- United States

- /

- Software

- /

- NYSE:NOW

Can ServiceNow’s New AI Partnerships Shift Its Long-Term Competitive Edge? (NOW)

Reviewed by Sasha Jovanovic

- In recent days, ServiceNow has announced expanded partnerships and integrations with NVIDIA, Figma, FedEx Dataworks, Horizon3.ai, VergeSense, and Tandym Group, underscoring its push to scale AI-powered workflows, enhance enterprise automation, and enrich its ecosystem across industries.

- These collaborations bring real-time occupancy intelligence, improved design-to-development tools, end-to-end supply chain automation, and accelerated workforce development directly into the ServiceNow platform, highlighting the company's growing influence in enterprise AI and digital transformation.

- We'll examine how ServiceNow's expanded AI and workflow partnerships with NVIDIA and Figma influence the company's investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

ServiceNow Investment Narrative Recap

Investing in ServiceNow means believing in the company’s ability to lead enterprise AI adoption, drive automation across industries, and expand its platform through strategic partnerships. The recent wave of integrations, including new collaborations with NVIDIA and Figma, signals a strong intent to boost workflow automation and AI capabilities, but these moves do not materially change the most significant short-term catalyst: expanding AI-powered workflows to cement revenue growth, nor do they reduce the risks from execution challenges in competitive markets and government exposure.

The standout headline from recent announcements is ServiceNow’s integration with Figma, which connects design intent directly to AI-powered app creation on the platform. This collaboration highlights the importance of speed and quality in delivering enterprise software and connects directly to the company’s catalyst of winning market share through AI-driven digital transformation.

By contrast, investors should also remain aware that execution risk in expanding new workflow markets, especially when combined with reliance on government contracts, still presents...

Read the full narrative on ServiceNow (it's free!)

ServiceNow's narrative projects $20.3 billion revenue and $3.3 billion earnings by 2028. This requires 18.9% yearly revenue growth and a $1.6 billion earnings increase from $1.7 billion today.

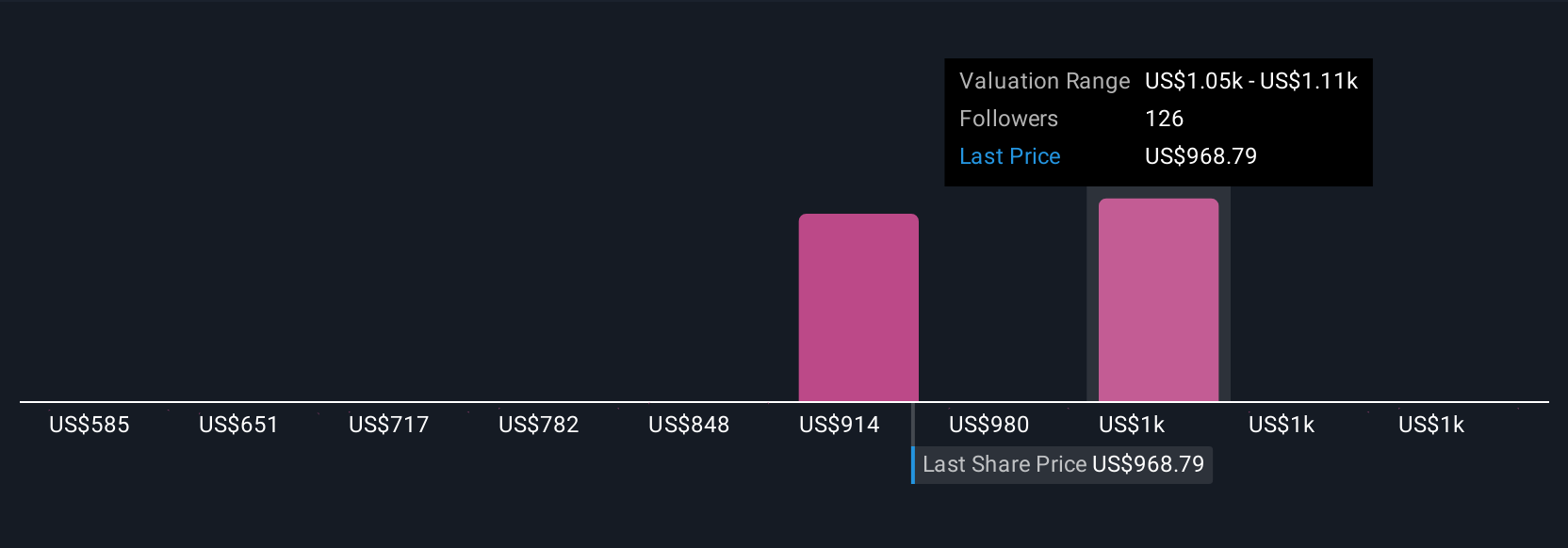

Uncover how ServiceNow's forecasts yield a $1157 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Some analysts have been much more optimistic, forecasting ServiceNow’s annual revenue to reach US$20.3 billion and earnings of US$4.2 billion by 2028. While consensus focuses on steady growth and platform stability, these bullish forecasts emphasize AI adoption and flexible pricing as key drivers, but also highlight revenue risks from the shift to consumption pricing and higher operational spending. Investor opinions can vary widely, be sure to explore how these new announcements might reshape both sides of the story.

Explore 17 other fair value estimates on ServiceNow - why the stock might be worth as much as 34% more than the current price!

Build Your Own ServiceNow Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ServiceNow research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ServiceNow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ServiceNow's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives