- United States

- /

- IT

- /

- NYSE:SNOW

A Look at Snowflake’s Valuation Following Analyst Optimism and NVIDIA Partnership News

Reviewed by Simply Wall St

Snowflake (SNOW) shares have been in the spotlight after the company announced a new integration with NVIDIA, designed to accelerate machine learning workflows for its users. The move, along with positive analyst commentary and optimism for future product growth, is attracting attention from investors.

See our latest analysis for Snowflake.

Momentum around Snowflake continues to build, with recent collaborations such as the NVIDIA integration and upbeat sector sentiment fueling a notable rally. Its year-to-date share price return sits at 57.9%, while its one-year total shareholder return has reached 43%. Despite some volatility in the short run, the company’s long-term numbers still reflect strong underlying growth potential as investors gear up for its next earnings update.

If this surge in cloud and AI stocks has you curious about other opportunities, now’s a smart time to explore See the full list for free..

With Snowflake’s share price surging and analysts staying bullish, the big question for investors is whether today’s optimism leaves room for further upside or if the market has already priced in all that future growth.

Most Popular Narrative: 6.7% Undervalued

Snowflake’s most popular narrative prices the stock at $266.56 per share, about $18 above its last close. This indicates positive expectations for ongoing growth driven by new product launches and AI initiatives.

Rapid product innovation, including the launch of approximately 250 new features and expanded offerings such as Snowflake Intelligence, Cortex AI SQL, and Postgres support, is increasing average revenue per user and deepening customer engagement. This is expected to drive recurring revenue and support long-term topline growth. Broader adoption of Snowflake's Data Cloud marketplace and data sharing and collaboration features, with 40% of customers now sharing data, is creating powerful network effects that both improve customer retention and increase usage, translating into higher revenue and improved margin leverage as scale grows.

Curious how new features and expanding network effects shape Snowflake's future? The full narrative outlines ambitious revenue growth projections and a potential future profit profile that stands out in the industry. Can Snowflake’s innovation support this valuation? Explore the key numbers driving market confidence.

Result: Fair Value of $266.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Snowflake’s growth story remains vulnerable if AI investments fail to deliver expected returns or if competition among cloud data platforms becomes even more intense.

Find out about the key risks to this Snowflake narrative.

Another View: Is the Market Expecting Too Much?

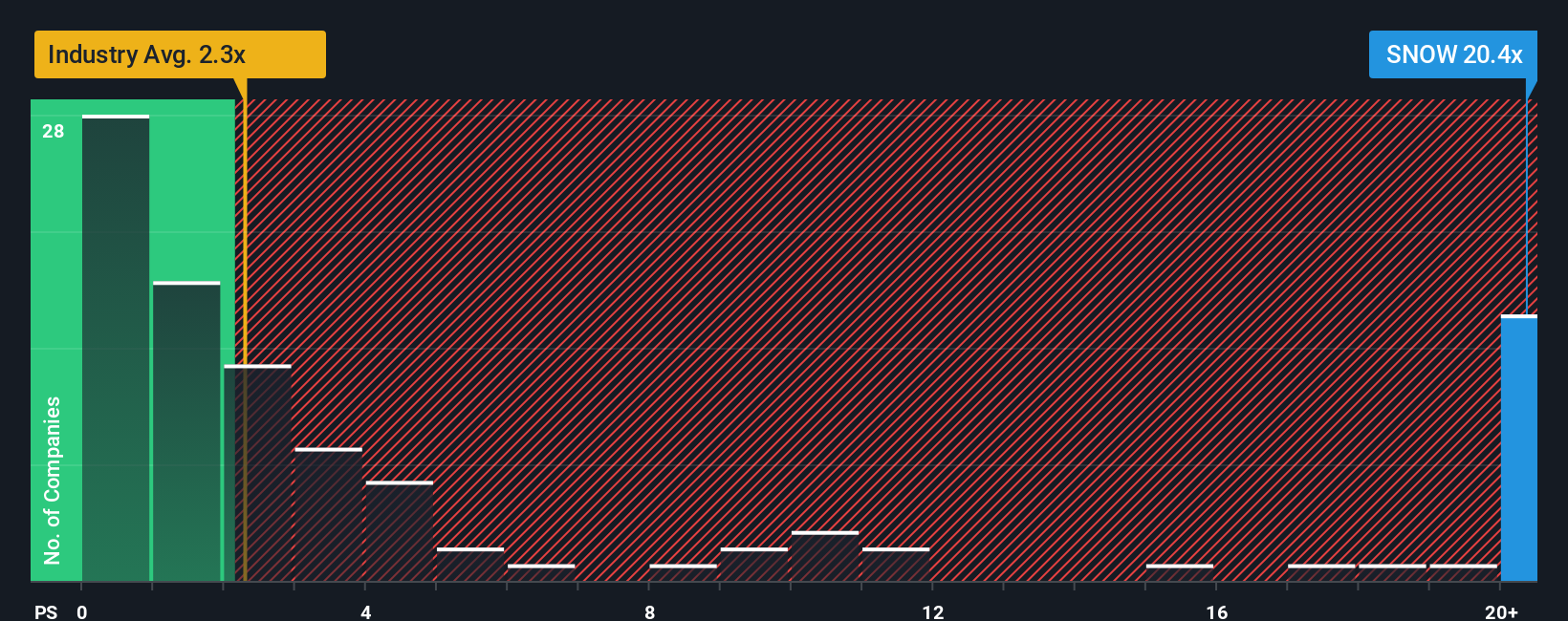

Looking at Snowflake’s valuation through the lens of its price-to-sales ratio tells a different story. With a current ratio of 20.5x, the stock appears expensive compared to both the US IT industry average of 2.6x and even its peer group at 20x. The fair ratio, which the market could move towards based on sector fundamentals, is 15x. This gap means Snowflake may be priced for perfection, leaving little margin for error if growth slows. Are investors overlooking valuation risks in their enthusiasm?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Snowflake Narrative

If you think differently or want to dig into the details yourself, you can analyze the numbers and build your own Snowflake narrative in just a few minutes. Do it your way.

A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Why limit yourself to just one stock when untapped potential is everywhere? Take charge of your investing game and seize new market trends before the crowd catches on.

- Spot hidden gems in high-growth sectors by checking out these 3579 penny stocks with strong financials with strong financials that could deliver game-changing returns.

- Capture future growth by targeting these 25 AI penny stocks positioned to benefit from the ongoing momentum of artificial intelligence innovations.

- Secure reliable income streams with these 15 dividend stocks with yields > 3% offering attractive yields for building a robust, long-term portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success