- United States

- /

- IT

- /

- NYSE:NET

How Cloudflare's (NET) Q3 Revenue Surge and Leadership Change Have Shifted Its Investment Story

Reviewed by Sasha Jovanovic

- Cloudflare recently reported third-quarter 2025 earnings, posting US$562.03 million in sales compared to US$430.08 million a year earlier and narrowing its net loss to US$1.29 million from US$15.33 million, while also providing upwardly revised revenue guidance for the fourth quarter and full year.

- Alongside its financial report, Cloudflare announced the departure of its President of Product & Engineering and highlighted significant global cybersecurity trends, reflecting continued growth in digital activity and the importance of its infrastructure solutions.

- We'll examine how Cloudflare's stronger revenue outlook and reduced net loss reinforce its long-term growth and operational efficiency story.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cloudflare Investment Narrative Recap

To hold Cloudflare stock, an investor needs conviction in the long-term rise of secure, cloud-native infrastructure as internet activity accelerates. The recent earnings report, with narrowed net losses and raised revenue guidance, supports optimism but does not remove ongoing risks from customer concentration and margin pressure, which remain the most important near-term catalyst and risk, respectively. The higher revenue outlook may ease pressure, yet gross margin trends still deserve close scrutiny.

Among recent announcements, Cloudflare’s upwardly revised guidance for both the fourth quarter and full year is most relevant. This update signals confidence in continued top-line momentum, which is crucial in offsetting concerns around profitability, especially amid heavy investment in innovation and platform expansion.

But while revenue momentum is encouraging, investors should be aware that margin compression remains a key risk if...

Read the full narrative on Cloudflare (it's free!)

Cloudflare's outlook anticipates $3.8 billion in revenue and $176.4 million in earnings by 2028. This scenario assumes annual revenue growth of 26.5% and a $293.5 million increase in earnings from the current figure of -$117.1 million.

Uncover how Cloudflare's forecasts yield a $232.49 fair value, in line with its current price.

Exploring Other Perspectives

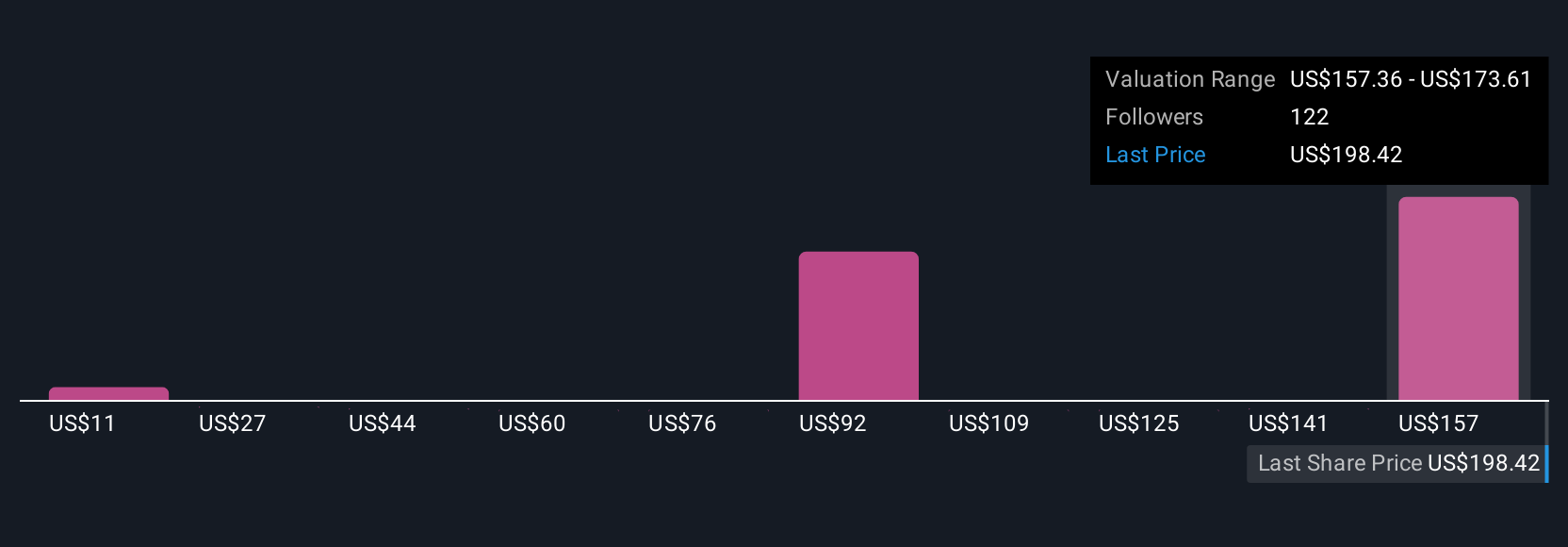

The Simply Wall St Community shared 28 fair value estimates for Cloudflare, ranging from US$11.58 to US$232.49. While optimism about demand and potential revenue growth prevails, opinion remains split on the impact of persistent margin pressure, so consider how your view aligns before making investment decisions.

Explore 28 other fair value estimates on Cloudflare - why the stock might be worth as much as $232.49!

Build Your Own Cloudflare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cloudflare research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Cloudflare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cloudflare's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives