- United States

- /

- Software

- /

- NYSE:SEMR

Semrush (SEMR): Profit Turnaround, 117% Annual Earnings Growth, and Discounted Valuation Drive Bullish Narrative

Reviewed by Simply Wall St

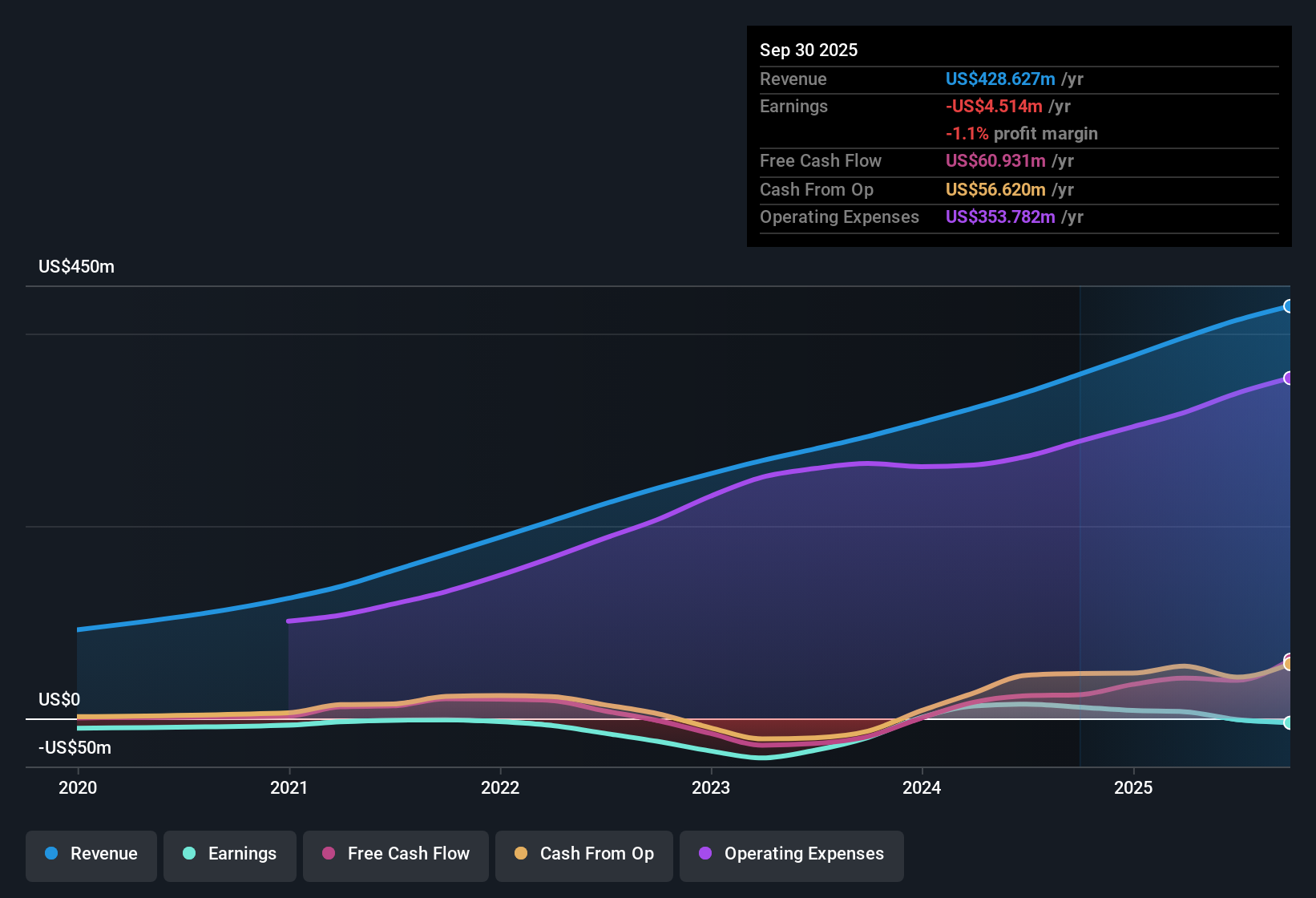

Semrush Holdings (SEMR) is currently unprofitable, but the company has managed to reduce its losses at an average rate of 25.7% per year over the past five years. With forecasts pointing to profitability within three years and earnings expected to grow 117.06% annually alongside 13.8% annual revenue growth, investors are eyeing both the improving trend and SEMR's discounted share price as key rewards in this earnings cycle.

See our full analysis for Semrush Holdings.Now, let's see how these latest numbers compare with the broader market narratives. Some market views may be confirmed, while others could be put to the test.

See what the community is saying about Semrush Holdings

Enterprise Margins Poised to Swing Positive

- Analysts expect profit margins to surge from -0.3% today to 12.4% within three years. This turnaround would mark a dramatic shift toward sustained profitability for Semrush Holdings.

- Analysts' consensus view spotlights the company's pivot to higher-value enterprise customers. They note that average annual recurring revenue per enterprise account is up 15% year-over-year, while the number of $50K+ customers increased 83% year-over-year.

- This changing mix supports the bullish narrative that expanded AI-driven product suites and a focus on enterprise solutions provide a much stronger foundation for margin improvement and long-run earnings stability.

- However, consensus analysts also caution that heavier reliance on large customers may introduce slower sales cycles and more volatile deal flow. This could challenge the optimistic margin trajectory if enterprise momentum slows down.

Discounted Valuation vs. Industry Peers

- With a Price-To-Sales Ratio of 2.5x, Semrush trades well below the US Software industry average of 5.1x and the peer group average of 3.5x. This signals good relative value despite ongoing losses.

- Analysts' consensus view argues that trading at $7.19, compared to a sector analyst price target of $10.67 and a DCF fair value of $13.04, heavily supports the bullish narrative that market skepticism is overdone, especially as future models assume a path to strong margin growth and earnings of $80.8 million by 2028.

- Bulls point to the company’s aggressive investment in AI-powered platform features and international expansion as key reasons this current discount may not last. Analyst targets imply a 48% upside from today’s share price.

- The consensus narrative still warns investors to be realistic about competitive risk and shifting search trends, which could limit upside if revenues lag these projections.

Growth Hinges on AI Adoption and Retention

- Revenue for Semrush is forecasted to grow at 13.8% annually, surpassing the US market average of 10.4%. Long-term models assume 16.2% annual top-line expansion over the next three years.

- Analysts' consensus view finds opportunity and caution in these growth drivers:

- On the positive side, the rapid adoption of AI-driven search and marketing tools is fueling average revenue per user growth, net retention, and deeper client engagement. Larger enterprise accounts still constitute less than 5% penetration for core offerings.

- Conversely, consensus analysts highlight operational risk if Semrush’s shift away from small business segments fails to deliver enterprise scale, or if the evolving search landscape with more “zero-click” results erodes the value of traditional SEO, limiting further growth.

Consensus expectations suggest that the latest trends reinforce the narrative of discounted value and margin expansion, yet highlight the critical need for continued product reinvention and execution in the emerging AI-powered marketing era. Read the full company narrative to see how these findings fit within broader market expectations. 📊 Read the full Semrush Holdings Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Semrush Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Noticing a different story in the numbers? Take just a few minutes to share your own perspective and shape the conversation. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Semrush Holdings.

See What Else Is Out There

While Semrush Holdings shows promise with rapid product evolution, its heavy focus on large enterprise customers leaves future growth and revenue stability exposed if key accounts hesitate or churn.

If reliable expansion is your priority, use stable growth stocks screener (2078 results) to zero in on companies consistently boosting revenue and earnings across different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEMR

Semrush Holdings

Develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives