- United States

- /

- Software

- /

- NYSE:QTWO

Q2 Holdings (QTWO) Is Up 21.3% After Profit Return Strong Guidance and Buyback Announcement – What's Changed

Reviewed by Sasha Jovanovic

- In the past week, Q2 Holdings reported a return to profitability in the third quarter with US$201.7 million in sales, raised its full-year 2025 revenue guidance to US$789 million–US$793 million, and announced a US$150 million share repurchase program.

- These developments were accompanied by executive leadership changes and reflect management's increased confidence in the company's outlook and operational momentum.

- We'll examine how Q2 Holdings' strong quarterly earnings and raised guidance could impact its broader investment narrative and future outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Q2 Holdings Investment Narrative Recap

To be a shareholder in Q2 Holdings, you need to believe in the company's ability to drive strong digital banking adoption amid accelerating industry demand for integrated fintech solutions. The recent return to profitability and raised revenue guidance signal positive business momentum, but do not fully eliminate the risk of customer churn from ongoing industry consolidation among mid-sized banks, a core Q2 customer group.

The newly announced US$150 million share repurchase program stands out as the most relevant recent development, reflecting management’s confidence in the company’s financial position. By committing capital to buybacks, Q2 reinforces its outlook even as investors weigh the short-term impacts of industry M&A and the competitive environment.

Yet, despite upbeat signals, investors should be aware that ongoing consolidation in the financial sector could still …

Read the full narrative on Q2 Holdings (it's free!)

Q2 Holdings' narrative projects $1.0 billion in revenue and $132.9 million in earnings by 2028. This requires 11.0% yearly revenue growth and a $128 million increase in earnings from the current $4.9 million.

Uncover how Q2 Holdings' forecasts yield a $90.36 fair value, a 23% upside to its current price.

Exploring Other Perspectives

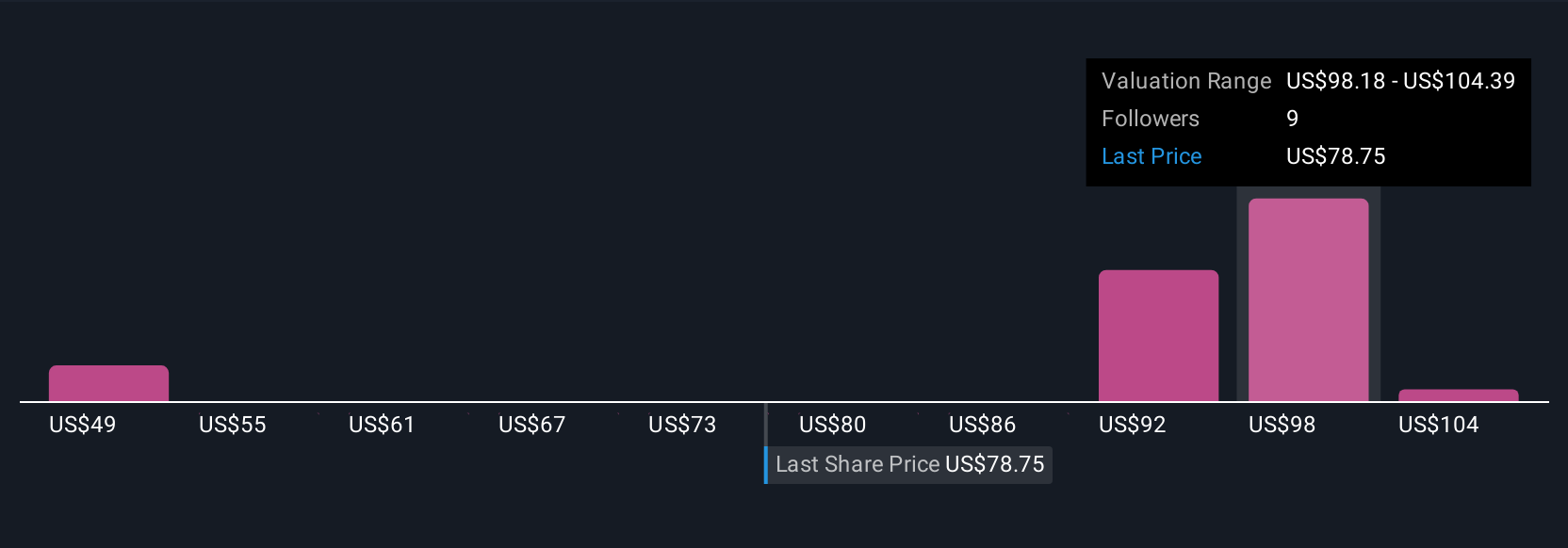

Simply Wall St Community members contributed five fair value estimates for Q2 Holdings, ranging from US$48.51 to US$110.60 per share. While perspectives vary greatly, consolidation risk among Q2’s core bank customers continues to shape expectations and could impact the company’s revenue growth story ahead, review several viewpoints to better understand what matters most.

Explore 5 other fair value estimates on Q2 Holdings - why the stock might be worth as much as 51% more than the current price!

Build Your Own Q2 Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Q2 Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Q2 Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Q2 Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives