- United States

- /

- Software

- /

- NYSE:SMWB

US$13.75: That's What Analysts Think Similarweb Ltd. (NYSE:SMWB) Is Worth After Its Latest Results

Investors in Similarweb Ltd. (NYSE:SMWB) had a good week, as its shares rose 3.0% to close at US$7.67 following the release of its first-quarter results. Revenues were in line with expectations, at US$67m, while statutory losses ballooned to US$0.11 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

We check all companies for important risks. See what we found for Similarweb in our free report.

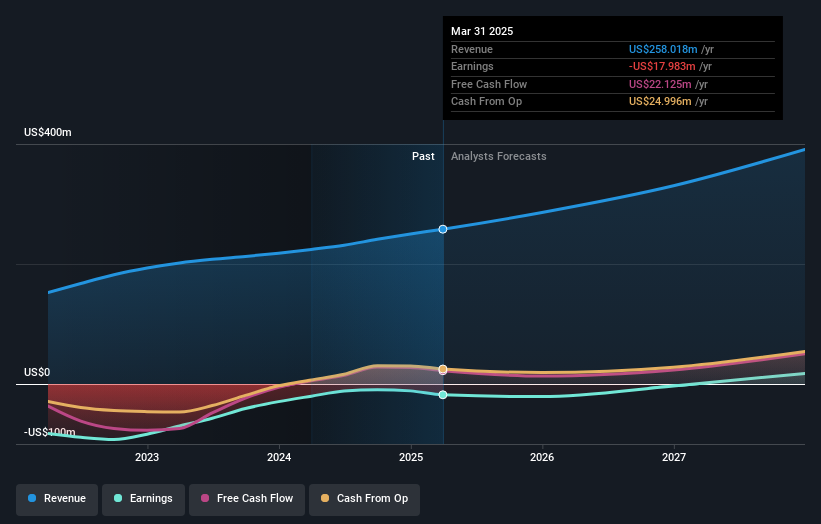

Following the latest results, Similarweb's eight analysts are now forecasting revenues of US$285.9m in 2025. This would be a notable 11% improvement in revenue compared to the last 12 months. Losses are expected to increase substantially, hitting US$0.25 per share. Before this earnings announcement, the analysts had been modelling revenues of US$285.4m and losses of US$0.23 per share in 2025. Overall it looks as though the analysts were a bit mixed on the latest consensus updates. Although revenue forecasts held steady, the consensus also made a pronounced increase to its losses per share forecasts.

See our latest analysis for Similarweb

The consensus price target fell 6.0% to US$13.75per share, with the analysts clearly concerned by ballooning losses. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Similarweb at US$18.00 per share, while the most bearish prices it at US$10.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The period to the end of 2025 brings more of the same, according to the analysts, with revenue forecast to display 15% growth on an annualised basis. That is in line with its 15% annual growth over the past three years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 13% annually. It's clear that while Similarweb's revenue growth is expected to continue on its current trajectory, it's only expected to grow in line with the industry itself.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at Similarweb. Happily, there were no real changes to revenue forecasts, with the business still expected to grow in line with the overall industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that in mind, we wouldn't be too quick to come to a conclusion on Similarweb. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Similarweb analysts - going out to 2027, and you can see them free on our platform here.

We also provide an overview of the Similarweb Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SMWB

Similarweb

Provides digital data and analytics for power critical business decisions in the United States, Europe, the Asia Pacific, the United Kingdom, Israel, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives