- United States

- /

- Software

- /

- NYSE:ORCL

A Fresh Look at Oracle (ORCL) Valuation After Latest Earnings Reveal Cloud Growth Momentum

Reviewed by Simply Wall St

See our latest analysis for Oracle.

Oracle’s latest results come after a year of momentum, with the stock delivering a 70.65% year-to-date share price return and a striking 64.91% total shareholder return over the past twelve months. Despite a brief dip during the last week, the longer-term trajectory remains strong as investors respond to its focus on cloud and data infrastructure growth.

If the surge in Oracle’s cloud business has you thinking about what’s next in tech, consider exploring the current leaders in transformation through our See the full list for free.

With Oracle’s share price sitting below some analyst targets but up sharply over the past year, investors may wonder whether there is still room for upside or if the market has already factored in all the expected growth.

Most Popular Narrative: 17.7% Undervalued

Despite Oracle closing at $283.33, the most-followed narrative values the company at $344.07 per share, positioning it well above the latest market close. This difference spotlights fresh optimism around Oracle’s pace of growth and ability to capture cloud and AI infrastructure opportunities.

Surging demand for AI workloads, both training and especially inferencing, has positioned Oracle as a key provider for major AI companies (e.g., OpenAI, Meta, xAI, NVIDIA). This has driven a 359% year-over-year increase in remaining performance obligations (RPO) and robust acceleration in cloud infrastructure and database revenue. These factors support expectations for sustained double-digit revenue growth over multiple years.

Want to know the growth blueprint behind this high valuation? The main ingredient is bold future estimates for earnings, margin expansion, and unmatched revenue momentum. Curious what else powers such an aggressive fair value? The full narrative unpacks the numbers and includes the head-turning projections guiding this outlook.

Result: Fair Value of $344.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Oracle’s outlook still faces hurdles, including heavy reliance on continued AI demand and the risk that cloud capacity investments may outpace real-world growth.

Find out about the key risks to this Oracle narrative.

Another View: What Do Valuation Ratios Reveal?

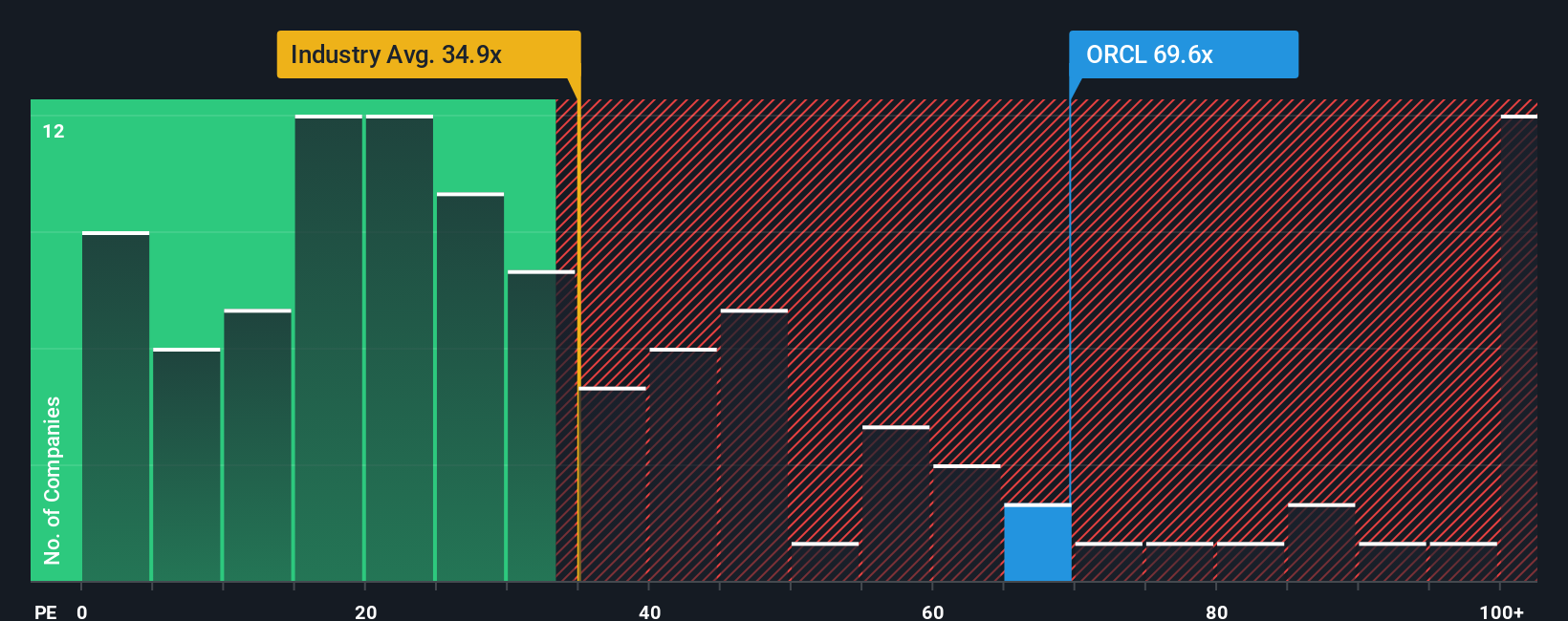

Looking through the lens of the most common valuation benchmark, Oracle’s price-earnings ratio stands at 64.9x, nearly double the US Software industry’s average of 33.3x and slightly higher than the peer group’s 79.5x. Notably, this is also above the company’s fair ratio of 62.7x, implying a premium that could signal valuation risk if growth slows. Does the market expect Oracle’s cloud surge to continue, or are hopes running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Oracle Narrative

If you see things differently or want to dig into Oracle’s story yourself, it only takes a few minutes to assemble your own perspective, your way. Do it your way

A great starting point for your Oracle research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors look beyond one opportunity. Don’t let your next standout pick pass you by. Use the screener to act decisively while the window is open.

- Capitalize on sustainable growth prospects by reviewing these 880 undervalued stocks based on cash flows that trade below their long-term potential.

- Capture tomorrow’s tech leaders earlier by checking out these 27 AI penny stocks making waves with rapid innovation in artificial intelligence.

- Elevate your income strategy by evaluating these 17 dividend stocks with yields > 3% offering attractive yields and the consistency you want for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives