- United States

- /

- IT

- /

- NYSE:NET

Is Now the Right Time to Invest in Cloudflare After Its 7.7% Price Pullback?

Reviewed by Bailey Pemberton

If you’re staring at your brokerage app and asking yourself whether it’s time to make a move on Cloudflare, you’re not alone. Few stocks have raced ahead like this one, with Cloudflare shares up a stunning 87.2% year to date and a whopping 140.4% over the past twelve months. Long-term holders are sitting on gains north of 280% over the last five years, so it’s no surprise everyone’s buzzing about whether there’s still runway left, or if the risk is starting to catch up.

Some of the recent price volatility, including this month’s 7.7% pullback, has tracked closely with a renewed focus on cybersecurity and networking infrastructure plays. Cloudflare’s ambitious rollouts and growing footprint in the AI and enterprise markets have been hot topics, fueling optimism in some circles, even as the valuation debate has gotten louder. This kind of growth story always attracts passionate opinions, and it’s clear investors are recalibrating what they're willing to pay for the company’s prospects as the market backdrop shifts.

Still, if you’re hoping to find a classic value play here, a quick look at Cloudflare’s current value score might leave you wanting more. The company scores a 0, meaning it doesn’t pass any of six core undervaluation checks. That’s got a lot of folks wondering whether growth can continue to outrun risk, or if it’s time to be more cautious.

So, how do you even begin to size up a stock like Cloudflare? Let’s dig into the standard ways investors judge valuation, and explore how well they really work, plus why there might be an even sharper way to think about what this company is worth.

Cloudflare scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cloudflare Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model aims to estimate a company's value by forecasting its future cash flows and discounting them back to their present worth. In short, it weighs the money Cloudflare is expected to generate over the next several years against today’s dollars, taking into account risk and the time value of money.

For Cloudflare, analysts estimate the current Free Cash Flow (FCF) at $226 million. Projections show this number increasing each year, with FCF expected to reach about $1.2 billion by the end of 2029. The first five years use analyst estimates, while numbers beyond that are extrapolated using growth assumptions. All cash flows are reported in US dollars. This rapid growth is a central part of the DCF’s value estimate for the company.

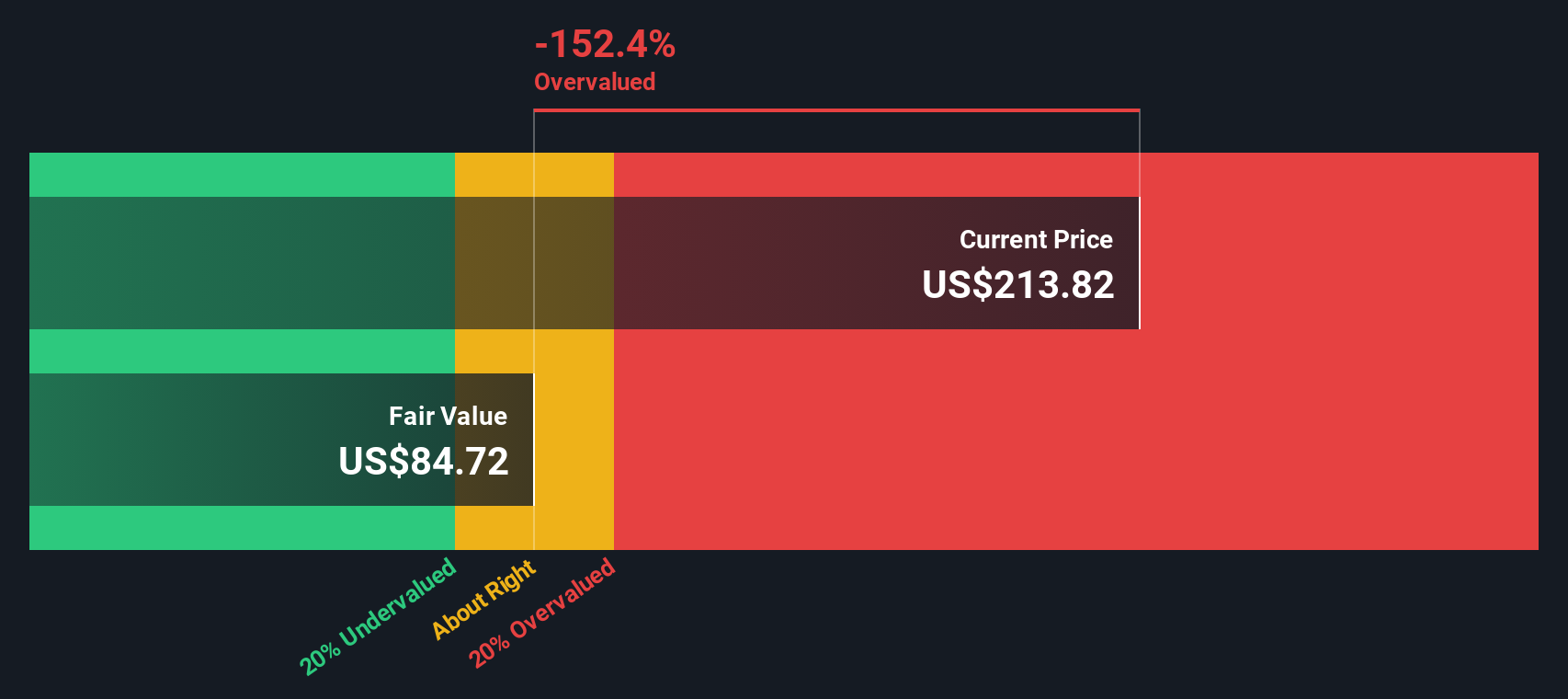

Using this model, Cloudflare’s intrinsic value is calculated at $77.60 per share. However, this is significantly lower than today’s market price, resulting in a calculated DCF discount of -171.6%. In other words, based on projected future cash flows, Cloudflare stock appears substantially overvalued relative to its fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cloudflare may be overvalued by 171.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Cloudflare Price vs Sales (P/S)

For high-growth tech companies like Cloudflare, the Price-to-Sales (P/S) ratio is often the most useful tool for valuation, especially since the company is not consistently profitable. This metric compares what investors are willing to pay for each dollar of revenue to the company’s actual sales. It is especially suitable for businesses focused on expansion rather than current profits.

Growth expectations and risk play a key role in determining what a "normal" or "fair" P/S ratio should be. Rapid growers often trade at higher multiples, justified by strong revenue expansion and the anticipation of future profitability. On the other hand, elevated risks or slowing growth can justify lower multiples, even within the same sector.

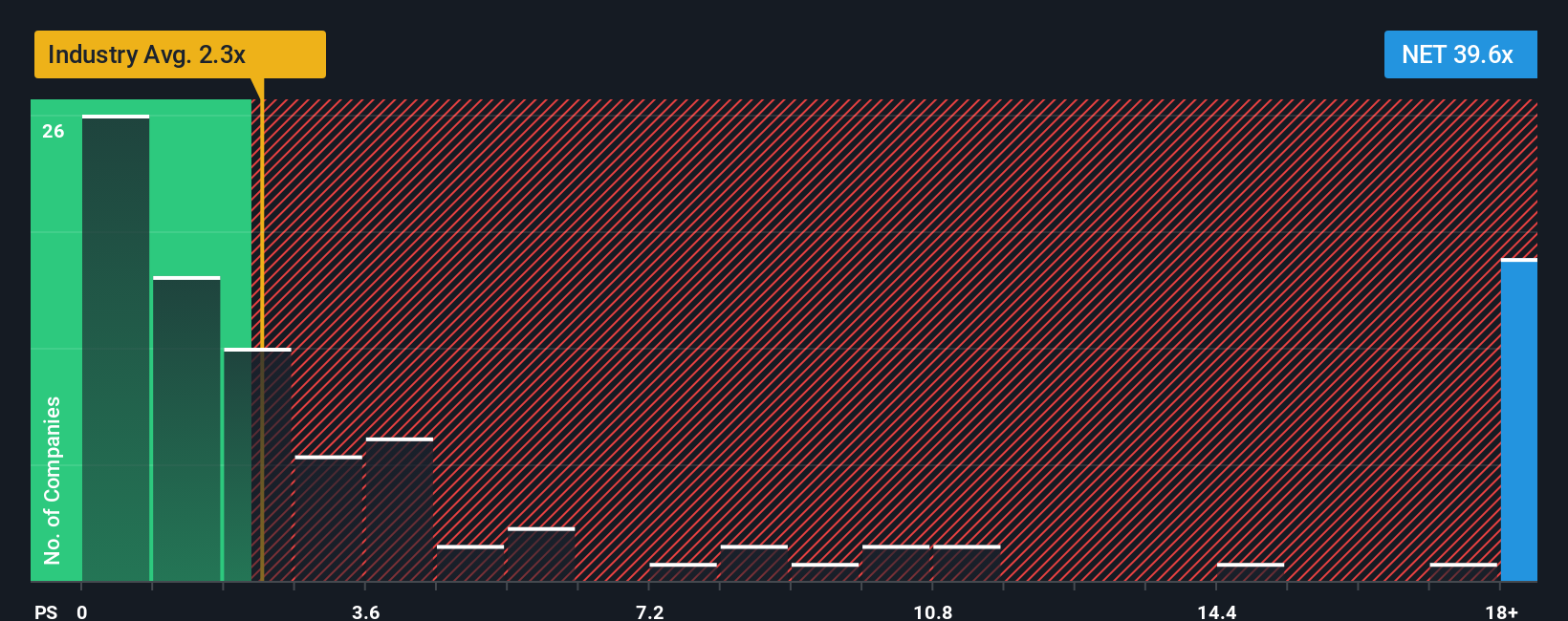

At the moment, Cloudflare is trading at a P/S ratio of 39.03x. For context, the industry average stands at 2.78x, and leading peers average 17.68x. These comparisons show that Cloudflare is valued significantly higher than both its sector and similar companies on a sales basis.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio calculates an ideal multiple by adjusting for Cloudflare’s specific growth outlook, margins, risk profile, industry trends, and size. Unlike a basic industry or peer average, the Fair Ratio offers a more tailored estimate grounded in what truly matters for this particular company. For Cloudflare, the Fair Ratio is 17.89x.

With the market paying a much higher multiple than the Fair Ratio suggests, Cloudflare stock appears overvalued on a sales basis at this time.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cloudflare Narrative

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a powerful yet simple tool that lets investors combine a company's story—your perspective on Cloudflare's future—with the financial numbers: how much it's worth, and what you expect for its future sales, profits, and margins.

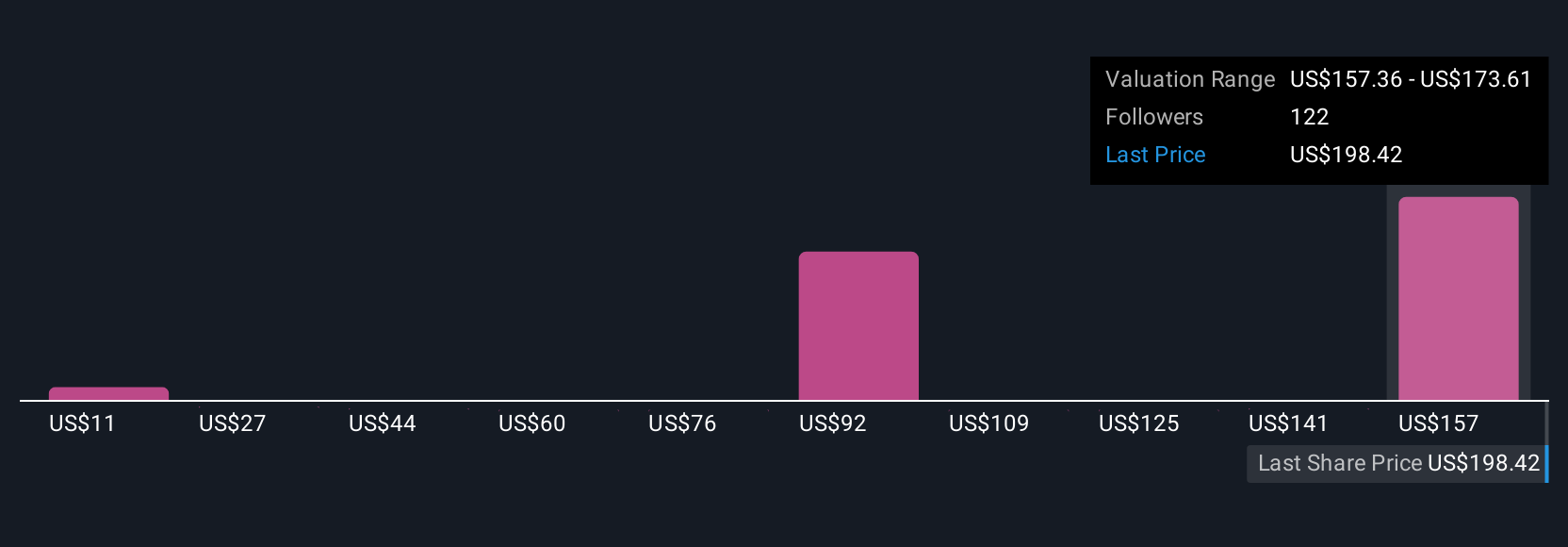

By linking a company's story to a personalized financial forecast and fair value, Narratives allow you to see how your beliefs translate into tangible numbers. On Simply Wall St’s Community page (visited by millions), Narratives make this process easy and interactive, helping you decide if now is the right time to buy or sell Cloudflare by comparing your fair value against the current market price.

Narratives refresh in real time as new information arrives, whether it’s earnings, news, or industry updates, ensuring your decisions adapt to the latest developments. For example, right now, some investors believe Cloudflare could be worth as much as $255.00, while others are far more cautious, setting their target at just $90.00, all depending on their unique reading of the company's future risks and opportunities.

Do you think there's more to the story for Cloudflare? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives