Stock Analysis

- United States

- /

- Software

- /

- NYSE:RNG

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The United States market has shown robust performance, climbing 2.2% in the last 7 days and an impressive 33% over the past year, with earnings projected to grow by 15% annually in the coming years. In such a dynamic environment, identifying high growth tech stocks involves focusing on companies that demonstrate strong innovation potential and adaptability to leverage these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Bitdeer Technologies Group | 37.45% | 111.07% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.88% | ★★★★★★ |

| Clene | 78.50% | 60.16% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 250 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Zai Lab (NasdaqGM:ZLAB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zai Lab Limited focuses on developing and commercializing therapies for oncology, autoimmune disorders, infectious diseases, and neuroscience with a market capitalization of approximately $2.60 billion.

Operations: Zai Lab generates revenue primarily from its biotechnology segment, amounting to $355.75 million. The company's focus spans oncology, autoimmune disorders, infectious diseases, and neuroscience therapies.

Zai Lab, amidst a challenging landscape for biotech firms, is navigating its path toward profitability with strategic agility and innovation. The company's recent collaboration with Pfizer to commercialize XACDURO in China exemplifies its strategic initiatives to enhance market presence and address critical health threats like carbapenem-resistant Acinetobacter baumannii. Financially, Zai Lab has demonstrated significant growth potential; its revenue is expected to surge by 34% annually, outpacing the US market's average of 8.9%. Moreover, earnings are projected to grow by an impressive 68.2% per year over the next three years as it transitions into profitability. This trajectory is supported by robust R&D investments that align with Zai Lab’s commitment to addressing unmet medical needs through advanced therapeutic solutions.

- Unlock comprehensive insights into our analysis of Zai Lab stock in this health report.

Gain insights into Zai Lab's past trends and performance with our Past report.

Pegasystems (NasdaqGS:PEGA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pegasystems Inc. is a company that develops, markets, licenses, hosts, and supports enterprise software across various regions including the United States, Europe, and Asia-Pacific with a market cap of approximately $7.85 billion.

Operations: The company's primary revenue stream is derived from its software and programming segment, generating approximately $1.48 billion. Pegasystems focuses on developing and licensing enterprise software solutions across multiple global regions, including the Americas, Europe, and Asia-Pacific.

Pegasystems, a player in the tech landscape, is making significant strides with its AI-driven legacy transformation initiatives. Recently appointing Ravesh Lala to head this division underscores their commitment to modernizing outdated systems—a move critical for staying competitive in today's fast-evolving software environment. This strategic focus is reflected in their R&D spending, which remains robust as they innovate within the cloud and AI spaces. Financially, while Pega’s revenue growth at 5.9% annually trails the US market average of 8.9%, its earnings forecast to expand by 23.9% per year outpaces broader market expectations significantly (15.4%). This juxtaposition highlights a potential shift towards profitability driven by strategic innovations rather than traditional growth avenues.

- Delve into the full analysis health report here for a deeper understanding of Pegasystems.

Examine Pegasystems' past performance report to understand how it has performed in the past.

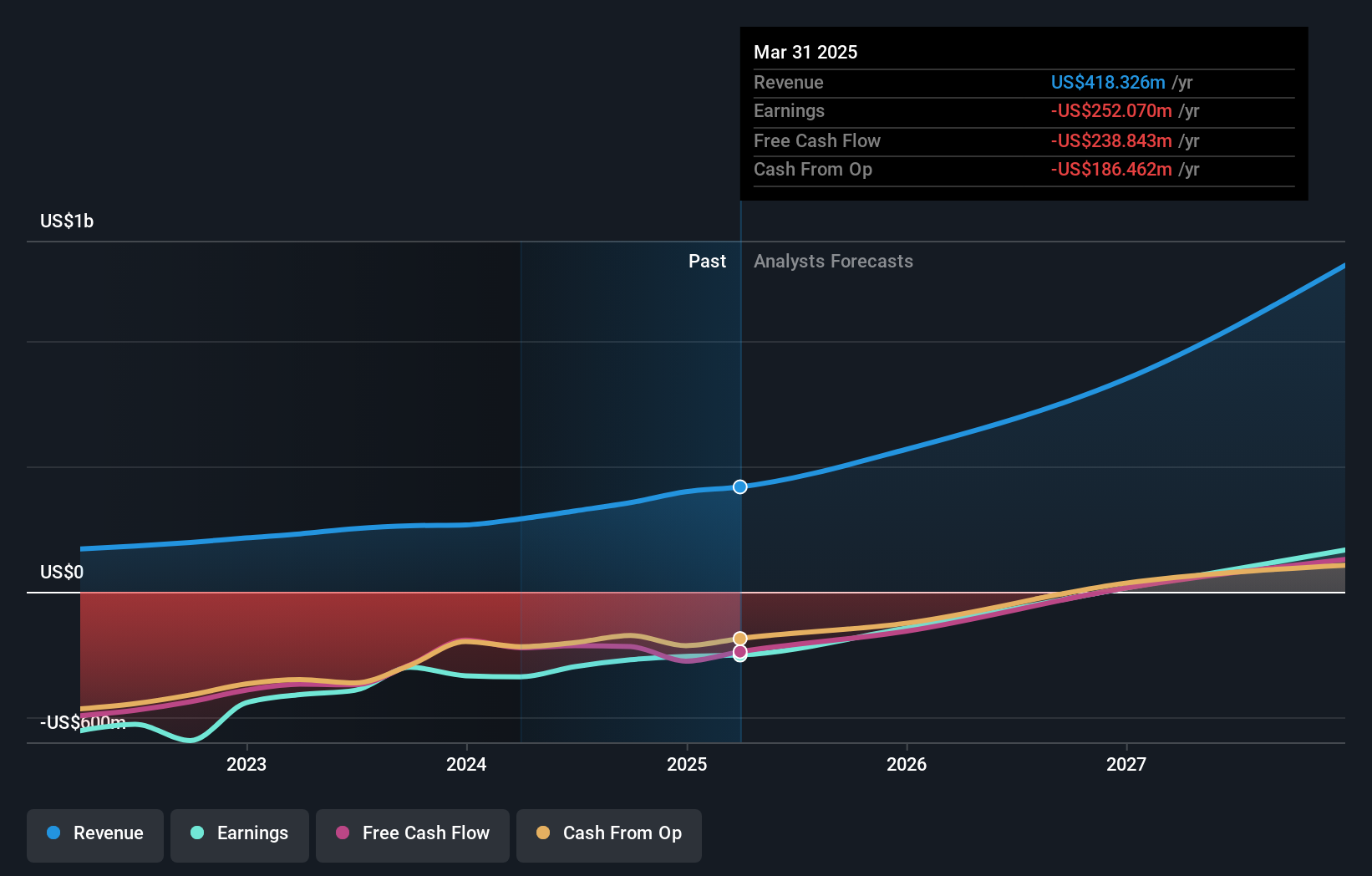

RingCentral (NYSE:RNG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RingCentral, Inc. offers cloud-based communication solutions including video meetings, collaboration tools, and contact center software globally, with a market cap of approximately $3.34 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $2.36 billion. Its offerings include cloud communications and software-as-a-service solutions for video meetings, collaboration, and contact centers worldwide.

RingCentral's recent financial trajectory and executive shifts paint a nuanced picture of its position in the tech sector. Despite a slower revenue growth rate of 6.9% compared to the US market average of 8.9%, RingCentral is navigating its path toward profitability, with earnings expected to surge by 79% annually. The appointment of Abhey Lamba as CFO, a seasoned leader from AWS, signals strategic reinforcement in financial oversight amidst these transitions. Moreover, substantial investments in R&D underscore its commitment to innovation; however, specific figures on R&D spending were not disclosed in the provided data. This blend of leadership acumen and focused investment could be pivotal as RingCentral strives to carve out a significant stance in cloud communications solutions moving forward.

- Dive into the specifics of RingCentral here with our thorough health report.

Assess RingCentral's past performance with our detailed historical performance reports.

Taking Advantage

- Explore the 250 names from our US High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNG

RingCentral

Provides cloud communications, video meetings, collaboration, and contact center software-as-a-service solutions worldwide.