- United States

- /

- Software

- /

- NYSE:RNG

RingCentral (RNG): Assessing Valuation After Credit Expansion, Buyback Plan, and Earnings Turnaround

Reviewed by Simply Wall St

Most Popular Narrative: 6.1% Undervalued

According to the most widely followed narrative, RingCentral is trading modestly below its estimated fair value, with a discount rate applied that reflects moderate expectations of future growth and risk.

The expansion of AI-powered products such as RingCX, RingSense, and AIR is driving new customer adoption and early double-digit growth. This is positioning RingCentral to capture additional market share as enterprises accelerate their digital transformation initiatives and seek more automated, data-driven communication solutions. These trends are likely to support future revenue growth and margin expansion.

Curious what is fueling this undervalued call? One number in particular could change the narrative for years to come, and it is not just about revenue. There is a bold set of assumptions working beneath the surface, including a major turnaround in profitability and robust market share expansion. Want to see how these projections all add up to that price target? The future is not as predictable as the numbers might suggest.

Result: Fair Value of $33.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, growing competition from bundled communications suites and dependency on key partners could quickly challenge this outlook if business conditions change.

Find out about the key risks to this RingCentral narrative.Another View: Discounted Cash Flow Perspective

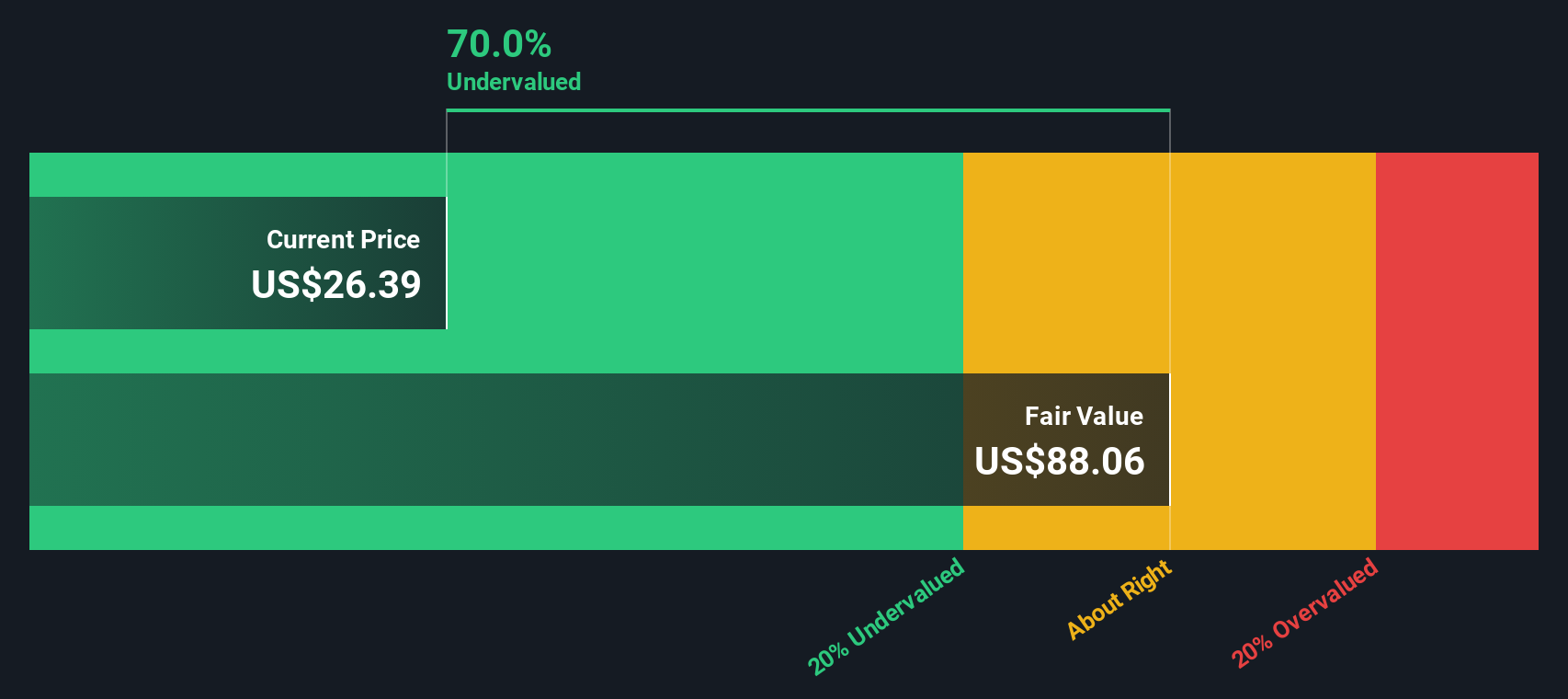

But our DCF model adds another angle entirely. It digs into long-term cash flow forecasts, and by this method, RingCentral still comes out significantly undervalued. Could this be a signal that the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RingCentral for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RingCentral Narrative

If you see things differently, or want to dig into RingCentral’s data on your own terms, you can craft your own perspective in just minutes. Do it your way

A great starting point for your RingCentral research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Investing Opportunity?

If you want to stay ahead of the curve, put your money to work smarter, and never miss the breakout stories, these ideas are made for you.

- Unlock the hidden value in the market by targeting top companies with solid fundamentals using our undervalued stocks based on cash flows.

- Capitalize on cutting-edge trends shaping medicine by browsing dynamic firms that are revolutionizing patient care with healthcare AI stocks.

- Kickstart your hunt for reliable income streams by checking out high-yield options through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNG

RingCentral

Provides cloud business communications, contact center, video, and hybrid event solutions in North America and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives