- United States

- /

- Software

- /

- NYSE:NOW

How ServiceNow's (NOW) AI Moves With KPMG and Work4Flow Could Reshape Its Investment Story

Reviewed by Sasha Jovanovic

- In recent days, KPMG launched its new Global Business Services platform powered by the ServiceNow AI Platform, while ServiceNow acquired the Now Assist Readiness Evaluation solution from Work4Flow Inc. to accelerate enterprise AI adoption.

- These moves underscore ServiceNow’s focus on strengthening its AI-driven workflow solutions and expanding its technological ecosystem across industries.

- We'll examine how ServiceNow’s AI platform integration with KPMG could shape its investment case and future enterprise adoption.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

ServiceNow Investment Narrative Recap

To invest in ServiceNow, you need to believe in the company's ability to consistently drive digital transformation for enterprises, particularly by deepening its AI-powered workflow solutions. The latest partnership moves, including the KPMG launch and AI acquisition, reinforce this underlying thesis but are not likely to materially shift the company’s most important short-term catalyst: rising enterprise adoption of AI platforms. However, integration risk around new solutions and intensifying competition in AI workflows remain the key risks to watch.

The KPMG Global Business Services platform launch stands out as the most relevant recent announcement, as it demonstrates real-world deployment of ServiceNow’s AI capabilities with a recognized global consultancy. Such collaborations could help the company capitalize on the ongoing enterprise push toward automation, supporting its goal of expanding addressable markets, but also highlight the challenge of ensuring these partnerships translate to measurable adoption and revenue impact.

By contrast, investors should be aware that risks like execution failures in expanding industry workflows could...

Read the full narrative on ServiceNow (it's free!)

ServiceNow's outlook projects $20.3 billion in revenue and $3.3 billion in earnings by 2028. This assumes an annual revenue growth rate of 18.9% and an increase in earnings of $1.6 billion from the current $1.7 billion level.

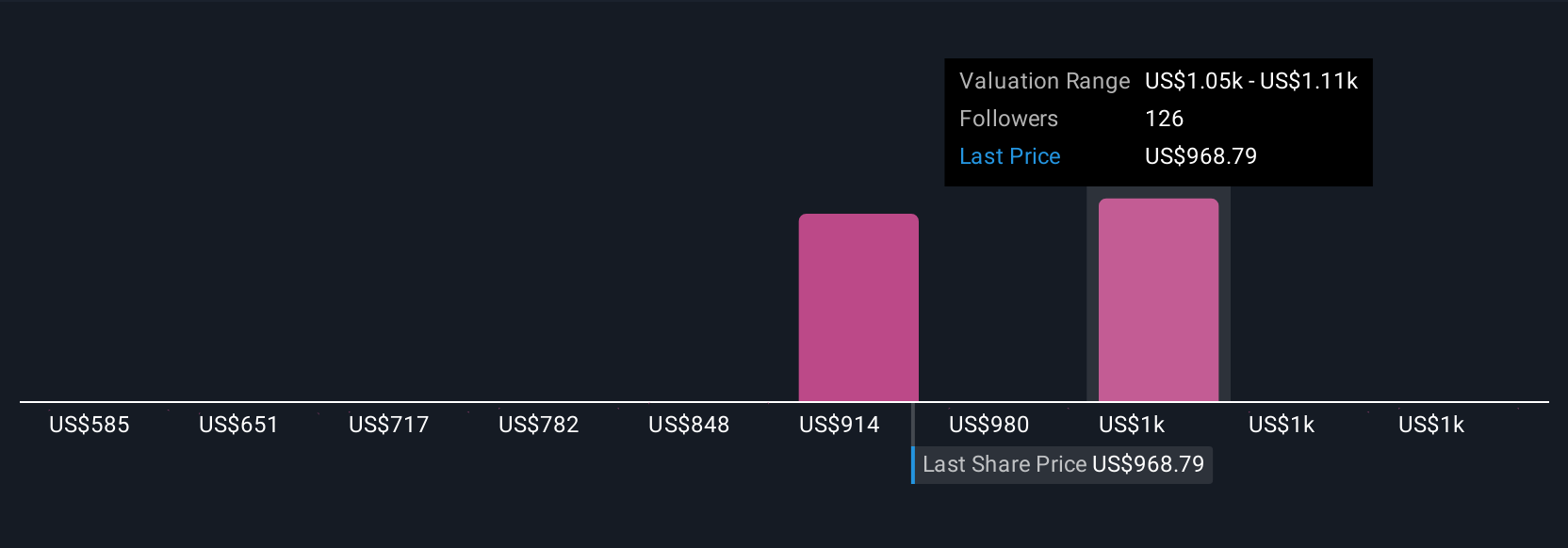

Uncover how ServiceNow's forecasts yield a $1143 fair value, a 22% upside to its current price.

Exploring Other Perspectives

The most optimistic analysts saw ServiceNow’s ambitious growth, projecting annual revenue to exceed US$20.3 billion by 2028 and assuming that additional agentic AI deals and flexible pricing models could rapidly boost margins. Their outlook is noticeably more optimistic than consensus, so it’s worth considering how the newest developments might influence both bullish and more cautious points of view going forward.

Explore 17 other fair value estimates on ServiceNow - why the stock might be worth 32% less than the current price!

Build Your Own ServiceNow Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ServiceNow research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ServiceNow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ServiceNow's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives