- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NOW): Examining Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

ServiceNow (NOW) shares have been trending lower, with a drop of nearly 15% over the past month and more than 23% since the start of the year. Investors are watching closely for signs of stabilization as broader market shifts continue.

See our latest analysis for ServiceNow.

This past year has been tough for ServiceNow shareholders, with turbulence in the tech sector contributing to a -24.08% year-to-date share price return and a -23.55% total shareholder return over the last twelve months. The recent slide suggests momentum is fading for now, even though the company delivered impressive multi-year gains earlier in the decade.

If you’re curious which other stocks are showing compelling growth stories right now, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With ServiceNow’s strong financial growth but a steep recent pullback, investors are left wondering if the current price is a bargain for long-term growth or if the market is already accounting for all the company’s future potential.

Most Popular Narrative: 30.7% Undervalued

ServiceNow’s current share price of $800.46 sits well below the narrative’s fair value estimate, suggesting significant upside if projections hold true. Strong growth catalysts and ambitious expansion plans underpin this prevailing market viewpoint.

ServiceNow's focus on AI platform and business transformation is gaining momentum, which is expected to drive future revenue growth as demand for AI-driven solutions increases. The acquisition of companies like Moveworks and Logik.ai can enhance ServiceNow’s offerings, potentially improving net margins by driving efficiencies and offering more integrated solutions.

What is the secret sauce fueling this bullish narrative? It all hinges on bold forecasts for rapid profit growth and aggressive margin expansion, powered by next-generation technology bets. Curious about the financial leaps analysts are baking in? Unlock the full narrative and catch the hidden drivers behind that sky-high valuation.

Result: Fair Value of $1,154.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, changes in U.S. federal spending or increased competition in AI could quickly undermine ServiceNow’s growth prospects and current analyst optimism.

Find out about the key risks to this ServiceNow narrative.

Another View: Multiples Raise Concerns

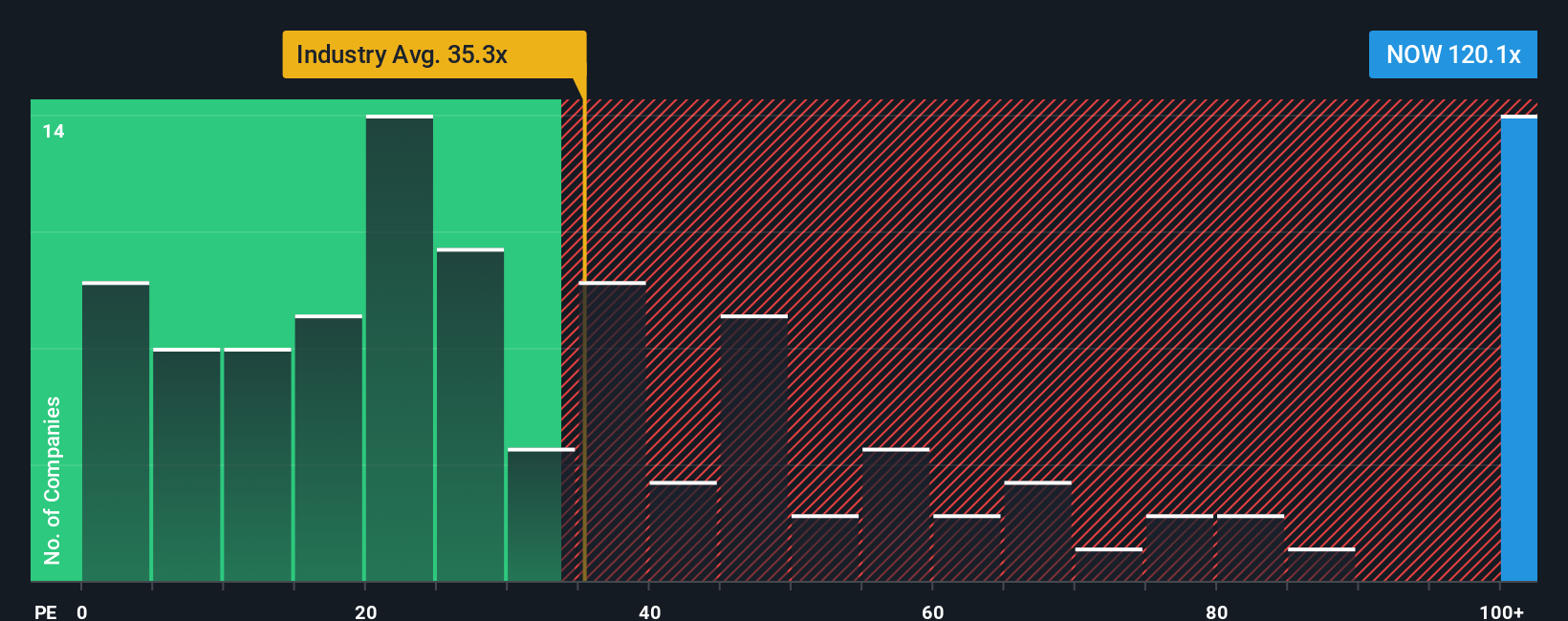

While the narrative suggests ServiceNow may be deeply undervalued, a look at the price-to-earnings multiple tells a different story. The company trades at 95.9x earnings, far above the US Software industry average of 29.2x and a fair ratio estimate of 49.6x. This big gap raises important questions about whether the market is pricing in too much future growth, or if investors are simply paying any price for a piece of the action. Which valuation approach feels closer to reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ServiceNow Narrative

If you feel another perspective fits ServiceNow better or want to dig into the data firsthand, you can easily shape your own story in just a few minutes. Do it your way

A great starting point for your ServiceNow research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Now’s your chance to move ahead of the crowd. Don’t wait on the sidelines; the best opportunities can pass by in a flash.

- Unleash the potential of the digital economy by tapping into these 81 cryptocurrency and blockchain stocks, making major moves in blockchain and decentralized finance technologies.

- Pounce on hidden gems with these 3593 penny stocks with strong financials, poised for outsized gains thanks to solid fundamentals and unique market positioning.

- Upgrade your passive income strategy and check out these 16 dividend stocks with yields > 3%, offering attractive yields and robust financial strength, perfect for building long-term wealth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives