- United States

- /

- Software

- /

- NYSE:SEMR

Semrush (SEMR): Examining Valuation After Recent 61% Weekly Share Price Surge

Reviewed by Simply Wall St

Semrush Holdings (SEMR) continues to be a point of discussion among investors following its recent stock movement. The company’s performance over the past month has drawn attention, particularly as its return trends upward along with annual revenue growth.

See our latest analysis for Semrush Holdings.

Zooming out, Semrush Holdings’ recent surge is a bright spot in what has otherwise been a challenging stretch for long-term holders. The stock’s one-week share price return of 61% stands out, yet its total shareholder return over the past year is still down 20%. This sharp shift in momentum suggests investors are recalibrating growth expectations, potentially unlocking new upside after months of sliding sentiment.

If strong turnarounds like this catch your attention, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

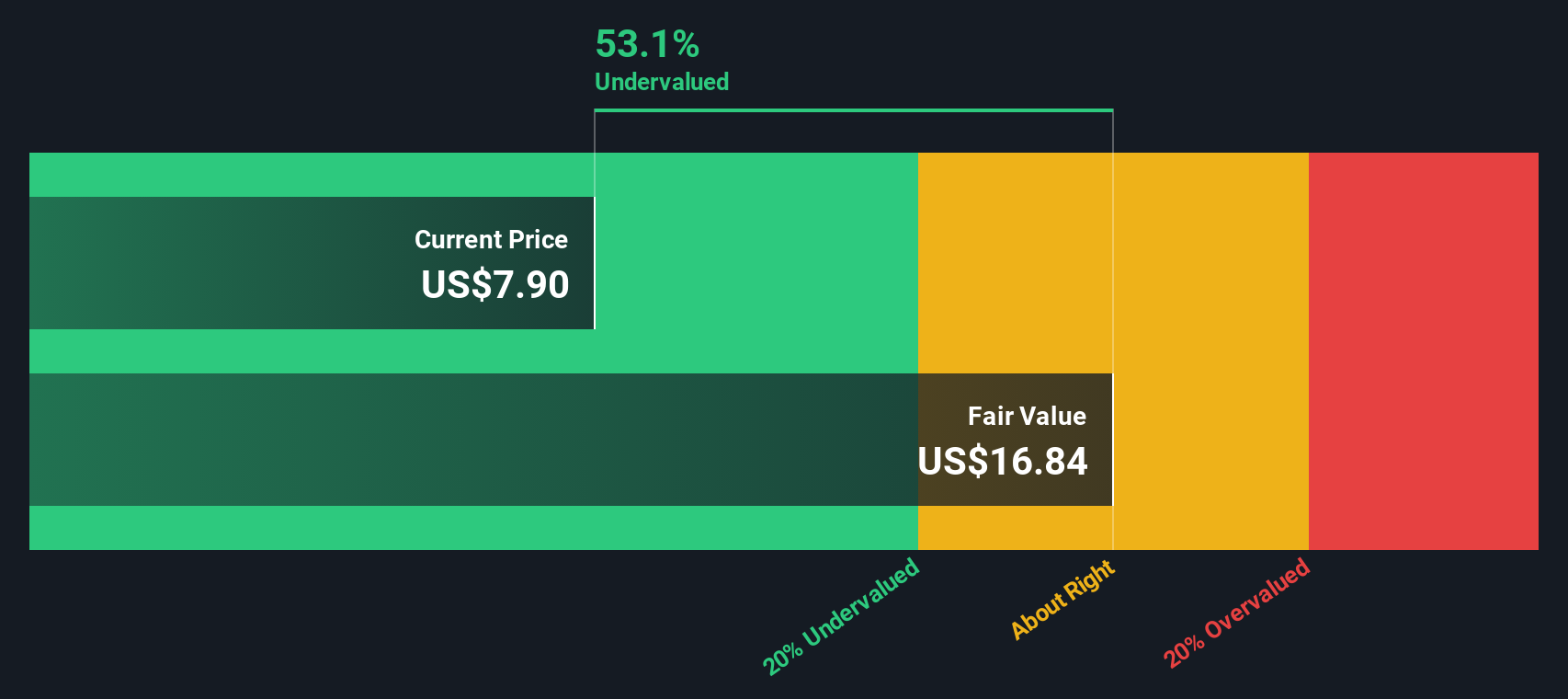

With shares rebounding sharply but still trailing historical highs, the big question is whether Semrush Holdings is trading below its true value or if investors have already factored future growth into the current price.

Most Popular Narrative: 8.6% Overvalued

With Semrush Holdings’ last close at $11.77 and the most-followed fair value set at $10.83, this narrative suggests shares have sprinted ahead of underlying fundamentals. Investors are now weighing whether recent momentum is outpacing realistic growth expectations, or if yet-untapped catalysts lie just ahead.

The accelerating adoption of AI-powered search and Large Language Model (LLM) interfaces is creating a new layer of complexity for digital marketing and online visibility, driving increased demand for advanced analytics and optimization tools like Semrush's AI products. This positions the company to capture higher-value enterprise clients and supports long-term revenue growth.

Want to know the financial logic behind this price? Yes, there are bold margin assumptions and ambitious top-line growth targets, along with a critical view on how AI disruption reshapes future profitability. Curiosity piqued? Unlock which forecasts make or break the case by diving into the full narrative.

Result: Fair Value of $10.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if enterprise growth falters or if AI-driven search reduces demand for core offerings, Semrush’s revenue trajectory could face renewed pressure.

Find out about the key risks to this Semrush Holdings narrative.

Another View: Discounted Cash Flow Value

While the most-followed narrative suggests Semrush Holdings is overvalued, the SWS DCF model tells a different story. Based on projected future cash flows, our DCF model estimates fair value at $14.17, which is about 17% above the current price. Why is there such a gap between theory and sentiment?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Semrush Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Semrush Holdings Narrative

Those with a different perspective or who prefer hands-on analysis can dive into the data and build a personalized view in just a few minutes. Do it your way

A great starting point for your Semrush Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities pass you by. Gain a fresh perspective and start building a smarter portfolio by using Simply Wall Street’s powerful stock screeners below.

- Explore the momentum of companies driving the artificial intelligence boom by checking out these 25 AI penny stocks with strong market positioning and a focus on future growth.

- Grow your income stream confidently and target reliable returns above 3% when you browse these 16 dividend stocks with yields > 3% that consistently reward their shareholders.

- Take the opportunity to invest early in tomorrow’s industry leaders by researching these 3612 penny stocks with strong financials before they reach mainstream attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEMR

Semrush Holdings

Develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives