- United States

- /

- Software

- /

- NYSE:PATH

UiPath (PATH) Valuation in Focus as Analyst Forecasts Highlight Growth and Enterprise AI Security Push

Reviewed by Simply Wall St

UiPath (PATH) is drawing attention after it announced its role as a founding technical contributor to AIUC-1, a key new security framework for AI agent adoption in enterprises. This move comes at a time when market watchers anticipate year-over-year improvements in UiPath’s upcoming earnings and revenues.

See our latest analysis for UiPath.

UiPath’s recent involvement in AI security frameworks appears to have caught the market’s attention, as seen in its 29.8% share price return over the past 90 days and a 9.2% gain year-to-date. However, the one-year total shareholder return is slightly negative, suggesting some investors remain cautious despite the company’s growing influence in AI-driven enterprise automation. Overall, momentum is building in the short term, while the longer-term performance remains a mixed bag.

If UiPath’s push into enterprise AI security has you thinking about the broader tech landscape, now is a great time to discover new opportunities with our tech and AI growth stocks screener See the full list for free.

With recent analyst forecasts predicting solid revenue and earnings growth for UiPath, investors are left wondering whether the company’s current valuation offers a bargain or if the market is already factoring in all that future potential.

Most Popular Narrative: Fairly Valued

UiPath’s most widely followed narrative sees fair value nearly matching the last close price. This suggests that there is little perceived gap between market price and future potential. Expectations remain high for innovation, product strategy, and the size of opportunity. How do recent partnerships and cloud focus influence this equilibrium?

New product launches such as Agent Builder and Agentic Orchestration, along with strategic partnerships like with Microsoft and Deloitte, are positioned to expand market opportunities and may increase earnings through higher-value deals. UiPath's commitment to cloud offerings, with over $975 million in cloud ARR, places the company in a strong position to benefit from AI-driven products and services, which could contribute to revenue growth and improved gross margins.

Curious how aggressive growth bets, future profit assumptions, and industry-level multiples have shaped this fair value? The answer runs deeper than headlines. Only the full narrative reveals what lies behind this narrow margin between analyst target and market price. If you want the inside story on the pivotal numbers, you’ll want to read more.

Result: Fair Value of $13.86 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic shifts and heightened competition could challenge UiPath’s growth story. These factors may potentially alter analyst sentiment and valuation outlook in the months ahead.

Find out about the key risks to this UiPath narrative.

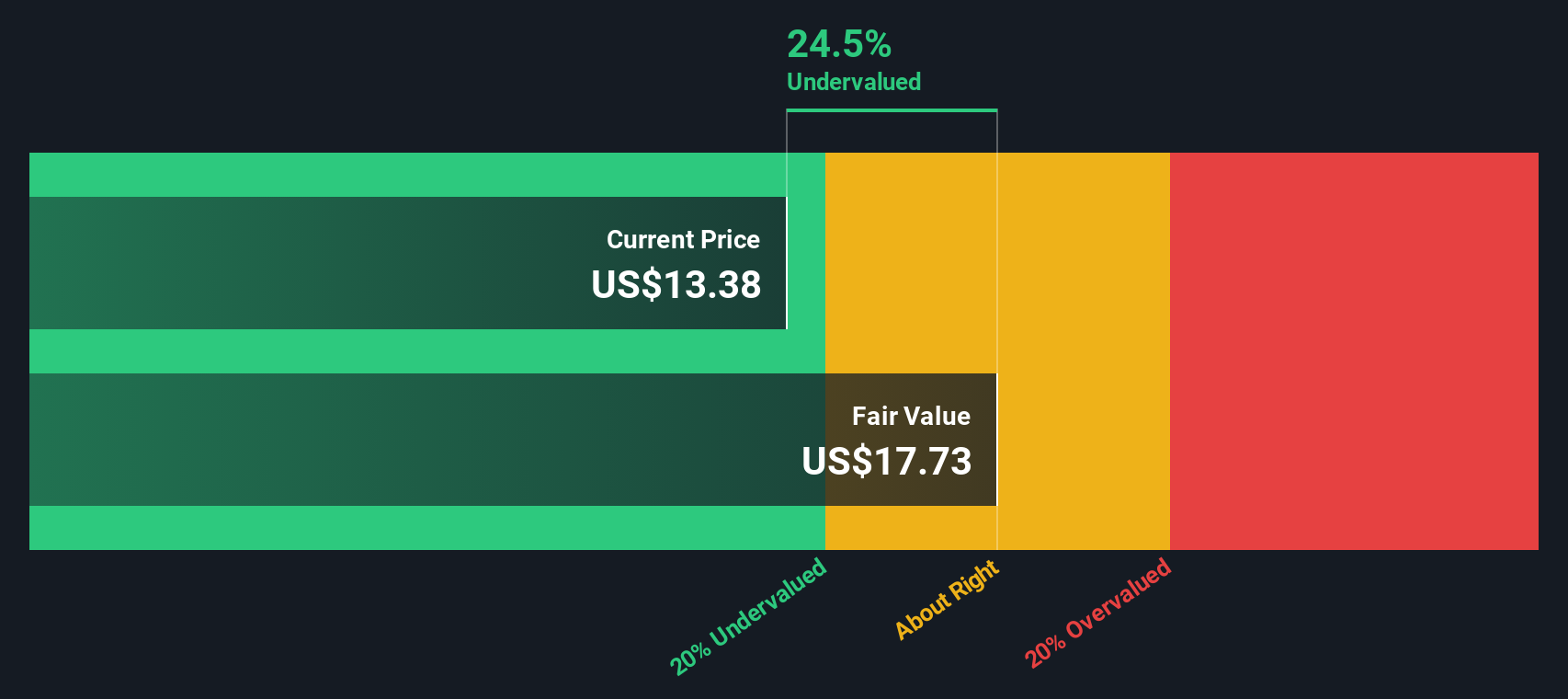

Another View: Discounted Cash Flow Shows Undervaluation

While the fair value narrative underscores the balance between market price and future expectations, our DCF model paints a different picture. According to this approach, UiPath is trading about 22% below what could be considered its fair value. This notable margin may signal overlooked potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UiPath for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UiPath Narrative

If you want to dig deeper or think the story looks different from your perspective, you can craft your own analysis of UiPath in just a few minutes. Do it your way

A great starting point for your UiPath research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know opportunities extend beyond a single company. Set yourself up for success by matching your goals with standout stocks handpicked by our data-driven screeners.

- Tap into the AI revolution to uncover breakout potential with these 25 AI penny stocks, which show strong promise in automation and machine learning.

- Boost your portfolio’s growth prospects by reviewing these 927 undervalued stocks based on cash flows, as analysts believe these stocks are trading below their true value.

- Seize the chance for steady income by checking out these 14 dividend stocks with yields > 3%, which offer attractive yields above 3% and stable track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026