In the last week, the United States market has stayed flat, yet it is up 9.8% over the past year with earnings forecast to grow by 15% annually. In this environment, identifying high growth tech stocks that align with these positive earnings expectations can be crucial for investors seeking opportunities in a dynamic sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Alvotech | 29.03% | 53.53% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.36% | 60.93% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.63% | 60.71% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 22.99% | 103.97% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Datadog (DDOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Datadog, Inc. provides an observability and security platform for cloud applications globally, with a market cap of $42.11 billion.

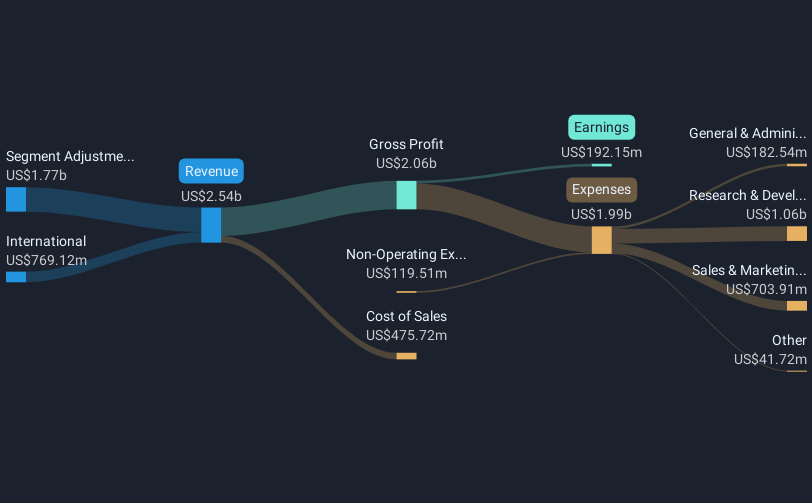

Operations: The company generates revenue primarily from its Information Technology (IT) Infrastructure segment, amounting to $2.83 billion.

Amidst a vibrant tech landscape, Datadog stands out with its robust performance and strategic initiatives. Recently, the company reported a substantial increase in sales to $761.55 million for Q1 2025, up from $611.25 million the previous year, showcasing a notable revenue growth of 24.6%. Despite a dip in net income from $42.63 million to $24.64 million, Datadog continues to invest heavily in innovation as evidenced by its active participation in major conferences and the launch of new integrations like with Chainguard for enhanced container security. This commitment not only underscores its agility but also fortifies its market position by addressing critical cybersecurity needs while fostering software development efficiency.

- Get an in-depth perspective on Datadog's performance by reading our health report here.

Examine Datadog's past performance report to understand how it has performed in the past.

Jabil (JBL)

Simply Wall St Growth Rating: ★★★★☆☆

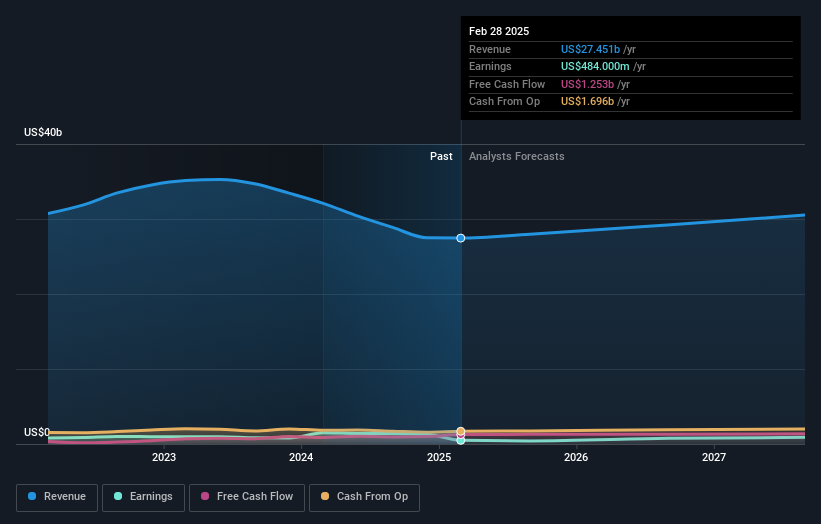

Overview: Jabil Inc. offers manufacturing services and solutions globally, with a market cap of $19.41 billion.

Operations: The company operates globally, providing a range of manufacturing services and solutions. With a market cap of $19.41 billion, it serves various industries through its diverse revenue streams.

Jabil's recent earnings report highlights a robust uptick in quarterly sales, reaching $7.83 billion, a significant rise from the previous year's $6.77 billion, reflecting a strategic expansion in its market presence. The firm also reported a sharp increase in net income to $222 million, up from $129 million year-over-year, with earnings per share nearly doubling to $2.05. This financial momentum is complemented by Jabil's forward-looking initiatives, including a promising collaboration with AVL Software and Functions GmbH aimed at pioneering next-generation vehicle technology—a move that not only diversifies Jabil’s portfolio but also aligns it with evolving industry trends towards smarter and more efficient automotive solutions. These developments underscore Jabil’s proactive approach in adapting to dynamic market demands while maintaining operational excellence and innovation at the core of its strategy.

- Click to explore a detailed breakdown of our findings in Jabil's health report.

Review our historical performance report to gain insights into Jabil's's past performance.

Cloudflare (NET)

Simply Wall St Growth Rating: ★★★★★☆

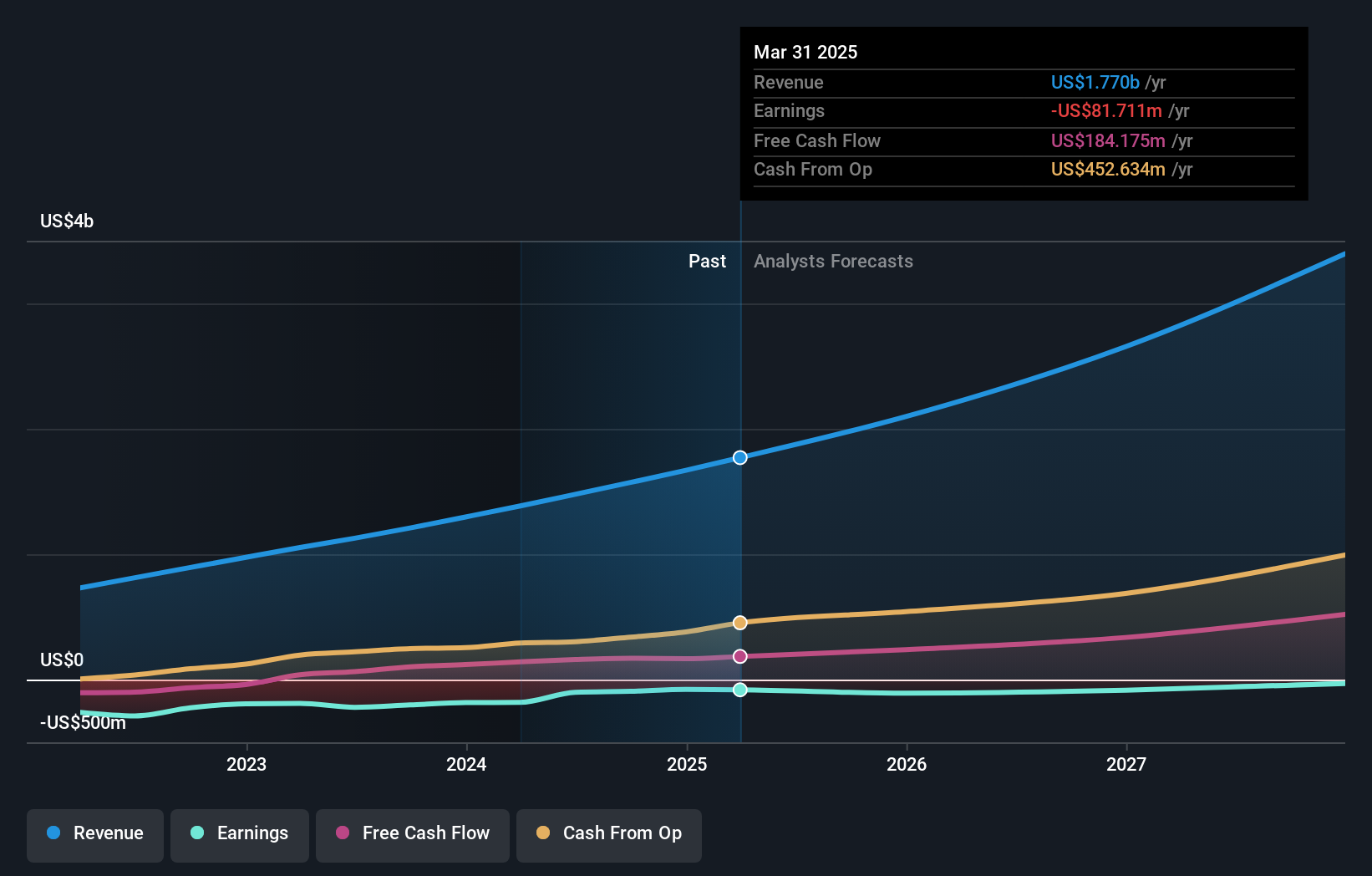

Overview: Cloudflare, Inc. is a cloud services provider offering a variety of services to businesses globally, with a market cap of $62.14 billion.

Operations: The company generates revenue primarily through its Internet Telephone segment, which reported $1.77 billion in sales.

Cloudflare, a key player in the tech landscape, recently reported a 19.6% annual revenue growth, underscoring its robust performance in the competitive market. The company's strategic expansion into Latin America through partnerships for managed security services highlights its innovative approach to capturing new markets and addressing hybrid work complexities. Notably, Cloudflare's R&D investment remains pivotal, with significant expenses aimed at enhancing cybersecurity measures and infrastructure resilience—critical factors driving its forward momentum in high-growth sectors of tech and AI.

- Take a closer look at Cloudflare's potential here in our health report.

Gain insights into Cloudflare's historical performance by reviewing our past performance report.

Where To Now?

- Explore the 231 names from our US High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives