- United States

- /

- Software

- /

- NYSE:PD

Did PagerDuty's (PD) Swing to Profitability Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- PagerDuty, Inc. recently reported its third quarter and nine-month earnings for the period ended October 31, 2025, highlighting a swing from a net loss last year to a net income of US$159.56 million on quarterly sales of US$124.55 million.

- This turnaround, marked by a shift to profitability and continued sales growth, stands out given the company's previous struggles with meeting earnings expectations and the intensified competitive landscape within the software sector.

- We'll look at how PagerDuty's move to sustained profitability could influence its long-term investment narrative and industry positioning.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

PagerDuty Investment Narrative Recap

To be a PagerDuty shareholder today, you need to believe in the company's ability to turn digital operations complexity and cloud adoption into recurring, profitable revenue, even as competition and evolving automation threaten its relevance. The recent Q3 swing to US$159.56 million net income confirms PagerDuty’s improved financial discipline and could boost confidence in its transition to both profitability and usage-based pricing models, yet does not fully remove near-term uncertainty around customer retention and revenue visibility.

Among recent announcements, PagerDuty’s launch of its AI agent suite stands out. With new generative and automation-focused tools improving incident response times, this directly ties into the short-term catalyst of upselling and cross-selling to enterprise clients, a capability that may prove critical as the company shifts its monetization approach and strives to maintain customer value in a rapidly evolving IT environment.

But in sharp contrast, the lingering unpredictability around the move to usage-based pricing is something investors should be aware of, as...

Read the full narrative on PagerDuty (it's free!)

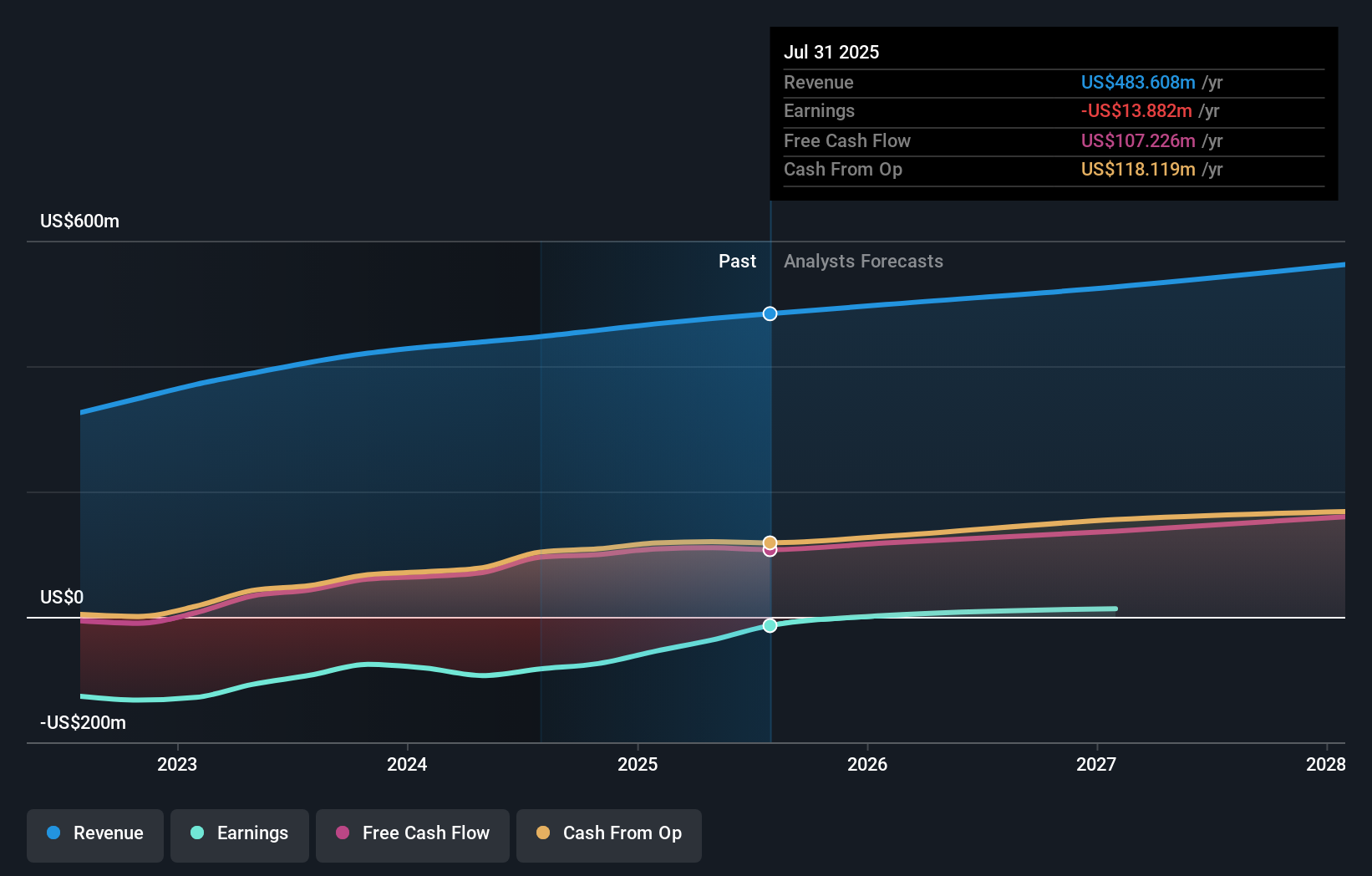

PagerDuty's outlook anticipates $572.1 million in revenue and $74.9 million in earnings by 2028. This scenario requires a 6.3% annual revenue growth rate and a $111.8 million increase in earnings from the current figure of -$36.9 million.

Uncover how PagerDuty's forecasts yield a $18.50 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members place PagerDuty’s fair value between US$18.50 and US$31.53 per share. With usage-based pricing volatility still a core challenge, the wide gap in views spotlights how differently investors see the company’s route to reliable, long-term growth.

Explore 3 other fair value estimates on PagerDuty - why the stock might be worth just $18.50!

Build Your Own PagerDuty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PagerDuty research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free PagerDuty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PagerDuty's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PD

PagerDuty

Engages in the operation of a digital operations management platform in the United States and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success