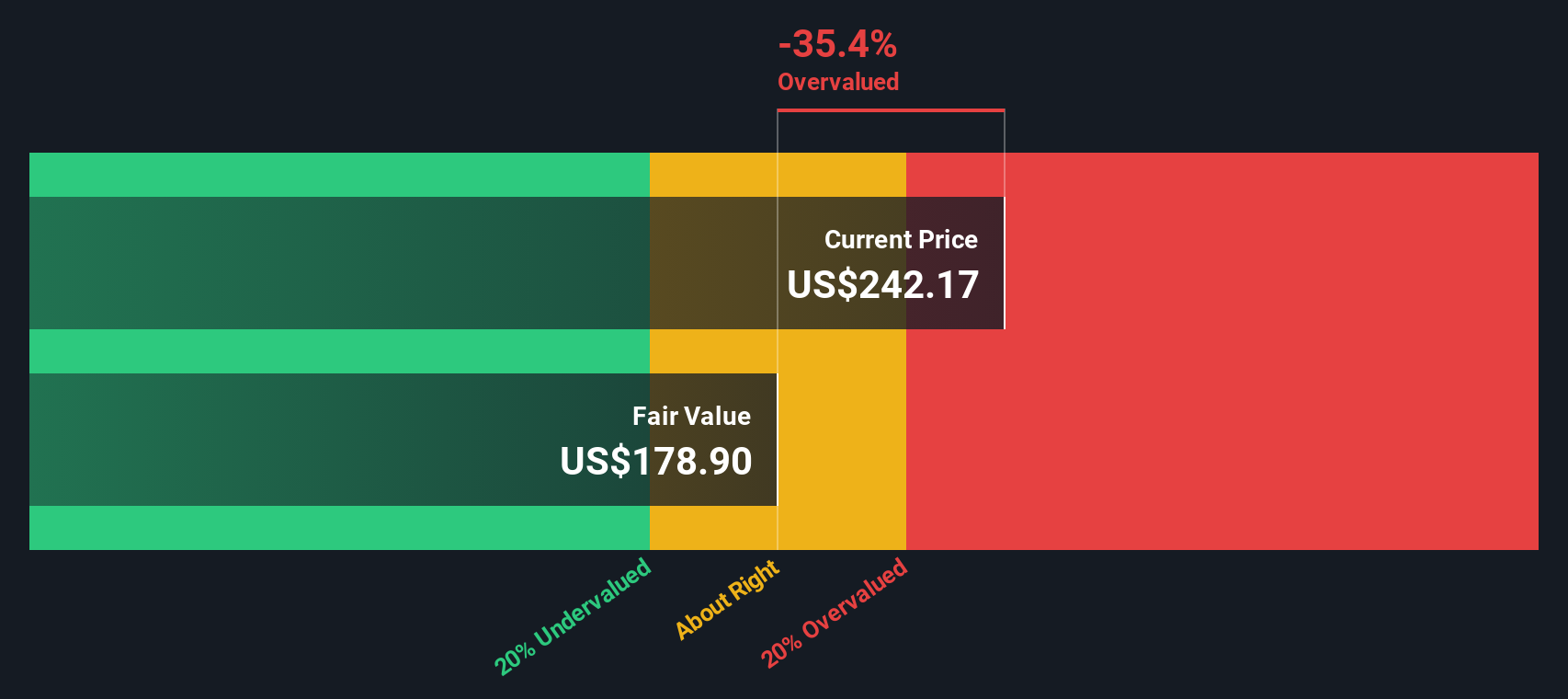

After plugging these numbers into the DCF model and discounting the projected cash flows, Snowflake's intrinsic value comes out to $178.47 per share. Compared to the current market price, this valuation implies the stock is about 44 percent overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Snowflake may be overvalued by 44.0%. Discover 879 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Snowflake Price vs Sales

The price-to-sales (P/S) ratio is a popular valuation tool for companies like Snowflake, where rapid revenue growth is a hallmark but profits are still emerging. The P/S ratio is especially relevant for high-growth technology companies, as it sidesteps accounting differences in profits and focuses on actual dollars coming in the door.

In practice, investors expect companies with stronger growth prospects and lower risks to trade at higher P/S ratios than their slower or riskier counterparts. However, when a company’s P/S ratio soars far above industry norms or its future growth fails to materialize, concerns about overvaluation arise.

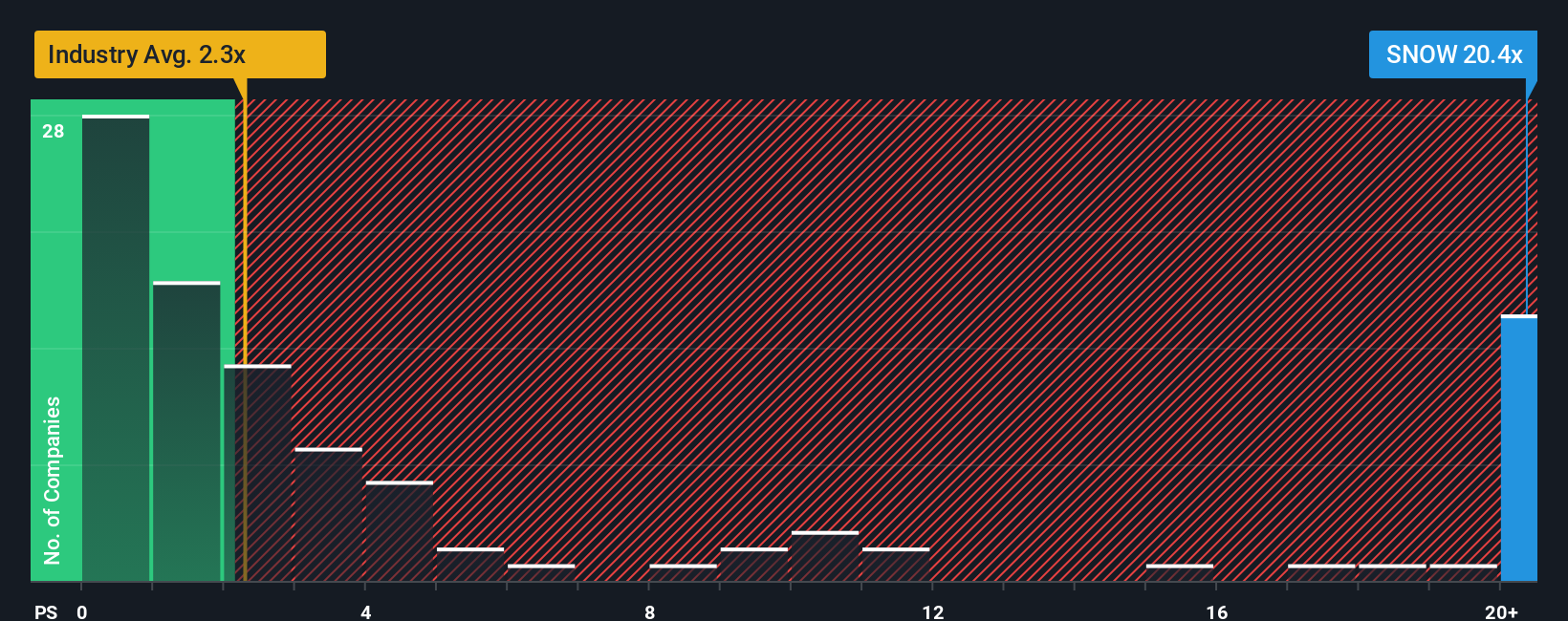

Currently, Snowflake trades at a P/S multiple of 21.15x, notably higher than the IT industry average of 2.36x and above the average for its direct peers at 19.07x. Simply Wall St’s proprietary Fair Ratio for Snowflake, which accounts for factors like its earnings growth, profit margins, risk profile, market cap and sector, sits at 15.91x. While benchmarking against industry or peer averages gives a general sense of comparison, the Fair Ratio provides a more nuanced view by blending Snowflake’s specific business strengths and challenges into the analysis.

Comparing the Fair Ratio of 15.91x to Snowflake’s actual P/S of 21.15x suggests the stock is trading well above what would be considered justified based on its fundamentals and outlook.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Snowflake Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple, powerful tool that lets you connect your perspective on a company to its numbers and fair value, all in one place.

A Narrative is more than a forecast. It is your personal story about a company's future, expressed through your own estimates for revenue, earnings, and margins, which then generates a fair value tailored to your beliefs.

Rather than just following generic models, Narratives help you articulate why you believe a stock like Snowflake deserves a premium (or a discount) by putting your expectations about its growth drivers, risks, and opportunities front and center.

This approach is accessible on Simply Wall St’s Community page, used by millions of investors, where you can quickly create and update Narratives as new news or earnings releases arrive, so your outlook always reflects the latest information.

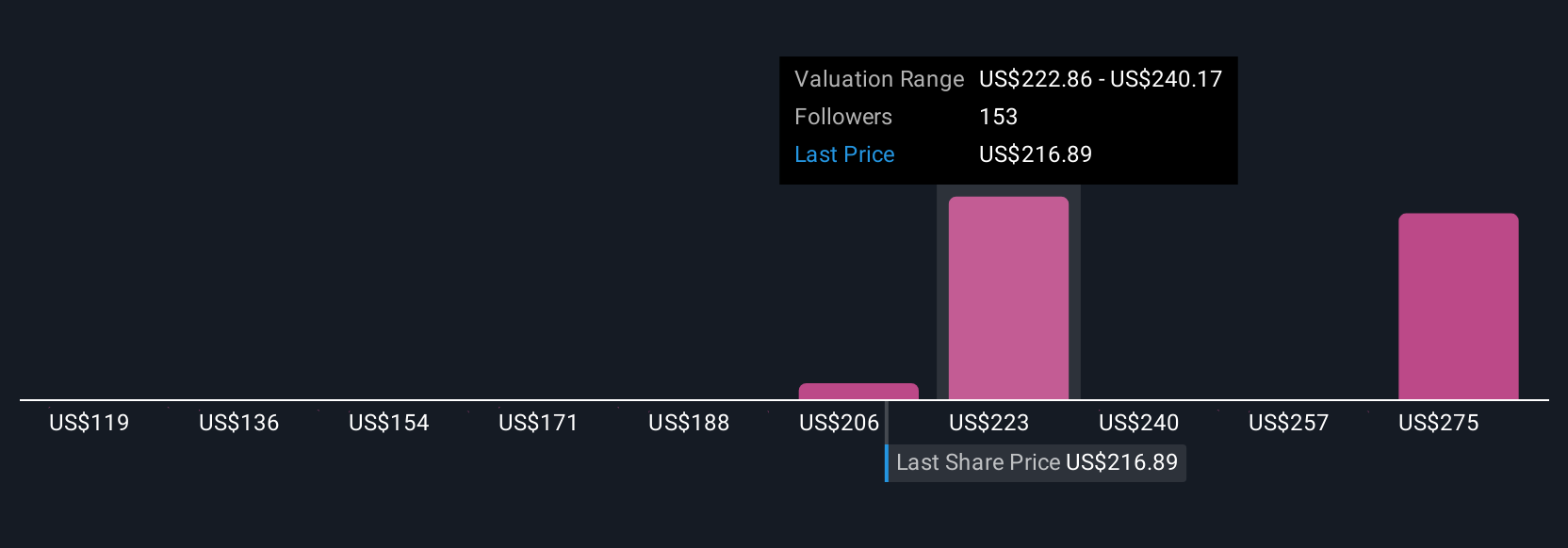

Comparing your Narrative’s Fair Value with the current share price gives you instant clarity on whether it might be time to buy or sell based on your assumptions, not just the consensus.

For example, some Snowflake Narratives are highly optimistic, anticipating future AI momentum will justify a $440 price target, while others, more cautious about competition and margin pressures, believe fair value is closer to $170. This is a clear reminder that different perspectives can lead to very different investing decisions.

Do you think there's more to the story for Snowflake? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives