- United States

- /

- Software

- /

- NYSE:NOW

A Fresh Look at ServiceNow (NOW) Valuation After Latest Share Price Slide

Reviewed by Simply Wall St

See our latest analysis for ServiceNow.

ServiceNow's share price has retreated about 13% year-to-date, reflecting a cooling in investor momentum even as the company continues to deliver steady revenue and profit gains. Still, its three-year total shareholder return remains an impressive 152%, which highlights the business’s longer-term strength.

If ServiceNow's shifting momentum has you wondering about broader tech opportunities, you might enjoy discovering the full spectrum of innovation with our easy-to-browse list: See the full list for free.

With its latest pullback, investors now face a critical question: is ServiceNow undervalued after its recent slide, or are markets simply factoring in every bit of expected growth already? Could this be a real buying opportunity, or has the window closed?

Most Popular Narrative: 21% Undervalued

ServiceNow’s most widely followed valuation narrative places fair value at $1,156.59, well above the recent close. This sizable gap frames a potential opportunity that investors cannot ignore, even as growth expectations cool slightly.

ServiceNow's focus on AI platform and business transformation is gaining momentum, which is expected to drive future revenue growth as demand for AI-driven solutions increases. The acquisition of companies like Moveworks and Logik.ai can enhance ServiceNow’s offerings, potentially improving net margins by driving efficiencies and offering more integrated solutions.

Want to uncover the secret sauce behind that bullish fair value? The real story lies in aggressive growth bets, ambitious expansion plans, and margin improvements that only a few tech giants can match. Get the inside scoop on what’s fueling these expectations and see why analysts are so confident in ServiceNow’s path.

Result: Fair Value of $1,156.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ServiceNow’s reliance on U.S. federal contracts and the unpredictable pace of global tech change could quickly alter the bullish narrative in the future.

Find out about the key risks to this ServiceNow narrative.

Another View: What Do Valuation Ratios Say?

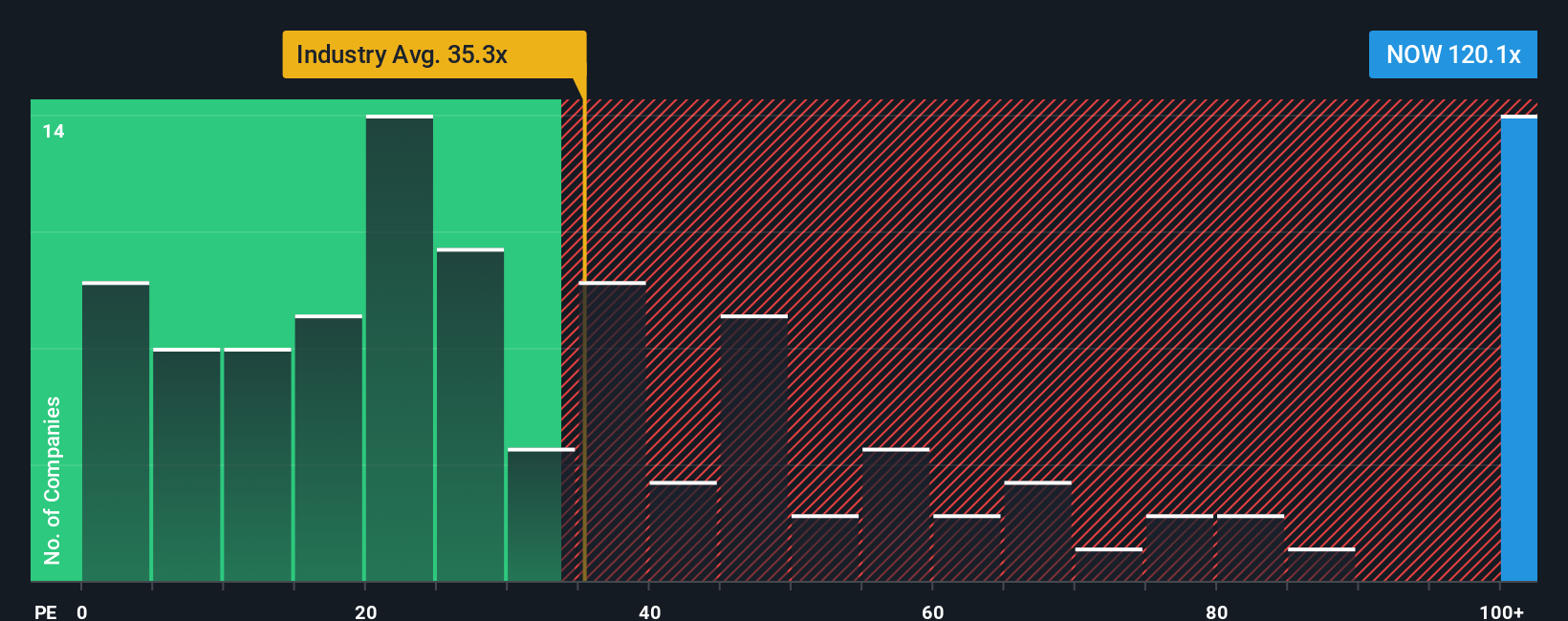

While the fair value narrative suggests ServiceNow is notably undervalued, looking at its earnings valuation presents a different perspective. ServiceNow is currently trading at 109.6 times earnings, far above the U.S. Software industry average of 35.9 and its peer average of 61.3. Even the fair ratio is just 50.2, highlighting how much investors are paying for expected growth. This significant gap means the market is holding ServiceNow to high standards. What happens if growth expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ServiceNow Narrative

Feel that your perspective differs, or want to see the data firsthand? Dive in and craft a narrative of your own in just minutes: Do it your way

A great starting point for your ServiceNow research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself to one stock when the next opportunity could be just a click away? Uncover unique companies and sharpen your portfolio strategy right now.

- Tap into tomorrow’s healthcare breakthroughs by checking out these 33 healthcare AI stocks, connecting medical innovation with the power of artificial intelligence.

- Boost the income potential of your investments with these 18 dividend stocks with yields > 3%, featuring reliable companies offering yields above 3%.

- Seize the upside in digital assets by exploring these 82 cryptocurrency and blockchain stocks and uncovering businesses at the forefront of blockchain and cryptocurrency technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives