- United States

- /

- IT

- /

- NYSE:NET

Cloudflare (NET): Evaluating Valuation After Launching Industry-First AI Security Integrations for Enterprise Clients

Cloudflare (NET) just made a splash with its latest set of product launches, becoming the first Cloud Access Security Broker to connect with all three leading generative AI tools: ChatGPT Enterprise, Claude by Anthropic, and Google Gemini. This is more than just another feature drop; it represents a clear step toward redefining how businesses control and secure the use of AI in the workplace. As enterprise adoption of AI accelerates, Cloudflare is positioning itself as the protector of sensitive data, an area that many companies are actively seeking to address.

These moves have caught the attention of the market. Over the past year, Cloudflare’s stock price has surged an impressive 153%, with momentum increasing in recent months as AI-related headlines become more frequent. The past three years also show a considerable gain, reflecting growing investor confidence. Like most fast-growing software names, the swings in price can be dramatic. This new push into enterprise AI security adds a timely dimension to the Cloudflare growth story.

With such strong gains, an important question arises: does Cloudflare’s current price offer a rare entry point, or is Wall Street already factoring in the potential for the company to capture the next wave of AI-driven growth?

Price-to-Sales of 38x: Is it justified?

Cloudflare currently trades at a price-to-sales ratio of 38 times. This makes its stock price look expensive compared to industry peers.

The price-to-sales (P/S) multiple measures how much investors are willing to pay for each dollar of revenue generated by the company. For high-growth, unprofitable software companies like Cloudflare, this metric is especially relevant because it reflects future growth expectations in the absence of current profits. However, Cloudflare’s multiple not only exceeds the US IT industry average of 2.4x, it is also much higher than its peer group’s 15x average.

This sizable premium suggests the market is pricing in not just Cloudflare’s current revenue growth but also high confidence in its long-term potential to compete in AI-driven security. Still, such a high valuation carries expectations that the company will deliver sustained, above-market expansion and eventually achieve profitability.

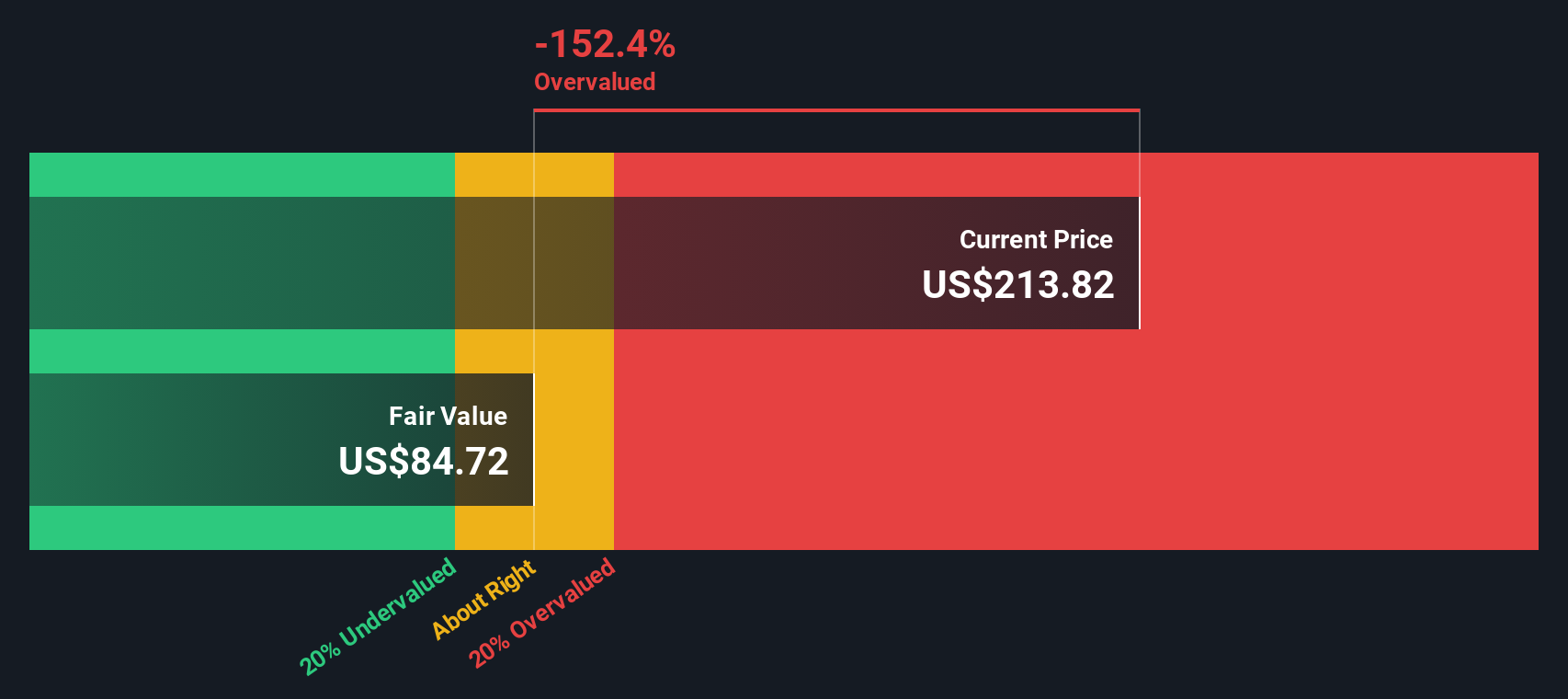

Result: Fair Value of $85.56 (OVERVALUED)

See our latest analysis for Cloudflare.However, any slowdown in enterprise AI adoption or continued lack of profitability could quickly dampen investor enthusiasm and put pressure on Cloudflare’s elevated valuation.

Find out about the key risks to this Cloudflare narrative.Another View: Our DCF Model Weighs In

While the market’s pricing based on revenue multiple looks lofty, our SWS DCF model tells a similar story. It signals that shares are overvalued from a cash flow perspective as well. So which approach better reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cloudflare Narrative

Of course, if you see things differently or prefer to dig into the numbers firsthand, crafting your own take is quick and straightforward. You can do it in under three minutes. Do it your way

A great starting point for your Cloudflare research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more opportunities?

Why stop here? The next standout investment could be just a click away. Take control of your research and uncover stocks that fit your strategy with these tailored ideas from the Simply Wall Street Screener:

- Uncover fast-rising companies with strong financial health by checking out penny stocks with strong financials to see which affordable stocks are making waves.

- Strengthen your portfolio with income-generating assets by browsing through dividend stocks with yields > 3% for stocks offering attractive yields above 3%.

- Position yourself ahead of the technological curve by exploring the transformative potential of quantum computing stocks and see which enterprises are pushing the frontiers of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.