- United States

- /

- Software

- /

- NYSE:PRO

Some Shareholders Feeling Restless Over PROS Holdings, Inc.'s (NYSE:PRO) P/S Ratio

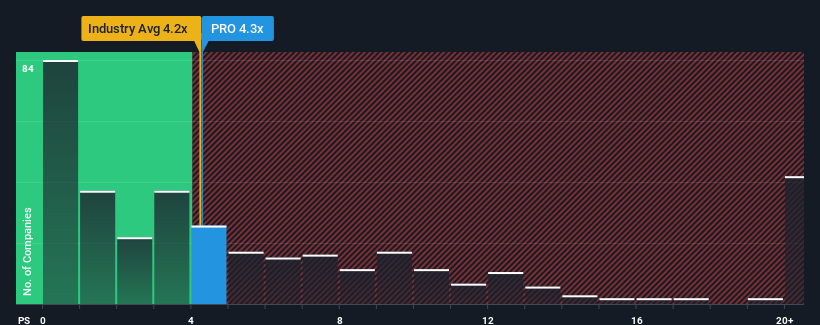

There wouldn't be many who think PROS Holdings, Inc.'s (NYSE:PRO) price-to-sales (or "P/S") ratio of 4.3x is worth a mention when the median P/S for the Software industry in the United States is similar at about 4.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for PROS Holdings

How Has PROS Holdings Performed Recently?

With revenue growth that's inferior to most other companies of late, PROS Holdings has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PROS Holdings.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, PROS Holdings would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. The solid recent performance means it was also able to grow revenue by 26% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 11% as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 14%, which is noticeably more attractive.

In light of this, it's curious that PROS Holdings' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does PROS Holdings' P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that PROS Holdings' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for PROS Holdings (1 doesn't sit too well with us) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PRO

PROS Holdings

Provides software solutions that optimize the processes of selling and shopping in the digital economy in Europe, the Asia Pacific, the Middle East, Africa, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives