- United States

- /

- Software

- /

- NYSE:RNG

RingCentral (NYSE:RNG) Shareholders Have Enjoyed A Whopping 880% Share Price Gain

Buying shares in the best businesses can build meaningful wealth for you and your family. While not every stock performs well, when investors win, they can win big. To wit, the RingCentral, Inc. (NYSE:RNG) share price has soared 880% over five years. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 13% over the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

It really delights us to see such great share price performance for investors.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for RingCentral

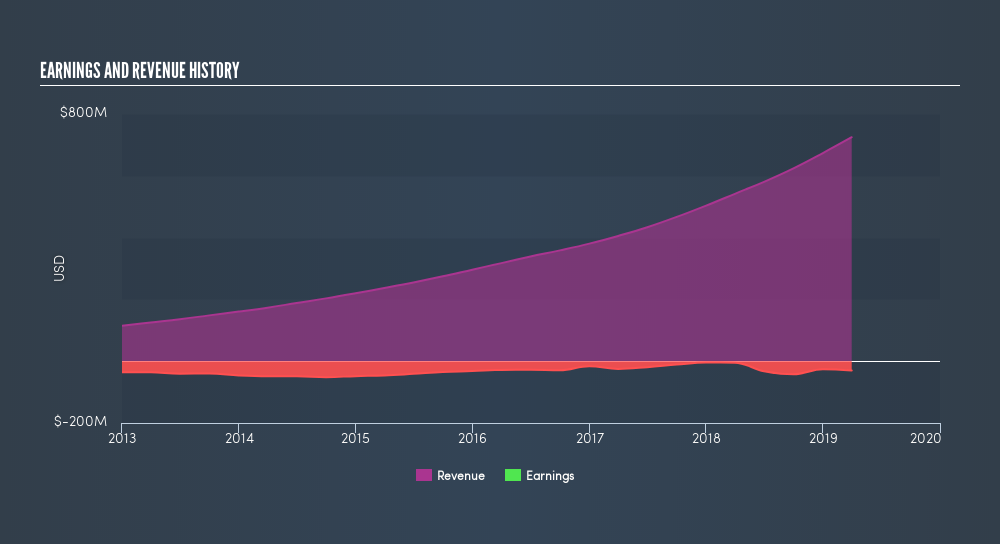

RingCentral isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, RingCentral can boast revenue growth at a rate of 27% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 58% per year in that time. Despite the strong run, top performers like RingCentral have been known to go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

RingCentral is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think RingCentral will earn in the future (free analyst consensus estimates)

A Different Perspective

It's good to see that RingCentral has rewarded shareholders with a total shareholder return of 61% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 58% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course RingCentral may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:RNG

RingCentral

Provides cloud business communications, contact center, video, and hybrid event solutions in North America and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives