- United States

- /

- Software

- /

- NYSE:S

Is SentinelOne’s Share Slide a Risk or Opportunity After Latest Cybersecurity Headlines?

Reviewed by Bailey Pemberton

- Curious if SentinelOne is actually a bargain right now, or if today's share price reflects the real value? Let's dig in and see what the numbers are telling us.

- SentinelOne's share price has slipped by 6.4% over the past week and is down 28.4% so far this year. This raises the big question of whether this drop spells opportunity or increased risk.

- The recent slide has come amid a flurry of headlines about cybersecurity trends and changing competitive dynamics, especially following industry-wide concerns over increased attacks and shifting enterprise budgets. News around major peers' strategic moves and government focus on digital security has put extra attention on how SentinelOne is positioned for the next phase of growth.

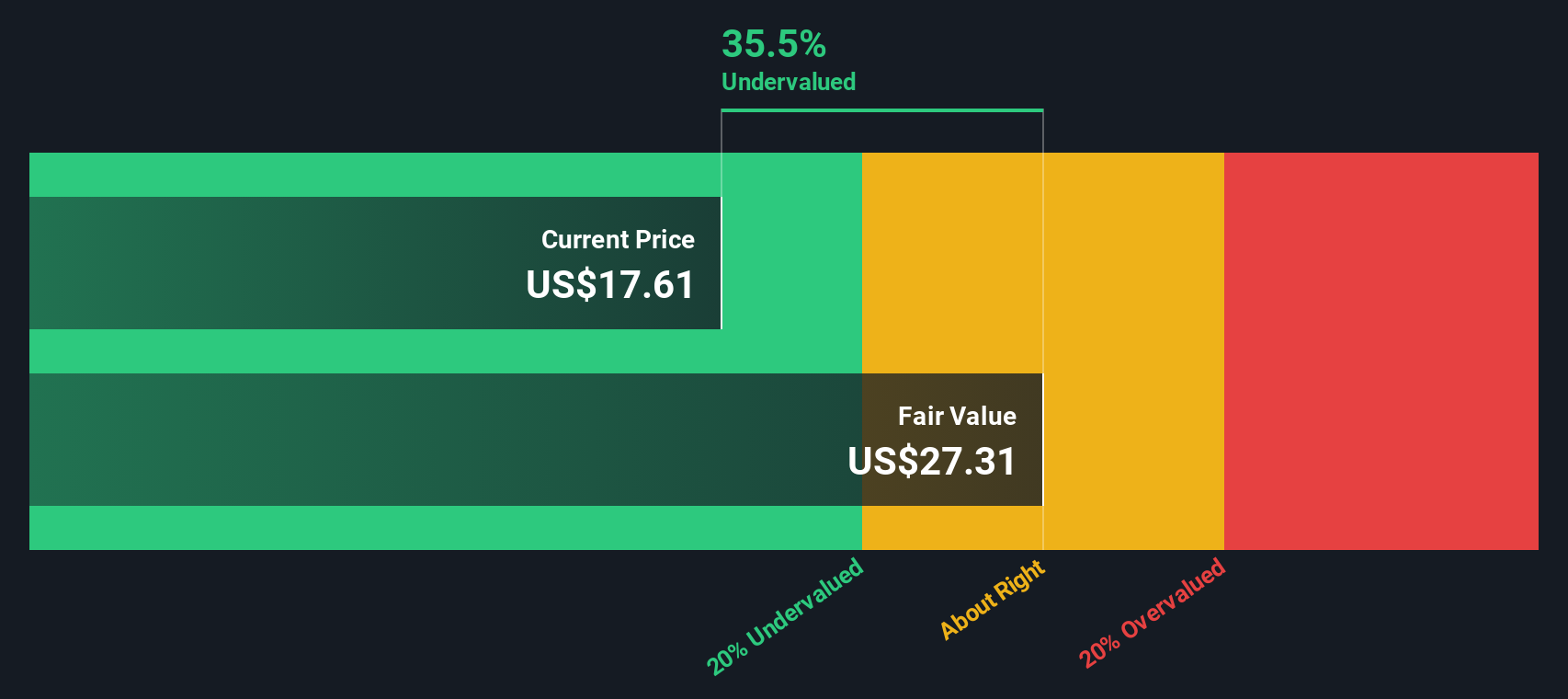

- According to our valuation checks, SentinelOne scores a 5 out of 6 for being undervalued. This puts it well ahead of many peers. We'll break down exactly what those numbers mean with several valuation approaches, and stick around to see an even better way to judge true value at the end of this article.

Find out why SentinelOne's -41.5% return over the last year is lagging behind its peers.

Approach 1: SentinelOne Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to today's value. This approach relies on how much free cash the business can generate over time, adjusted for risk and the time value of money.

SentinelOne has a current Free Cash Flow (FCF) of $12.3 Million. Analysts expect strong growth in the coming years, projecting FCF to rise to $214.99 Million by 2028. Further out, extended estimates suggest free cash flow could grow to over $600 Million annually within the next decade, though these later years depend more on extrapolation than explicit analyst forecasts.

Based on these cash flow projections and using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share is $23.61. Compared to the current market price, this represents a 31.5% discount and suggests the stock is significantly undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SentinelOne is undervalued by 31.5%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

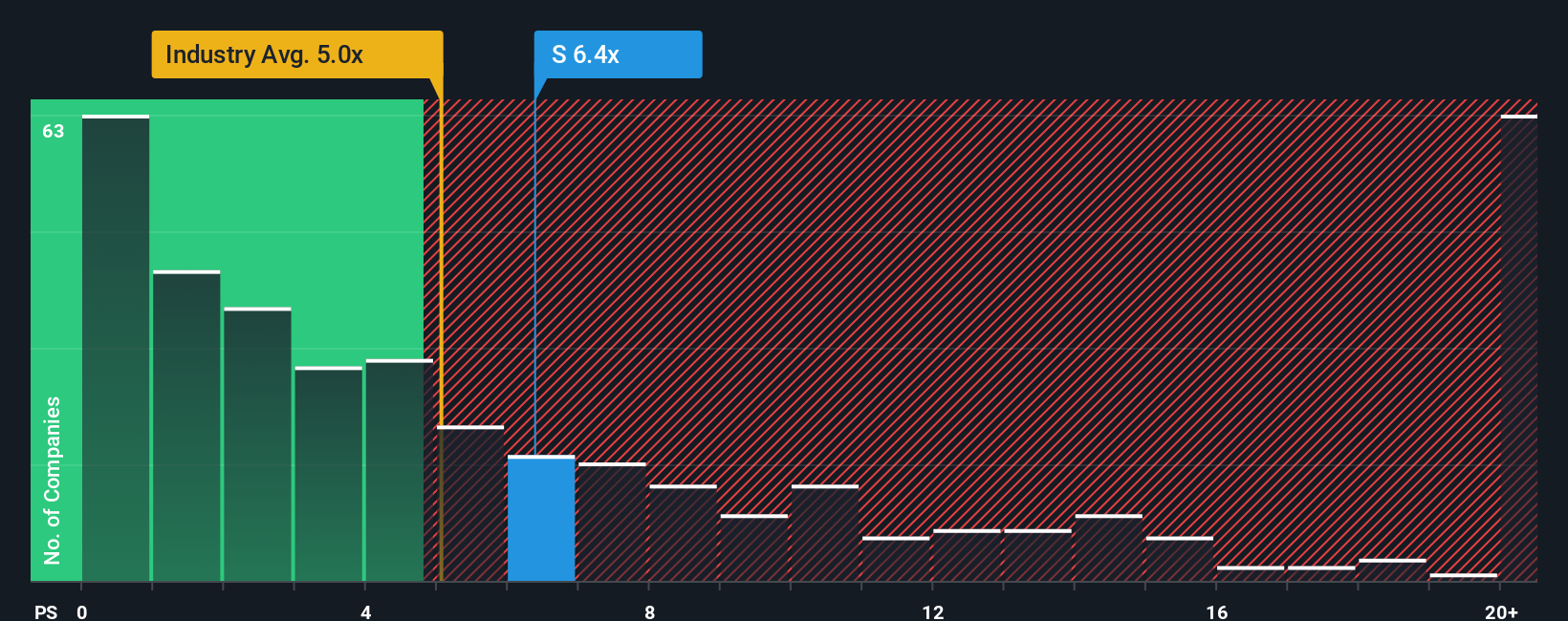

Approach 2: SentinelOne Price vs Sales

For a fast-growing software company like SentinelOne, the Price-to-Sales (P/S) ratio is often the most relevant valuation metric, especially when profitability is yet to be solidly established. This multiple is widely used in the tech sector because it allows investors to compare companies regardless of whether they are currently earning profits, focusing instead on their ability to generate sales.

Growth potential and risk play critical roles in what makes a "normal" or "fair" P/S ratio. Companies with higher revenue growth, stronger margins, and lower risk profiles often justify higher multiples, while slower-growing or riskier businesses tend to trade at lower ratios.

SentinelOne currently trades at a P/S ratio of 6.0x, which is below both the average of its closest peers at 6.8x and the broader Software industry average of 4.7x. This positions SentinelOne as slightly cheaper than its peer group, though a bit higher than the industry norm.

To bring an even sharper lens to the analysis, we use Simply Wall St’s proprietary “Fair Ratio.” This is calculated by factoring in SentinelOne's growth outlook, industry, profit margins, market capitalization, and overall risk profile to determine what an appropriate multiple should be. Unlike simple peer or industry comparisons, the Fair Ratio gives a more tailored assessment of value by recognizing SentinelOne’s unique characteristics.

Currently, the Fair Ratio for SentinelOne is 6.89x, which is almost exactly in line with its actual P/S multiple of 6.0x. With such a small difference, the share price appears to fairly reflect the company's underlying fundamentals based on this approach.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SentinelOne Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply a story or perspective about a company’s future, a way to connect your beliefs about SentinelOne’s products, industry leadership, or risks with concrete financial forecasts like future revenue, margins, and a fair share price.

Unlike static models, Narratives link SentinelOne’s unique story to a tailored financial forecast, helping you see how your assumptions shape an estimate of fair value. They are designed to be easy and accessible, available right now on Simply Wall St’s Community page, where millions of investors use Narratives to capture and share their viewpoints about companies.

With Narratives, you can instantly compare your own calculated fair value to the current market price. This gives you a dynamic tool to decide when to buy or sell, instead of just following consensus opinions. Whenever new information arrives, such as earnings releases or news, Narratives can update in real time to ensure your view stays relevant.

For example, some SentinelOne investors might build an optimistic Narrative that expects powerful AI-driven growth, a fair value of $30 per share, and aggressive margin expansion. Others may be more cautious, projecting only modest improvements, a fair value closer to $19, and slower profitability timelines. Narratives put these perspectives and numbers side by side so you can make smarter, more confident investment decisions based on your own story.

Do you think there's more to the story for SentinelOne? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives